Sticky Inflation Means Higher For Longer And The Magnificent 7 Are Out Of Gas

(Click on image to enlarge)

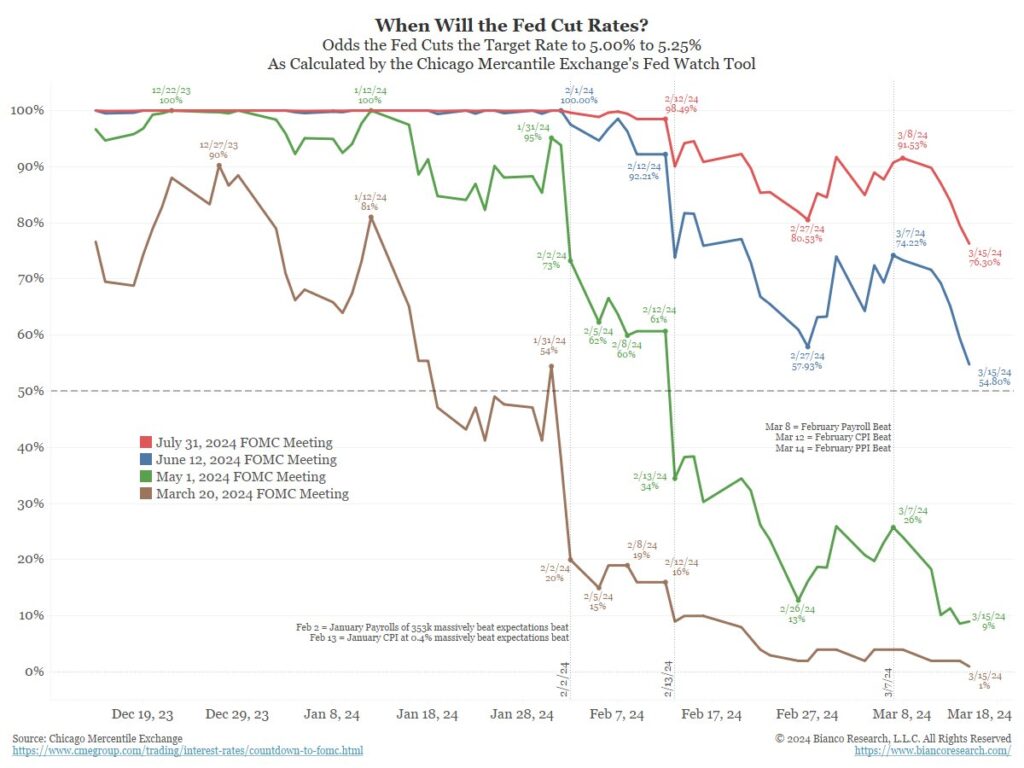

Stocks rallied hard on Tuesday in the wake of the February CPI – but it didn’t make any sense. The CPI came in slightly hotter than expected and this sticky inflation has taken a May rate cut off the table. In fact – as you can see in the chart above by Jim Bianco – the probability of a June rate cut is now only slightly above 50%. As markets have digested the report, all of Tuesday’s gains have been given back and the S&P is currently trading below where it closed on Monday (5,118).

(Click on image to enlarge)

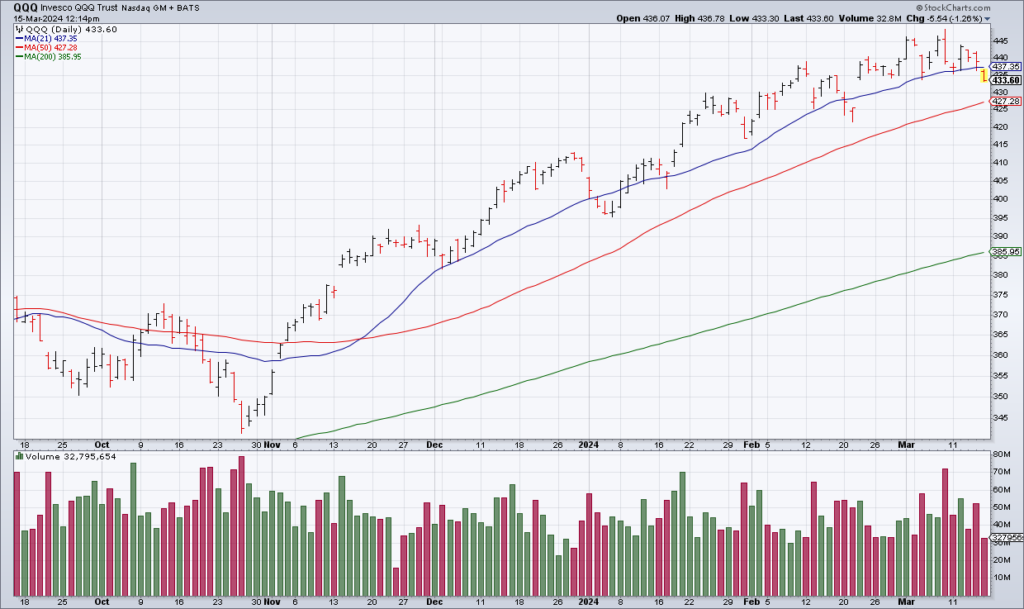

After Nvidia’s (NVDA) blow-off top and hard reversal last Friday, Microsoft (MSFT) briefly took the lead this week breaking out above $420 yesterday – but it’s back below that level this morning. The market has been driven higher by big cap tech but QQQ broke below its 21 DMA this morning – a level active traders like Scott Redler won’t hold below.

On Monday the market will start looking ahead to Wednesday’s Fed Meeting. A hawkish Fed would likely send stocks significantly lower.

More By This Author:

The Return Of Higher For Longer, DLTR: A Tale Of Two EconomiesIs Inflation Sticky? NVDL: 2x Long NVDA

February CPI, ORCL Is Growing Again, NVDA