This Was The Year Bond Yields Were Suppose To Take Off

Forecasting is generally a mugs' game, no more so than in forecasting interest rates. For good and valid reasons, the forecasts for long-term rates in early 2018 were touting a host of conditions that would lead to a steady rise in the 10-year rate in the United States. Perhaps the single most important factor driving interest rates higher would be strong economic growth as the world finally shrugged off the weight of the post-2008 financial crisis. The U.S. economy was given a further boost from a huge corporate tax cut. Optimistically, analysts thought that the U.S. economy could grow at a sustained real rate of 3 per cent or better in 2018; that unemployment would fall below 4 percent, and that inflation would remain in check around the Fed’s target of 2 percent. Lastly, this would be the year that wage growth accelerated in response to the low unemployment rate. Economic growth, unemployment, and inflation clocked in close to their predictions. The exception was that there was no acceleration in wage growth.

Bond yields were expected to move higher in response to tightening by the Fed. The Federal Reserve has made it clear that its policy of extraordinary accommodation has ended. Several successive increases in the Fed funds rate were anticipated and, perhaps more importantly, the unwinding of quantitative easing would also push fixed-income yields higher as the year unfolded. Bond market gurus started to muse that the 35-year-old bull market was at an end and that we should anticipate the beginning of a bear market for bonds. In addition, the higher issuance of government debt would likely add to the pressure on yields. Finally, there was a widespread expectation that worldwide long-term rates would move up, partly in tandem with those in the United States, and partly in response to a generally positive outlook for the global economy. And, indeed, real rates of interest were moving up faster than nominal rates, an indication that economic growth was picking up speed.

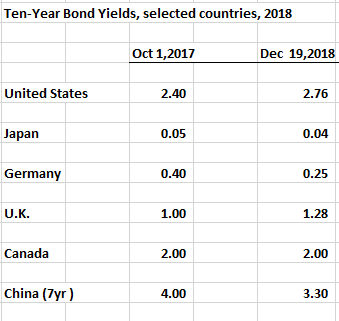

Now, as the year is coming to a close, we see that the bond market predictions disappointed many forecasters (accompanying table). Long-term rates did not take off and moved very little when viewed in the context of expectations expressed early in the year.

What threw these forecasts off were a series of developments, some foreseen and others unforeseen including:

· Inflation stubbornly remaining in and around the 2 per cent range;

· World trade weakening as the China-US trade tensions intensified and tariffs dominated increasingly a larger share of the bilateral trade;

· The negative impact on business capital formation from the withdrawal of liquidity (quantitative tightening by the Fed);

· The disinflationary effects of a deep slump in oil prices; and,

· The slowdown in total output spawning growing sentiment that a recession is not too far off.

Finally, these developments were not lost on the Fed in its rate-setting deliberations. Today’s announcement that the Fed will take a more gradual approach towards rate hikes in the future--- i.e. fewer and farther between--- signals to the financial markets that long-term rates are not going to go up as previously expected.

There are certainly a lot of well thought comments on this post. It must be a good one.

Yes, William. Good post. Besides the reasons given by the author, there is still a massive demand for bonds, as well. Measuring demand of increased collateral needs is hard to do, but the concept of long treasuries being the new gold has not been disproven.

Perhaps we need some more deflationary actions, so that things other than the wealth of the very rich can increase. I regard inflation as a cancer of the economy.

We need a better distribution of income and wealth. Deflationary actions will not bring that around. Taxation and spending policies can re-distribute swealth and income and have been in the past many time. Alas, the current US govt is doing precisely the opposite.

It always seems that when the government taxes everybody, somehow the very rich wind up not being taxed so much. And really, redistribution of wealth has such a socialist aroma that it does not seem reasonable. Some of us are able and willing to produce services and goods that we do get compensated for, even almost adequately. But some do not seem to be willing or able to produce, but they have the unions to support their wants. The one big problem seems to be the inordinate incomes of some folks. Perhaps a HUGE tax on the organizations that overpay the very top folks, so that there would be more available to pay those actually doing the work. A very radical concept, I admit.

Read David Brooks today in the NYT. He mentions how Canada

Is able to redistribute income through fiscal policy and universal health care to the benefit of the middle class. It can be done if there is a political will. Canada has had universal health care since 1965.

Eventually, labor share of GDP becomes so low that it comes back to bite the wealthy.

While excessive inflation can be very damaging, isn't inflation inevitable and natural?

I agree, as long as it isn't a return to hyper inflation of the 1970's. A little inflation keeps bond rates from going negative. 1 to 2 percent seems reasonable, Alexis. William K is right that excess inflation is not good.

Sort of like cancer, iisn't it? Inflation primarily benefits the very wealthy. And I have never heard any explanation of how inflation actually benefits anybody. A believable explanation of the mechanism by which inflation provides any real benefit would certainly be an interesting thing to read, wouldn't it?

Prof, this article nails it. So many deflationary shocks, so little time.

So true.

You are right. I think the stock market recognizes the deflationary shocks and then looks at the Fed and then says in effect " can't you guys read the handwriting on the wall?"

Very sound analysis...long-term rates will remain static for the foreseeable future...what is the likely impact on mortgage rates and construction industry?

Yes, excellent indeed.

Thanks.

Leon,

Mortgages rates run off the 5 yr bond yield which today is 1.90%, so that should keep mortgage rates well under control. Also, the prime rate will not go up because the Bank of Canada is on hold for some time--- the data in Canada is looking bleak with the CPI coming in negative for November. So, variable mortgages which are usually prime less 100 bps are get value.