Gold Rises Without Its Brother Silver - What's Going On?

Gold has continued to rise over the last two weeks, especially this week. Silver, however, seems to be struggling to find its way back to the uptrend. Let’s therefore analyze the precious metals a little more closely...

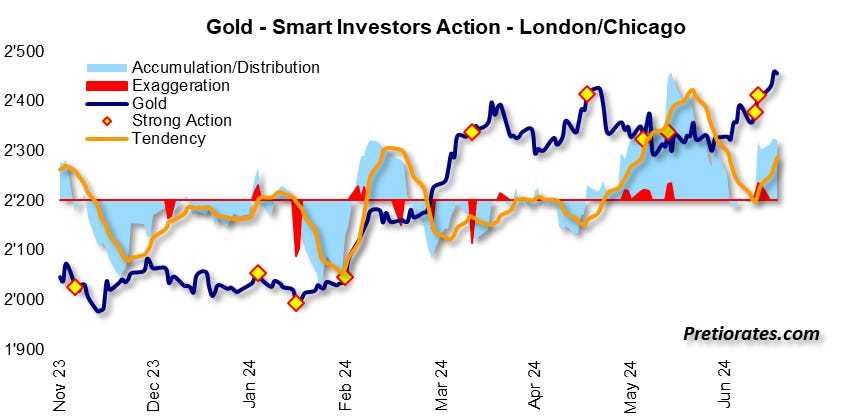

In the gold markets of London and Chicago, the last few days have seen a renewed accumulation (blue area up), but there has also been an 'exaggeration', which casts some doubt on a continuation. On the positive side, the trend (line in orange) is still rising...

(Click on image to enlarge)

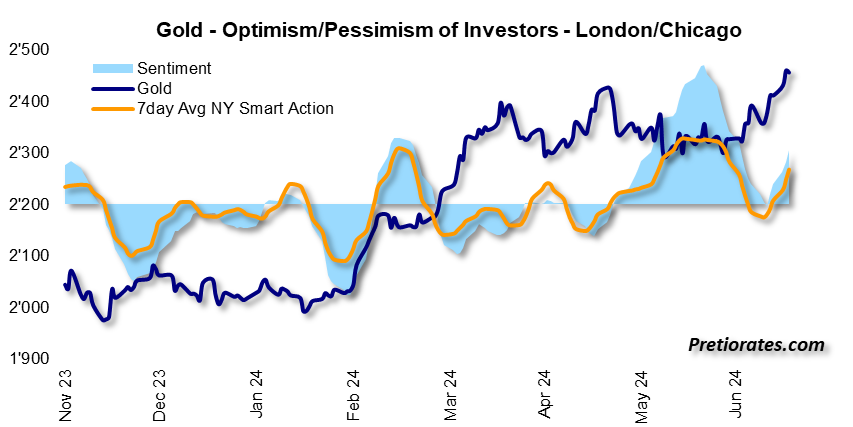

Optimism in the market has also increased again recently. A prerequisite for further price rises...

(Click on image to enlarge)

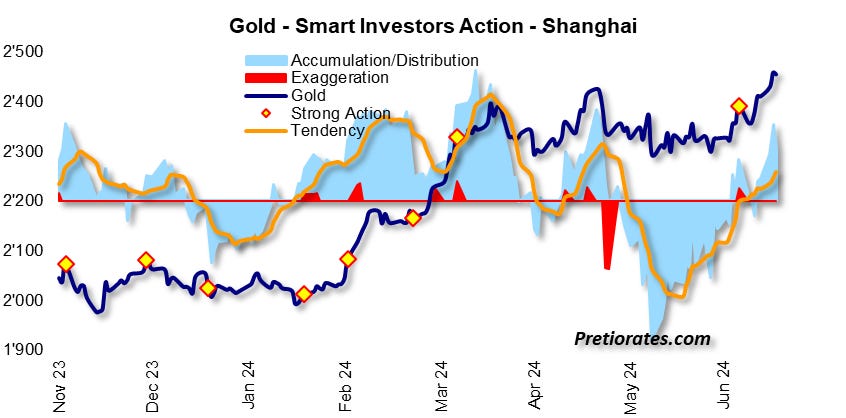

Shanghai has actually become the key market for gold these days. And chinese investors are accumulating, the trend has even been rising again since mid-May...

(Click on image to enlarge)

However, optimism is already very advanced in Shanghai too...

(Click on image to enlarge)

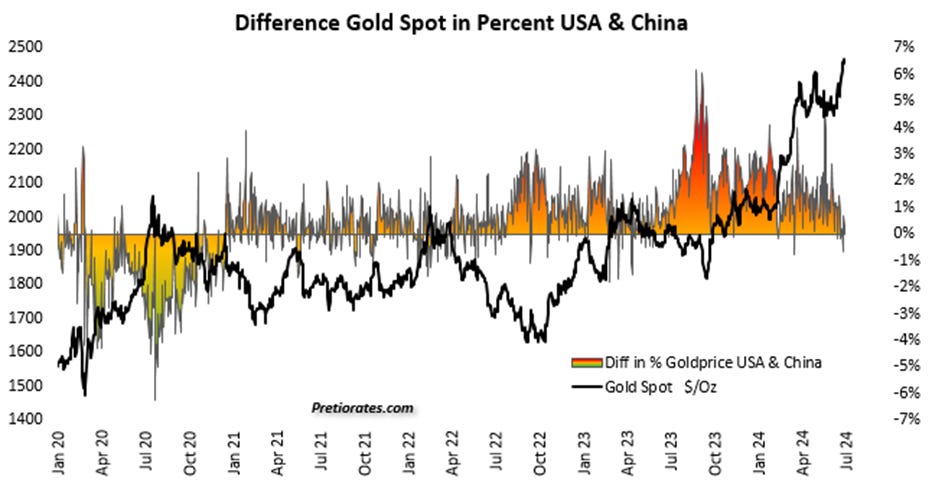

And no premium is currently being paid over London & Chicago. This indicates that Chinese investors are not responsible for the uptrend of the last two weeks...

(Click on image to enlarge)

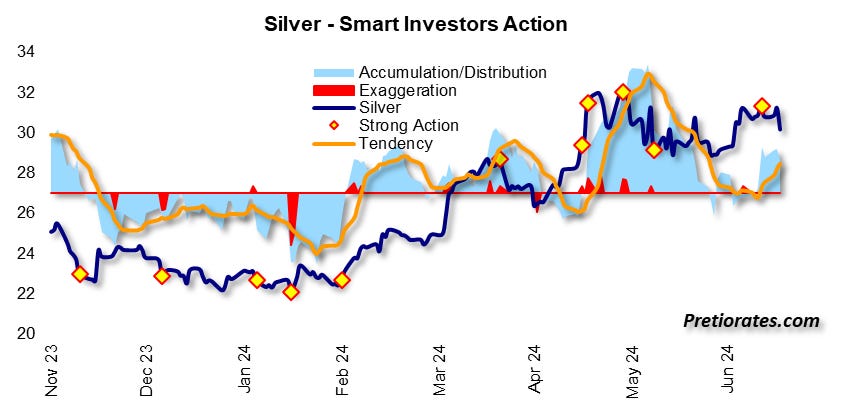

What about the silver market? Here, too, there is an accumulation of smart investors, but it is not really convincing because there are many 'strong action' points - which usually indicate a potential countermovement...

(Click on image to enlarge)

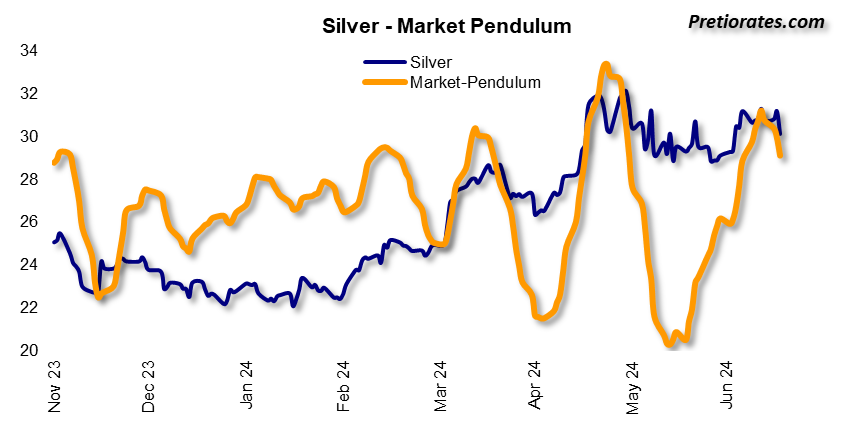

The market pendulum has already turned south again without the silver price really being able to rise. This rather indicates a continuation of the current consolidation...

(Click on image to enlarge)

Nevertheless, in Shanghai, a premium of 10 to 15 % is still being paid compared to London & Chicago. Physical silver still seems to be in short supply in China - or rather, demand remains high...

(Click on image to enlarge)

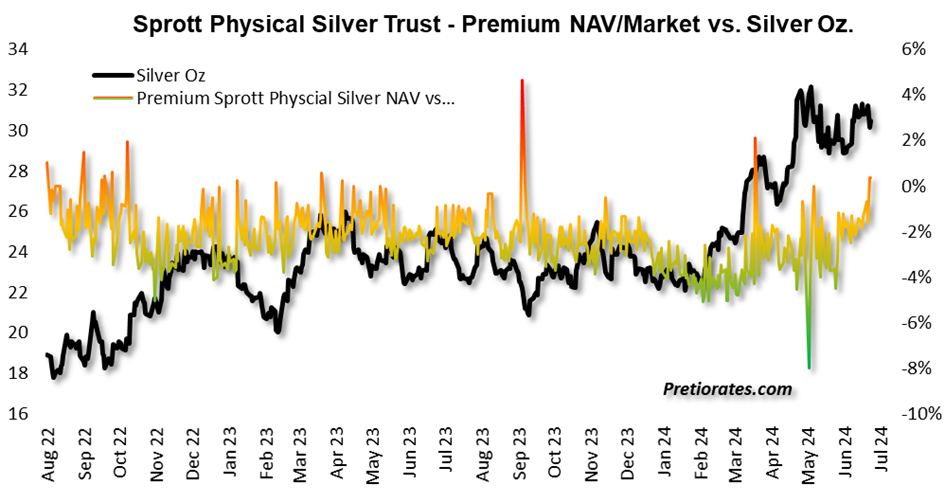

Striking: The discount between physical silver and the Sprott Physical Silver Trust has disappeared. This is an indication of greater interest on the part of Canadian investors. This is usually the case at the upper trading band...

(Click on image to enlarge)

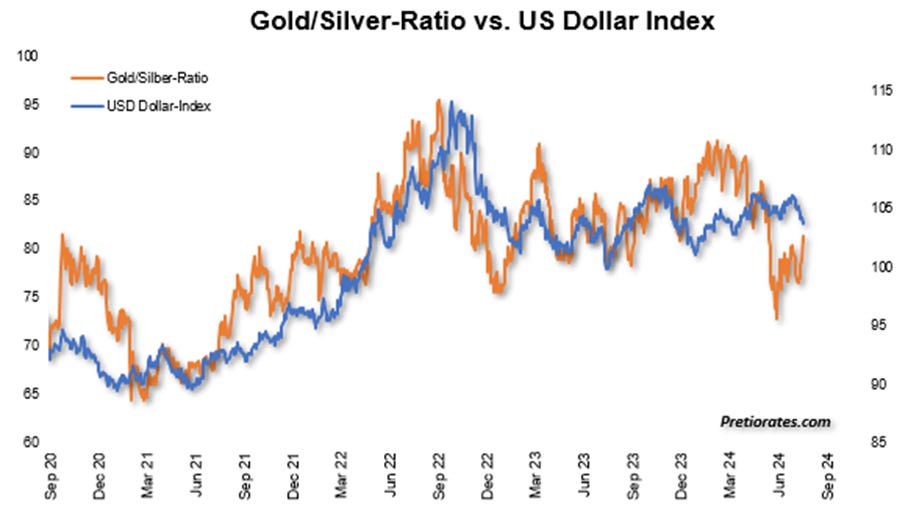

Gold has recently risen considerably again, but not silver - which has led to a higher gold/silver ratio. This also reduced the mispricing that was the case against the US dollar just a few weeks ago. Remember: the US dollar and silver, which is more of an industrial metal, rise when the economic outlook is good - while gold tends to rise when the opposite is true. Hence the high correlation between the currency and the ratio...

(Click on image to enlarge)

Conclusion: Gold is rising, but not because of Chinese investors. Silver is not rising at all. It is obvious that the potential next US President Trump - and also his Vice President Vance - could be responsible for the rising gold price: they want to focus on China rather than Ukraine. This should further boost the de-dollarization...

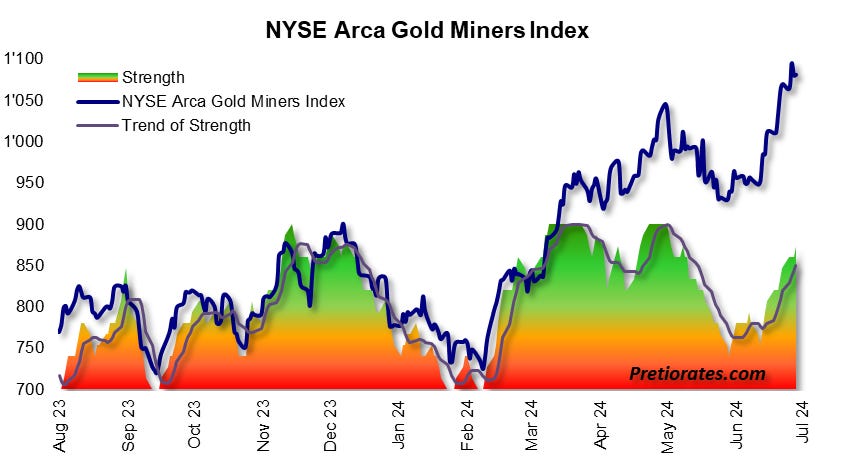

A sideways glance at the gold miners, which have recently been able to realize nice advances: The Arca Gold Miners GDM Index has increasing strength (lagging indicator)...

(Click on image to enlarge)

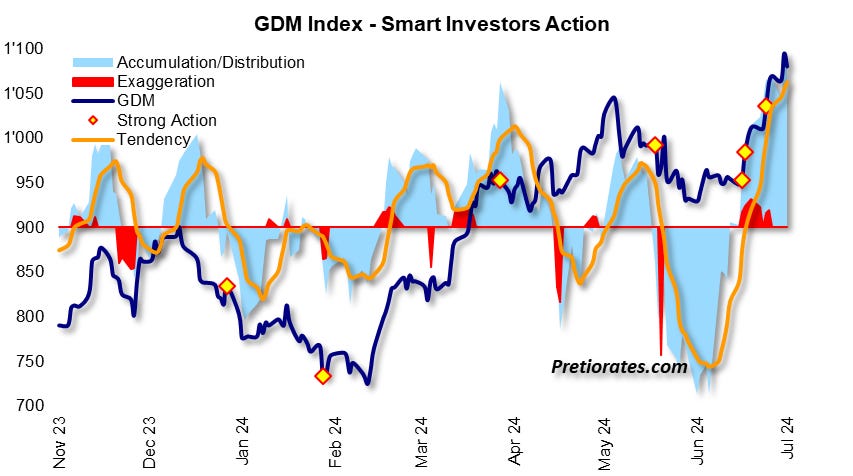

The accumulation on the part of smart investors has been very strong since the beginning of June, almost too strong...

(Click on image to enlarge)

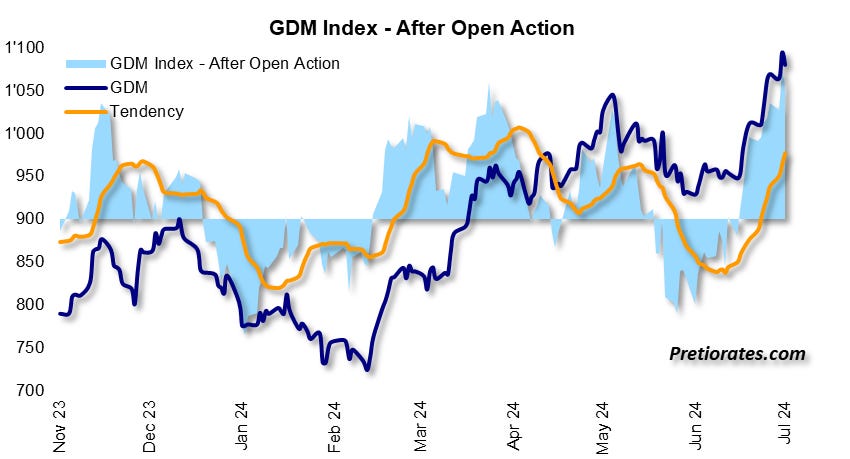

The 'after open action' has also reached a level where professional investors are starting to behave a little more cautiously...

(Click on image to enlarge)

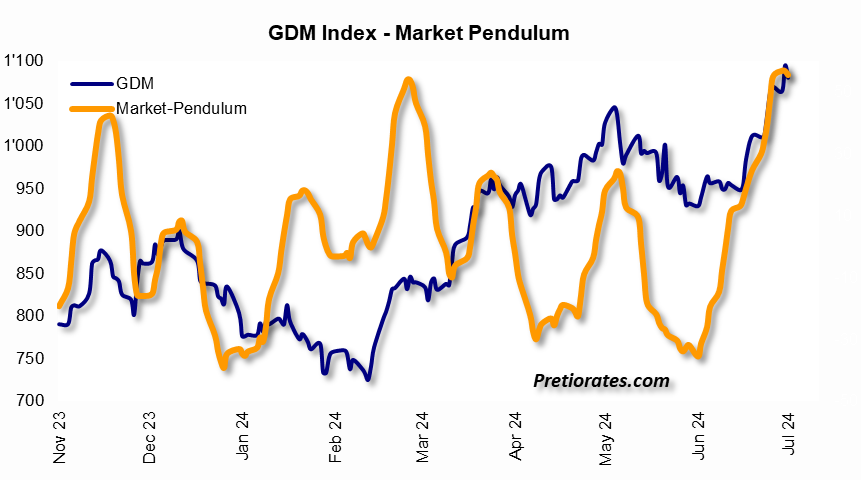

And the pendulum seems to have reached its peak and is turning south again... a consolidation would therefore come as no surprise...

(Click on image to enlarge)

More By This Author:

How Magnificent Are The Seven Individual Magnificent?

The U.S. Equity Market, The Last Man Standing?

The Potential For Interest Rate Cuts Is Still Alive

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more