The US Dollar Should Not Yet Be Written Off

In our analyses, we regularly examine current movements, identify possible influencing factors, and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Image Source: Pexels

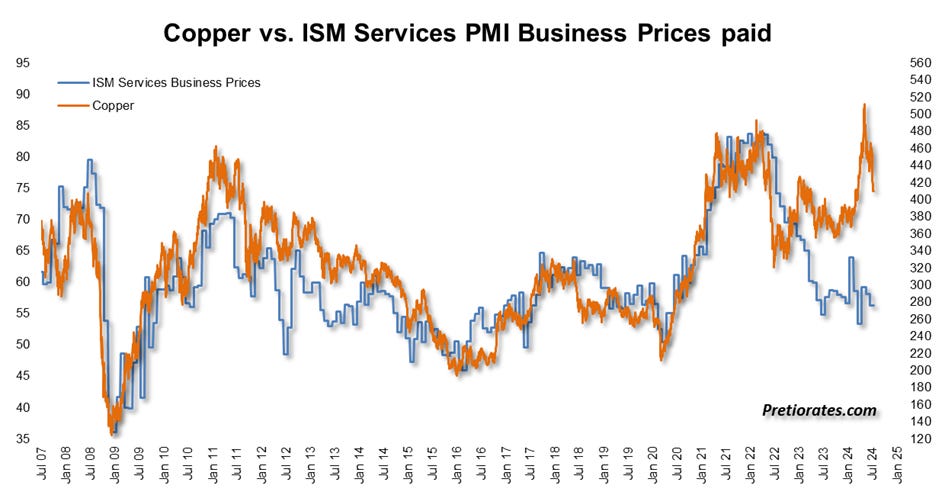

The price of copper often has a high correlation with economic development. In spring, a temporary supply problem caused a price spike, which has already been corrected. The economic development in the US may suggest that the brown metal could see a lower market price in the near future.

(Click on image to enlarge)

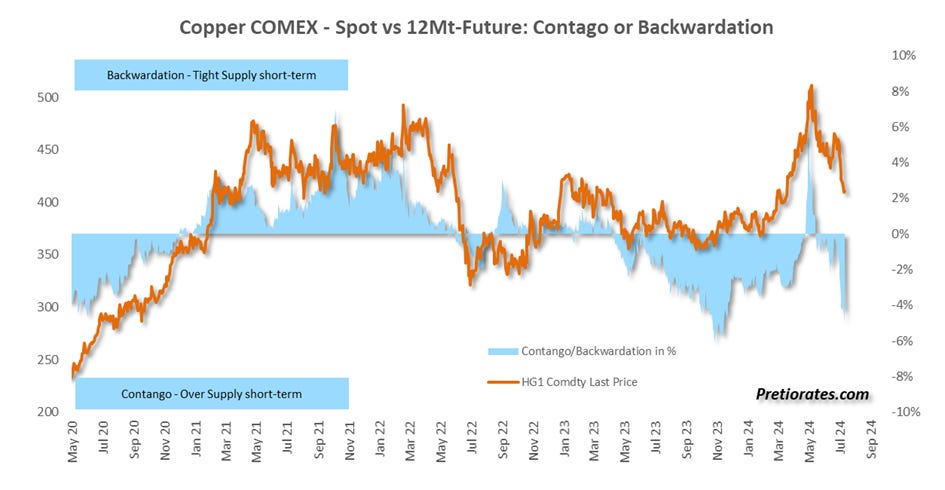

The futures market seemingly also confirms that a falling market price is to be expected.

(Click on image to enlarge)

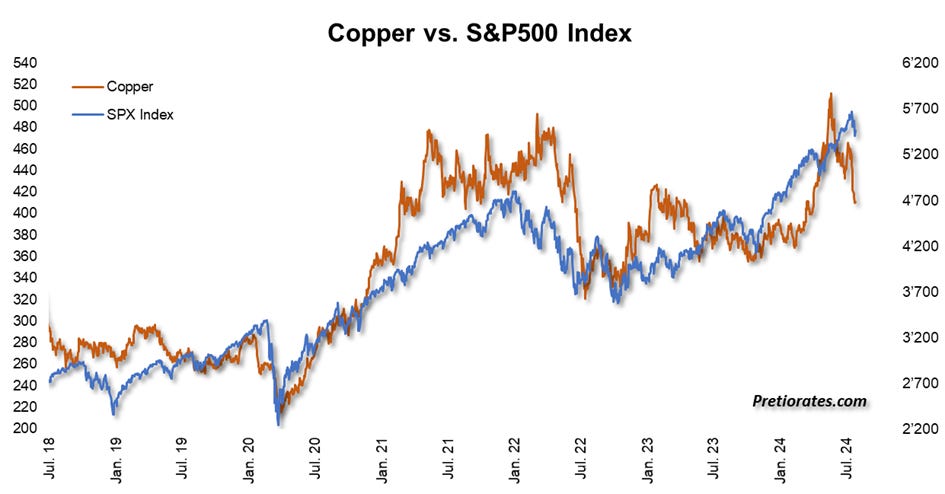

Since the economic trend is one of the most important inputs for the stock market, it is not overly surprising that the skies over the US stock market are now also clouding over.

(Click on image to enlarge)

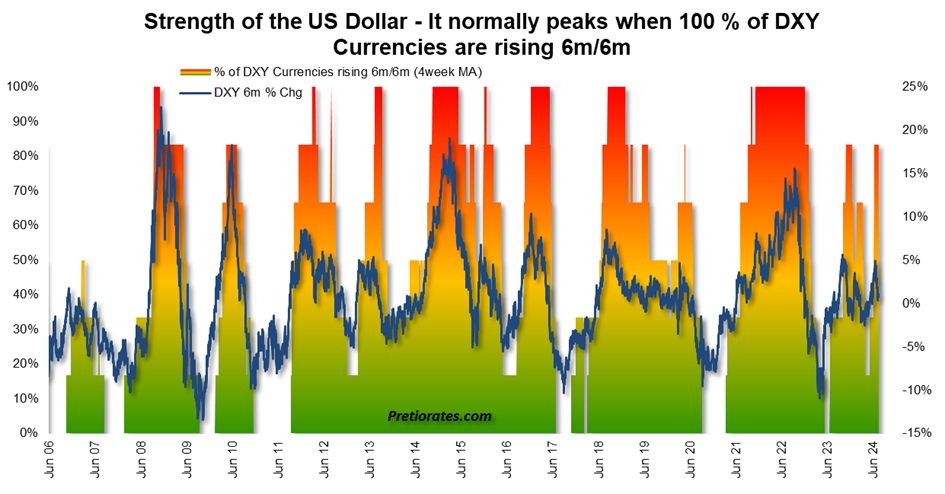

The US dollar is (still) one of the most important safe-haven currencies. When economic times get tough, the US currency usually sees increased demand and a rise in price. Ergo, the same applies to the counter-correlation with many industrial metals. In fact, our strength indicator seems to confirm that the US dollar could appreciate again in the near future.

(Click on image to enlarge)

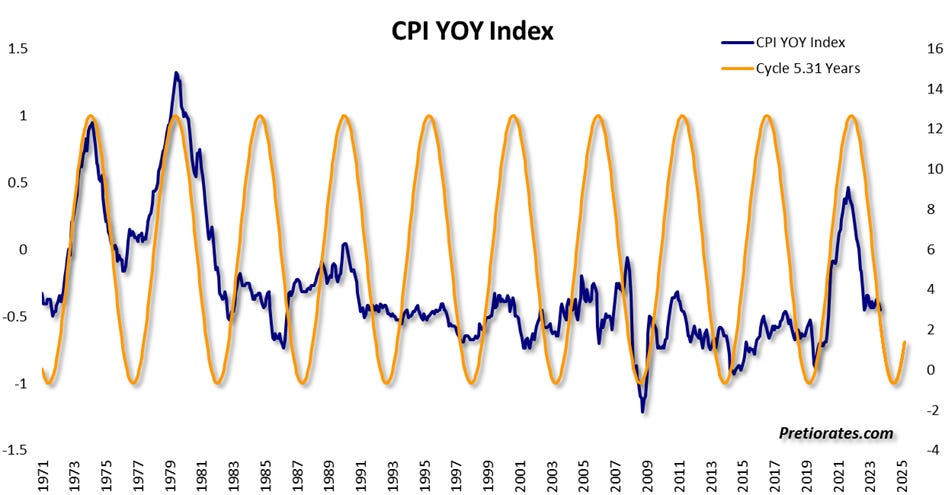

A stronger US dollar means lower costs for goods imported into the US, which should mean that inflation continues to fall -- which the cycle also confirms, at least until the end of the year.

(Click on image to enlarge)

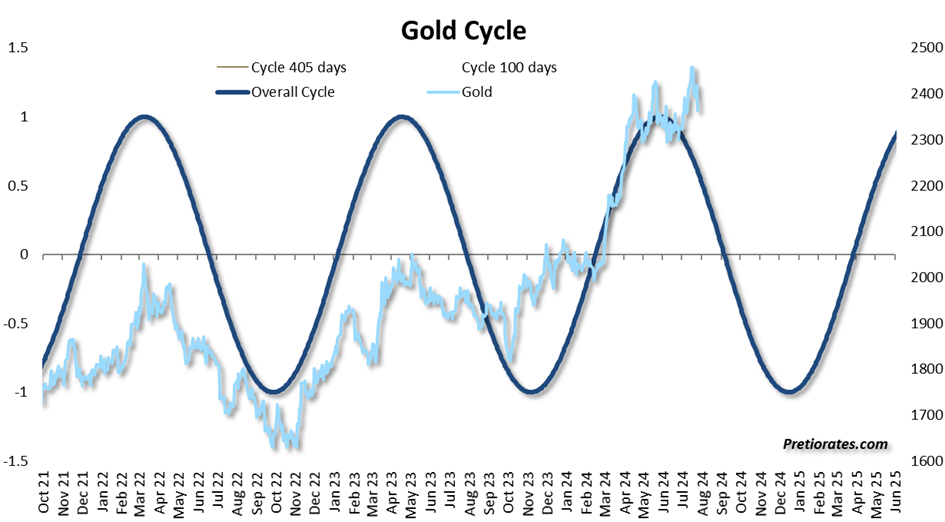

A rising US dollar also puts pressure on precious metal prices, especially gold. And as mentioned in a previous issue, no support can be expected from the gold cycle in the near future. If the geopolitical situation does not heat up further worldwide – which we hope it won't – the gold price is likely to continue the consolidation that has begun recently.

(Click on image to enlarge)

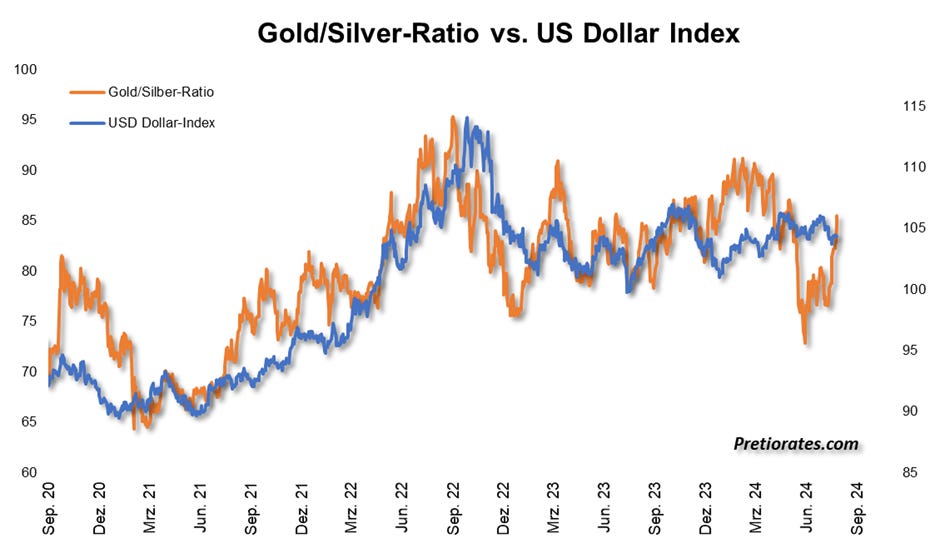

Silver bugs have recently been suffering more and more, as the ratio between gold and silver has once again increased massively. Silver is increasingly seen as an industrial metal, which is why the gold/silver ratio is also increasingly correlated with the economy and the US dollar. Compared to the US dollar, this ratio has therefore been too low in recent weeks and months -- and it has now returned to normal.

(Click on image to enlarge)

That’s it for today. Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions. Do your own due diligence. We wish you successful investments.

More By This Author:

Gold Rises Without Its Brother Silver - What's Going On?How Magnificent Are The Seven Individual Magnificent?

The U.S. Equity Market, The Last Man Standing?

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more