The Trend Break In CPI

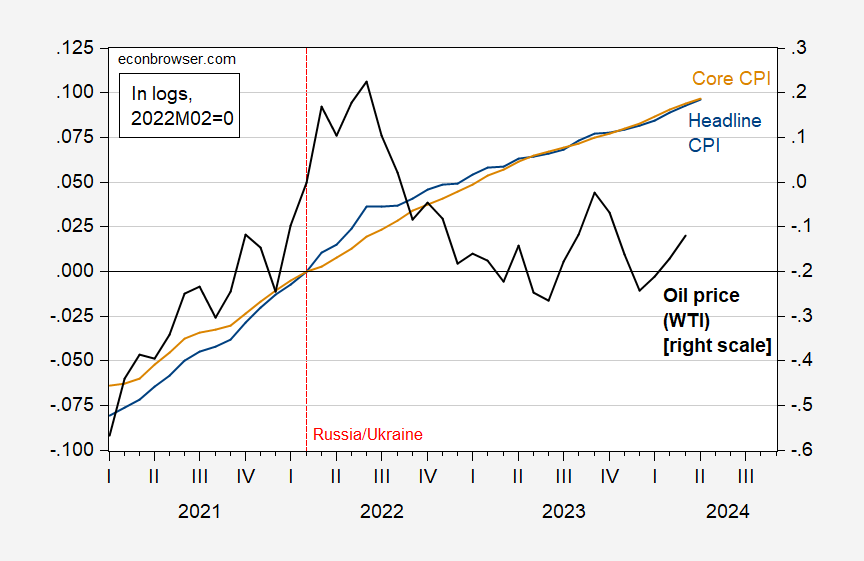

Readers [1] [2] inquired why there appears to be a trend break in (log) CPI at 2022M06. My best guess is the spike in oil prices.

Figure 1: CPI (blue, left scale), core CPI (tan, left scale), and WTI oil price (bold black, right scale), all in logs, 2022M02=0. Source: BLS, EIA via FRED, and author’s calculations.

While the CPI trend breaks at 2022M06, matching the peak in oil prices, core CPI doesn’t such evidence. Using a unit root break test (Perron, 1997) identifies a trend and intercept break at 2022M04.

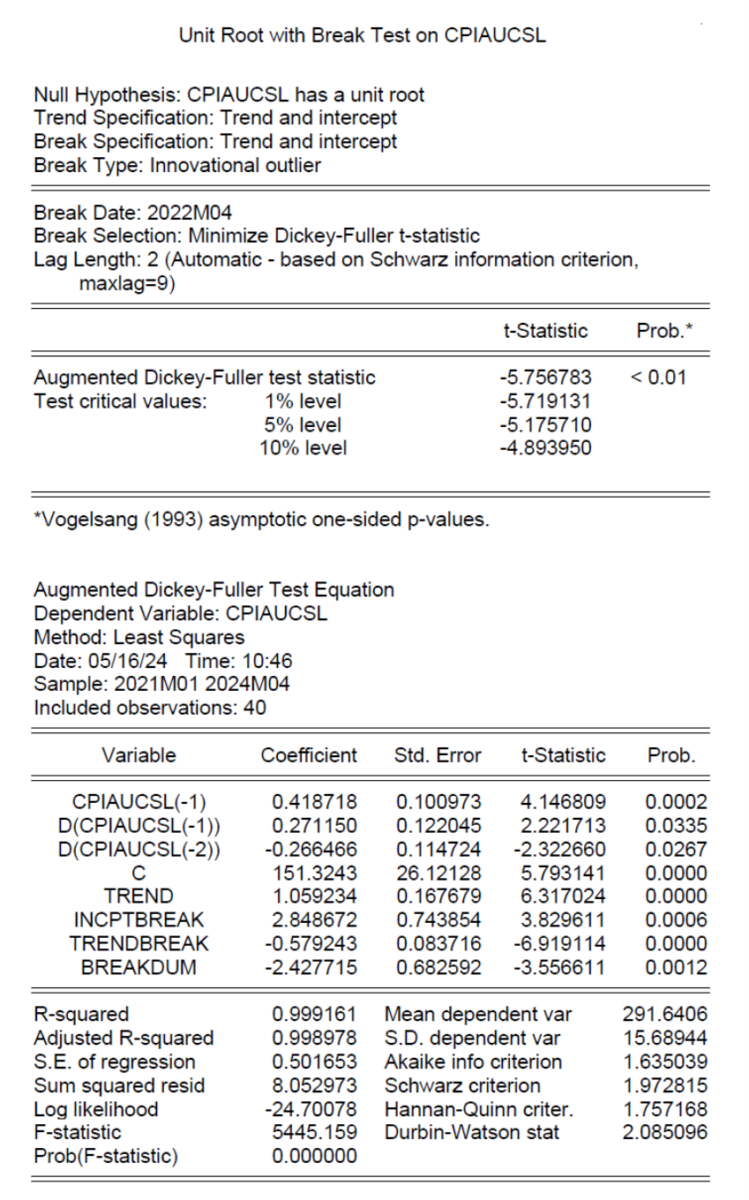

(Click on image to enlarge)

Note that there is a break in core CPI as well, although the same test finds a break at 2023M01.

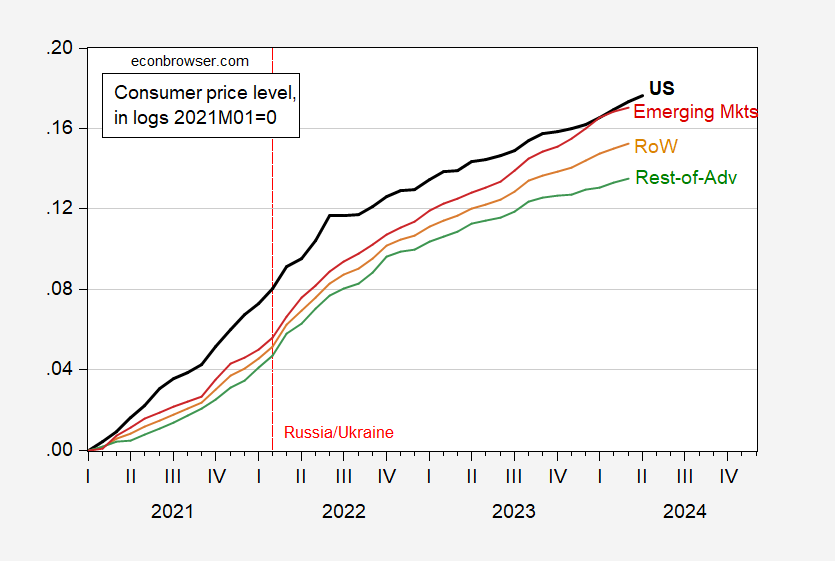

For the world, there is a similar pattern:

Figure 2: US CPI (bold black), rest-of-world (tan), rest-of-advanced countries (green), emerging markets (red), all seasonally adjusted, in logs 2021M01=0. Source: BLS, Dallas Fed DGEI, and author’s calculations.

More By This Author:

Six Measures Of Consumer PricesGrocery Prices Decline

Manufacturing Over The Long Term