The S&P 500 Rises During Slow Trading Week

Shortened by the Thanksgiving Day holiday, the S&P 500 (SPX) mostly rose during a slow trading week, only dipping slightly on Friday, November 25, 2022 to end the week at 4,026.12. The index is 770.44 points (or 16.1%) below the index' all-time record high close on January 3, 2022.

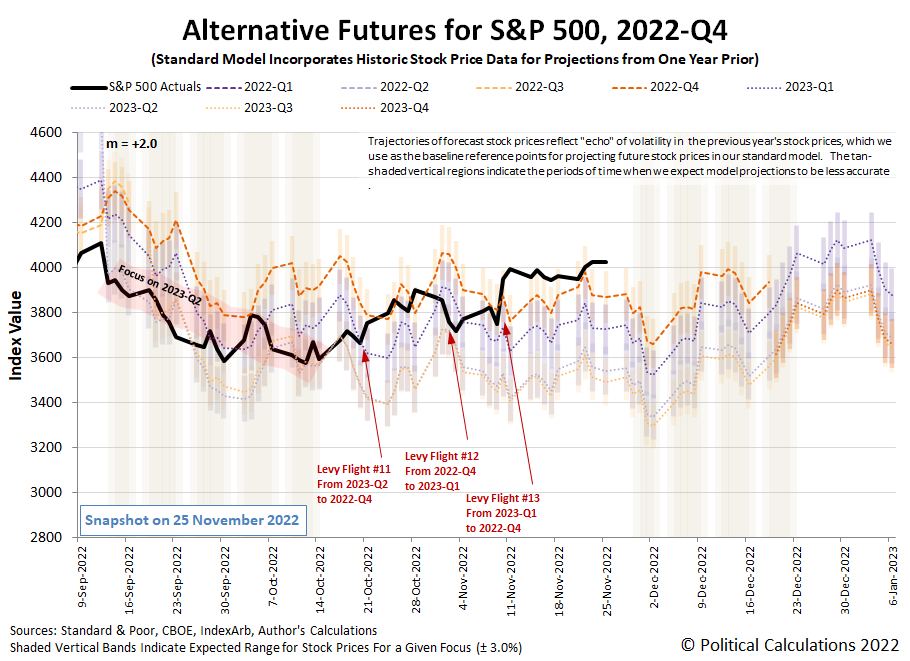

The newly updated alternative futures chart shows the index' trajectory as running to the high side of the range associated with investors focusing their attention on the current quarter of 2022-Q4.

We'll soon be entering a period where the echoes of past volatility will skew the dividend futures' model's raw projections. Looking past that period however, we see the projections for 2023-Q1 are rising to a similar level as today's stock prices. That opens up the possibility that when investors act to shift their forward-looking focus away from the current quarter, which they'll be forced to do in the next several weeks, stock prices may not change much from their current level.

Until, that is, investors have reason to look past 2023-Q1 to consider what comes after. As we've seen over the past several weeks, the top two drivers affecting how far into the future investors are looking is what the Fed will do with interest rates and when it will do them.

We'll cover what changes they're expecting and when they're expecting them at the end, but for now, here are the market moving headlines of the week to provide the context in which investors made decisions during the holiday-shortened, slow trading week that was.

Monday, 21 November 2022

- Signs and portents for the U.S. economy:

- Fed minions say smaller rate hikes ahead, Federal Funds Rate to peak around 5%

- Bigger trouble developing in China:

- Bigger stimulus developing in China:

- JapanGov, BOJ minions looking to deliver more stimulus:

- Positive growth signs, bigger stimulus developing in Eurozone:

- ECB minions thinking about backing off from bigger rate hikes, say Eurozone inflation will top out in early 2023:

- Wall Street slips as concerns rise of stricter China COVID curbs

Tuesday, 22 November 2022

- Signs and portents for the U.S. economy:

- Fed minions say their focused on fighting inflation with rate hikes, wonder why Americans aren't saving more:

- Bigger trouble, stimulus developing in the Eurozone:

- BOJ minions see inflation hit record high while they continue never-ending stimulus:

- ECB minions excited to deliver smaller rate hikes with Eurozone entering recession:

- ECB set to raise deposit rate 50 bps as euro zone enters recession -economists: Reuters poll

- ECB's Nagel opens door to smaller hikes but sees long way to go

- ECB's Rehn says inflation, economy will decide pace of rate hikes

- ECB's Holzmann says leaning towards a 0.75% rate hike as things stand

- ECB still has long way ahead of it on rate hikes -Ifo president

- S&P closes at more than two-month high on retail, energy lift

Wednesday, 23 November 2022

- Signs and portents for the U.S. economy:

- Oil slides over 3% on Russian price cap talks, U.S. gasoline build

- U.S. weekly jobless claims at 3-month high; equipment spending resilient

- U.S. new home sales unexpectedly rise in October

- U.S. business activity weakens further in November - S&P Global survey

- U.S. core capital goods orders, shipments rebound strongly in October

- Fed minions getting set to shrink size of rate hikes:

- Bigger stimulus developing in China:

- ECB minions thinking about smaller rate hikes as they expect recession to take hold this quarter:

- Wall Street rises as Fed signals slowdown in rate hikes

Friday, 25 November 2022

- Signs and portents for the U.S. economy:

- Bigger trouble developing in Japan:

- BOJ minions looking for reasons to continue never-ending stimulus:

- Bigger stimulus developing in China:

- ECB minions point at inflation to justify rate hikes, claim its peaking:

- Nasdaq ends down as investors eye Black Friday sales, China infections

The CME Group's FedWatch Tool continues to project a half point rate hikes at the Fed's upcoming December (2022-Q4) and February 2023 (2023-Q1) meetings. Followed by a quarter point rate hike in March (2023-Q1), the Federal Funds Rate is still projected to peak at a target range of 5.00-5.25%. Looking further forward, the FedWatch tool now anticipates a quarter point rate cut in July (2023-Q3) as the Fed is forced to go into reverse by developing recessionary conditions in the U.S. economy.

The Atlanta Fed's GDPNow tool's projection for real GDP growth in 2022-Q4 rose slightly to +4.3% from last week's +4.2% estimate. There continues to be a large gap between its current projection and the so-called "Blue Chip consensus" that predicts near zero growth in 2022-Q4.

More By This Author:

Turkey ShrinkflationTraditional Thanksgiving Dinner Cost Rises 20% Higher Than 2021

The S&P 500 Drifts Lower With Investors Focused On Fed's Upcoming Actions

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more