The Weakest Week Of The Weakest Month Is Here

Image Source: Unsplash

Remember in late August when the media made a huge deal about the bearishness of September? Yeah. Neither do they. I actually met with someone who first wanted to sell everything he had because he knew it was going to be bad. And then he decided not to invest with us because I wasn’t giving the media’s story any credibility. But I did the research and homework to give you the facts and details. And if you’re keeping score at home, the S&P 500 is up more than 3% this month. The NASDAQ 100 and Russell 2000 are up even more.

Today starts the weakest week of the weakest month of the year. My good friend and data miner extraordinaire, Rob Hanna, coined this years ago. Historically, the next five days are down the vast majority of the time. There are other pieces of data which exaggerate or mitigate the study which we won’t go into here. Someone forwarded me another study which I have yet to verify that shows the next two weeks to be down 90%+ of the time. Just remember what I always write about seasonal trends. They are tailwinds and headwinds, not triggers for action.

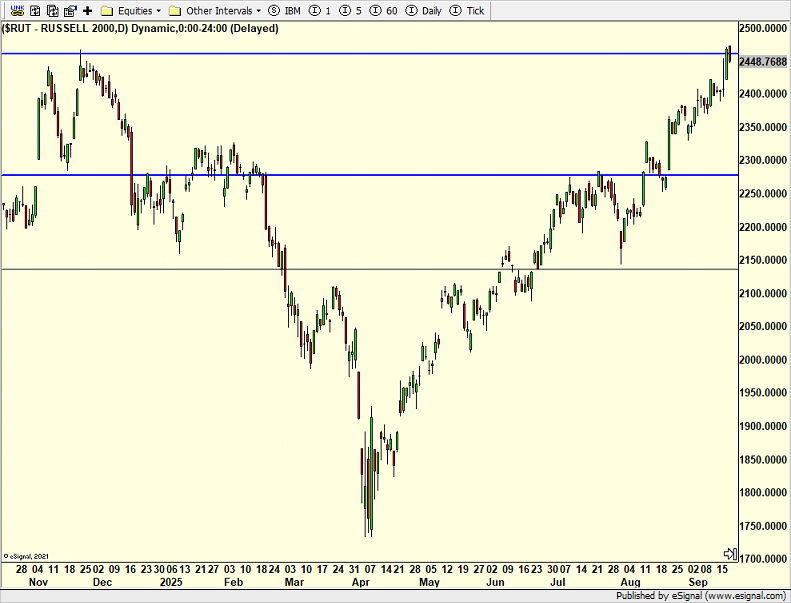

I have been writing about the Russell 2000 since April. Remember all that road rash and tire marks I have on me from trying this trade over the past decade? The results have been much better so far in 2025, but as Yogi Berra once famously said, “it ain’t over until it’s over”. Friday, we saw the bears reject the Russell’s attempt at the 2024 highs. On the surface, I don’t think it will amount to much, maybe a mild pullback.

(Click on image to enlarge)

Finally, tonight starts Rosh Hashanah. There is an old adage about selling today and buying after Yom Kippur. As with most of these trite sayings, they don’t stand up to scrutiny when you do the homework.

On Friday we bought FSEP and more QSPT. We sold some IJT and some QLD.

More By This Author:

Powell Moves As Expected – Small Caps Continue To RipMarkets Stronger Than Expected

Be Careful What You Wish For – But Smalls Caps Are Delivering

Disclosure: Please see HC's full disclosure here.