This Isn’t The First ‘Fed Pause’

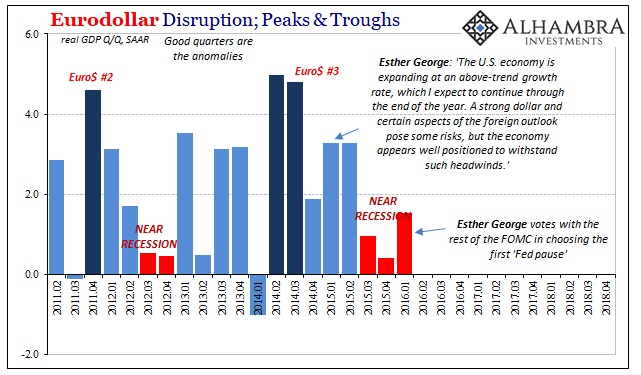

And we come full circle back again. It’s not what they say, it’s what they do. Kansas City Fed CEO Esther George was at least consistent, unlike all the other voting FOMC members. Throughout 2015 and 2016, the rest of them would say the economy was strong but then vote the other way, no “rate hike.” December 2015 was the lone exception (and perfectly fitting).

President George, on the other hand, was almost irredeemably optimistic about the economy and voted that way, too. While the majority held steady, Esther was the one who would dissent against the then Fed Pause. The few times she didn’t was in early 2016 when the US economy approached recession conditions.

You knew it was serious when the hawkest of hawks stopped walking how she talked. In March 2015, George had said:

The U.S. economy is expanding at an above-trend growth rate, which I expect to continue through the end of the year. A strong dollar and certain aspects of the foreign outlook pose some risks, but the economy appears well positioned to withstand such headwinds…

Importantly, this improved outlook for consumers and businesses suggests that momentum in the labor market will likely continue going forward. The economy added more than 3 million jobs in 2014, the highest level since 1999, and the rapid pace of job creation has continued into the beginning of 2015.

Sounds very familiar, doesn’t it, especially how none of it was true – a fact George herself would confirm in January 2016 voting in unanimity forgoing a second hike immediately after the first (which was the original plan).

Can we stop with all the “rate hikes are causing this” nonsense? The upper boundary of federal funds is currently 2.50%, hardly any sort of hardship on anyone anywhere. If 250 bps is the cause of so much fright and angst, how in the world did the world function when risk-free was 6% or better? You might even notice that the economy did function so much better when interest rates were higher (interest rate fallacy).

Something big changed between 2017 (three rate hikes) and 2018 (four rate hikes) and it wasn’t the extra 25 bps. The global economy isn’t going to be sailing into globally synchronized growth with federal funds around 150 bps and then on the precipice of full downturn with the addition of just 100 bps more.

The strongest economy in decades would never have been cut off by another 1%, at least if it was actually strong in any realistic sense.

What I mean is therefore perfectly clear; the “rate hikes” didn’t cause this, therefore the Fed pause can’t fix it. The pause, however, is very real anyway and now for a second time. Here’s Esther George today:

A pause in the normalization process would give us time to assess if the economy is responding as expected with a slowing of growth to a pace that is sustainable over the longer run.

It’s this “slowing pace of growth” that has caught them off-guard, more so markets’ reactions to it. Here’s what she said back in October, not quite as unhinged as Atlanta’s Raphael Bostic but similarly confident nonetheless.

By nearly every measure, the U.S. economy is performing well. With accommodative financial conditions, elevated levels of confidence and solid labor markets, it seems reasonable to expect economic growth slightly above trend with low and stable inflation for the next few years. Consumers are poised to continue to be the main force behind this expansion, and the recent pickup in business investment may continue as well.

Perhaps unconsciously, she was simply repeating her views from March 2015. Was it the lags of the last two or three (or four) rate hikes catching up with a truly robust economy that caused it to fall back? Does anyone really believe that? It’s what they’ll write in the Wall Street Journal.

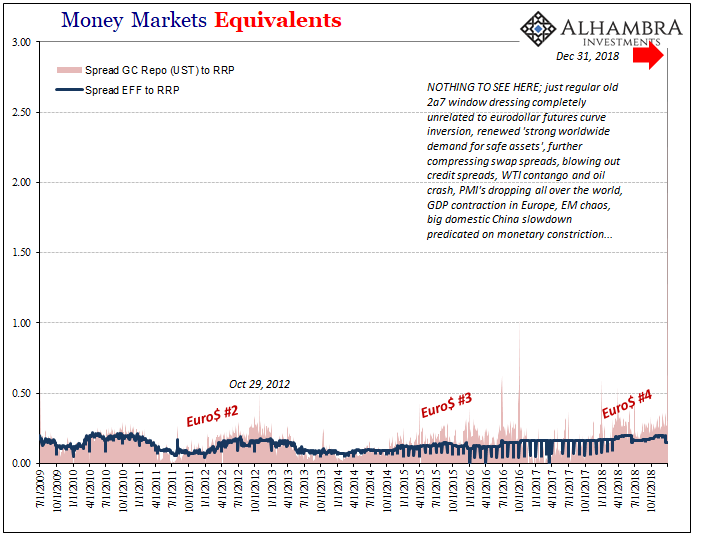

The real problem is much deeper, a fact we are reminded of again with various banks putting up some eye-opening numbers for last quarter. In the textbooks, they always say that dealers run matched books, market-makers picking up a few pennies on others trading. Volatility is good for business.

Supposedly, it was the Fed being so accommodative to the monetary system throughout the ZIRP period that killed off the dealer business. FICC shrank and according to conventional wisdom, the lack of volatility was the reason. Thanks, Bernanke.

Except, whenever there was a serious bout of market volatility, as the end of 2015 and the beginning of 2016, FICC revenues would collectively plunge. Banks, it seems, can’t actually make money in money during volatile periods. I noted this actually consistent inconsistency almost three years ago during the last one:

In “low volatility” environments investment banks get smaller; in “high volatile” environments investment banks get smaller. You might just get the impression that investment banks reduce themselves regardless of the volatility environment, and thus are projecting some other concern or structural tendencies.

Rates are rising, the markets were volatile so dealers should be cleaning up. Instead, as they are beginning to report, in Q4 2018 they got cleaned out.

JPMorgan Chase reported fourth-quarter FICC sales and trading revenue that missed analysts’ estimates, just like Citigroup on Monday. JPMorgan’s adjusted earnings per share also trailed estimates.

Bond traders just suffered their worst quarter in a decade.

Revenue from fixed-income trading, typically the biggest contributor to the company’s markets business, plunged 18% in the fourth quarter to the lowest since the depths of the financial crisis as wild markets kept clients on the sidelines. The drop more than outweighed an increase in equity-trading revenue and advisory fees, making for the corporate and investment bank’s worst quarter in three years.

Citi’s FICC, “bond trading” numbers were even worse, down 39% in Q4 2018 from Q3, and off 21% year-over-year from a Q4 2017 that was far from fantastic.

It’s another few data points for why December, especially in curves (liquidity hedges), was so bad. This renewed “overseas turmoil” has come home once more, a confirmation of sorts performed unintentionally by Esther George. Again.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more

Others have said it is a combo of rate hikes and balance sheet run off. But the wimpy rate hikes would likely be a sign to Will Rogers that the economy and financial system are pretty weak.

Well said, Gary.