The Sober Spending Of Drunken Sailors

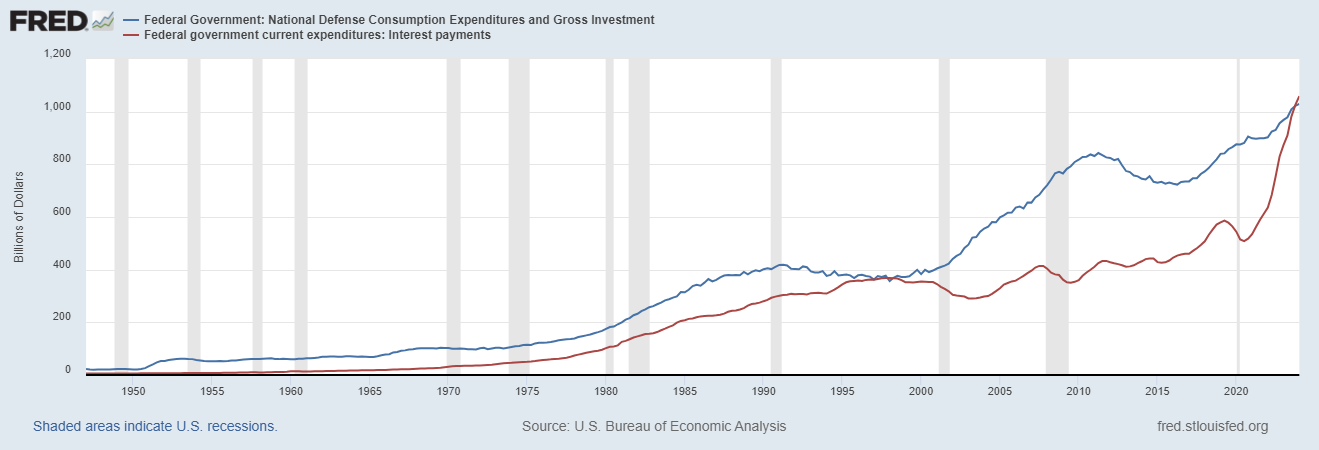

Any great power that spends more on debt service (interest payments on the national debt) than on defense will not stay great for very long. True of Habsburg Spain, true of ancien régime France, true of the Ottoman Empire, true of the British Empire, this law is about to be put to the test by the U.S. beginning this very year.

Historian Niall Ferguson

I don’t often venture my opinion on things over which I have little control and the federal budget and debt certainly fall into that category. I can’t express my opinion by voting because there is no political party of fiscal responsibility anymore (and I wonder if there every truly was); both parties have proven they can’t control themselves when it comes to spending our money. The Trump administration ran a trillion dollar deficit in 2019 – before COVID – and the deficit rose every year he was in office, in absolute terms and as a percentage of GDP. The deficit had improved from nearly 10% of GDP in 2009 to 3.1% of GDP in 2016 but worsened to 4.6% of GDP by 2019. That doesn’t mean the Obama administration was a paragon of fiscal virtue because I’m sure they would have spent more if they had had the legislative heft to do so. But the spending of the Obama era looks positively sober compared to the two who came after him.

The Biden administration did improve the deficit from the COVID 2020 level but that is damning with faint praise. The deficit hit 14% of GDP in 2020 but improved to a still horrid 11.8% in 2021. It further improved last year to 5.3% of GDP which beat the record for worst non-recessionary, non-war related deficit previously held by….Trump. And now the CBO has raised the deficit estimate for this year by $400 billion because of: a) student loan forgiveness; b) FDIC not recovering payments it made to bail out banks last year; c) additional legislation passed this year and d) higher than expected Medicaid costs. The deficit this fiscal year will be near 7% of GDP depending on how the economy performs the rest of the year and, assuming we avoid recession this year, will set another non-recessionary record. And that assumes the deficit doesn’t further deteriorate over the next 3 months, an assumption I wouldn’t make.

Niall Ferguson’s observation is a good one but doesn’t take into account that we are spending less on defense as a % of GDP today than we have in the last 70 years. Considering what’s going on in the world today, it may be that we avoid his great power failure metric – for a while at least – because we have to ramp up defense spending. Defense spending as a % of GDP is already rising in Europe because every country with a Russian border is in full blown panic mode and the rest of the continent has no choice but to panic just a little too. But that would only delay things because there is no chance an American president would actually raise taxes or cut some other spending to pay for an increase in defense spending. As of Q1 2024 annualized defense spending was $1,029,903,000 while interest expense annualized at $1,059,400,000 so if that is sustained the rest of the year, we’ve already crossed the debt Rubicon.

The debt is not, in and of itself, the problem in my opinion but rather what it is being spent on. Over the course of the last 15 years, the US has dedicated more and more of its budget to what is called “industrial policy”. Much of the increase in the deficit under the Biden administration is from increased spending in this category and the US is far from the only country pushing government directed investment in favored industries. The rationale for the Inflation Reduction Act and the CHIPs and Science Act is a combination of climate policy, jobs and geopolitics – competing with China. If that sounds like a political platform that’s because it is; economic policy driven by polling and focus groups. This is easily seen by the allocation of these “investments”, which have been overwhelmingly directed to states that didn’t favor the current president in the last election. There are battery plants being built in South Carolina and North Carolina, just to name two pretty red states that are benefitting from Joe Biden’s dedication to climate policy. Is it coincidence that semiconductor plants are being built in Arizona and Ohio? An analysis by Fitch recently showed that 51% of IRA and CHIPs Act spending is directed at red states and another 29% to swing states.

These programs are having an impact on the economy right now because the money is starting to be spent which shows up in the GDP calculation. The long term impact is harder to judge right now but there are a couple of easy points to be made. First, these programs are not going to create a large amount of jobs. Current estimates are that the CHIPs Act semiconductor plants will create a little over 100,000 permanent jobs – assuming the companies can find people to fill them. Second, for the EV and battery subsidies, it seems the programs ignored one really important factor, mainly that people don’t seem all that interested in buying EVs. Will there be enough demand to keep all these new battery plants operating? Even if we did get people to switch, the benefit to the environment is probably overstated especially if AI increases the demand for reliable electricity at the same time. Electricity demand is already rising faster than expected and renewable sources can’t be ramped up fast enough (who wants a solar farm or wind turbines in their backyard?) to meet the new demand; gas fired plants are the only short term answer. The better long term answer is nuclear but the lead time on a nuclear plant is measured in years.

Can investment directed by government for political purposes pay dividends? If you throw enough cash against the wall you’ll certainly have some success stories. But I’d be willing to bet right now that the biggest output from these government directed investment programs will be embarrassment. The history of industrial policy, no matter the country or the form, is filled with corruption and waste. The subsidies offered by the Biden administration, coupled with tariffs that started under Trump and continue under Biden, raise prices and produce inferior products while crowding out private investment. Meanwhile if we continue to spend at a pace that exceeds growth, our debt burden will continue to grow, slowing growth and eroding confidence in the dollar.

I am not concerned about a debt crisis in the short term, although geopolitics may have something to say about that. Our current debt/GDP level is around 120% of GDP when we include everything (some use “debt held by the public” but that excludes all those non-marketable Treasuries sitting in the Social Security Trust fund) which puts us in a worse fiscal position than most of the developed world. But we do still have the world’s reserve currency and that isn’t likely to change anytime soon, mostly because there isn’t a viable alternative at present. At some point though, the world is going to balk at funding our deficits at a preferred rate. One way to speed that day of reckoning is to do exactly what we’re doing right now – subsidizing and protecting our domestic industries at the expense of foreign economies, friend or foe. When you’ve dug as deep a debt hole as we have it seems obvious that you should: 1) stop digging and 2) try not to tick off your lenders. We’re still digging and testing the limits of our creditors.

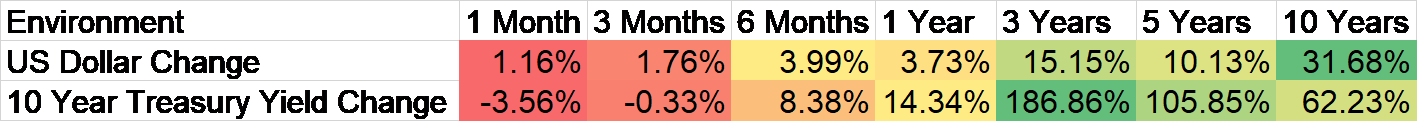

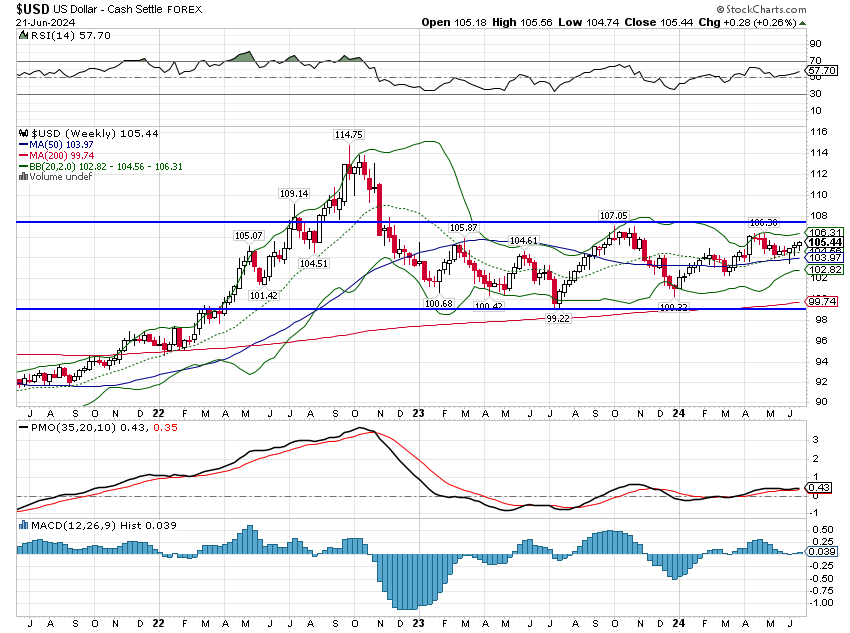

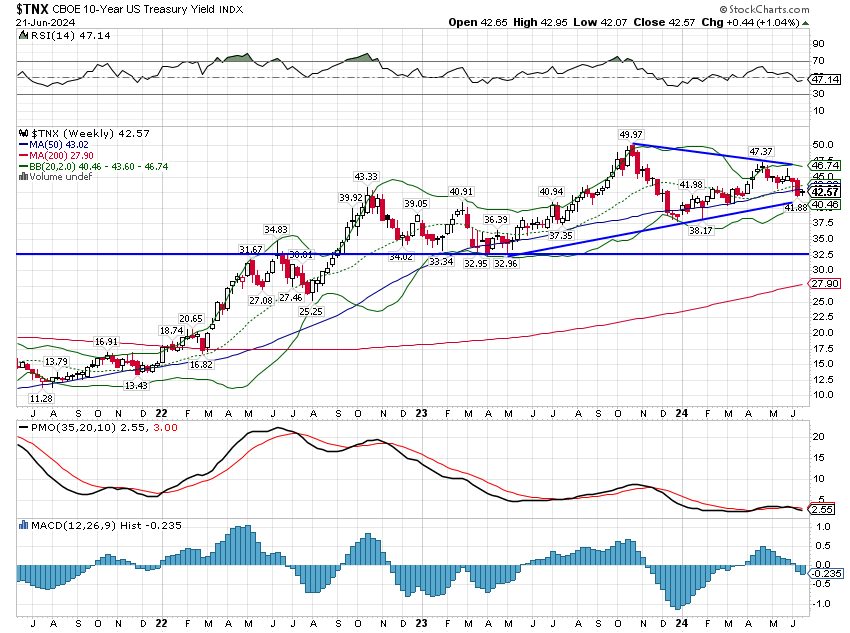

As I said, I don’t often comment on topics like this because I have no control over them. As an investor, I have to deal with the world we have rather than the one I’d like. Our national debt issues will be reflected in the markets long before our politicians decide to do anything about it so we can prepare for it even if we can’t affect the outcome. Interest rates will likely be higher and the dollar lower than would be the case if we were more fiscally responsible. If interest rates are now in a secular uptrend because we can’t control our spending, that is going to impact how I invest. If the dollar is worth less – versus other currencies and/or real things – that is going to affect how I invest. In fact, we are, right now, considering a change in our strategic allocations because of what we perceive as a long term change in the trend of interest rates. This is a change that we would expect to last for decades; it isn’t just a tactical change that would get reversed in a matter of months or a few years.

Secular changes, by definition, don’t come along very often. They are hard to identify for the same reason. The last two secular trends in interest rates – rising from the 1950s to the 1980s and falling from the ’80s to 2020 – lasted decades. Forty years of falling interest rates made debt easy to accumulate and service. Now with higher interest rates, the higher cost of servicing the accumulated debt means that other spending must be curtailed or the debt will continue to grow leading to higher interest rates and more debt. Getting out of that loop requires higher growth – that excessive government spending makes harder to produce. The old secular trend (falling interest rates) creates a problem (excessive debt) that leads to a new secular trend (rising interest rates).

Environment

The economic environment was unchanged last week as the 10 year rate and the dollar both rose slightly. Both have been trending sideways for about 18 months and while I think both will resolve lower eventually, there is no indication of that yet.

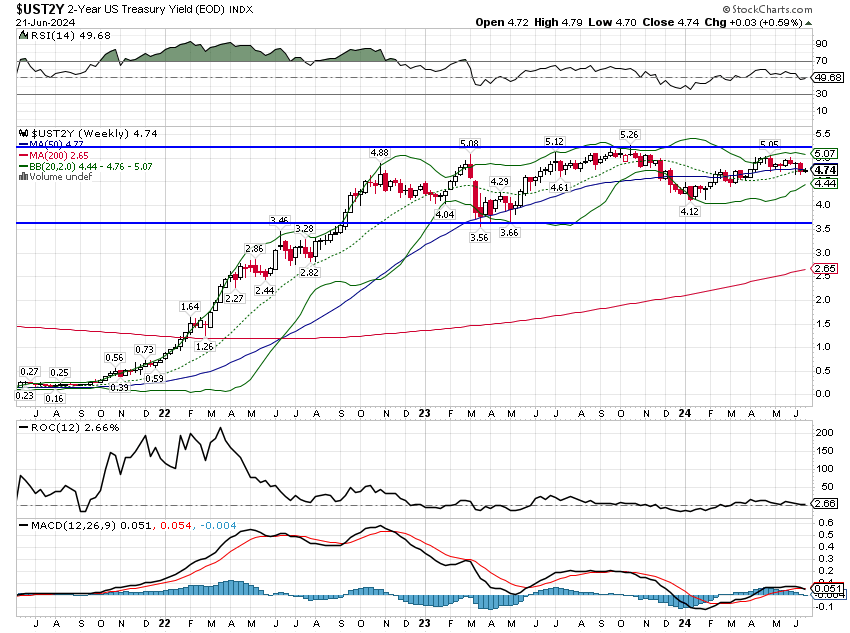

The 2 year note yield is also still trending sideways. The Fed may cut this year but you won’t find it in markets yet.

Markets

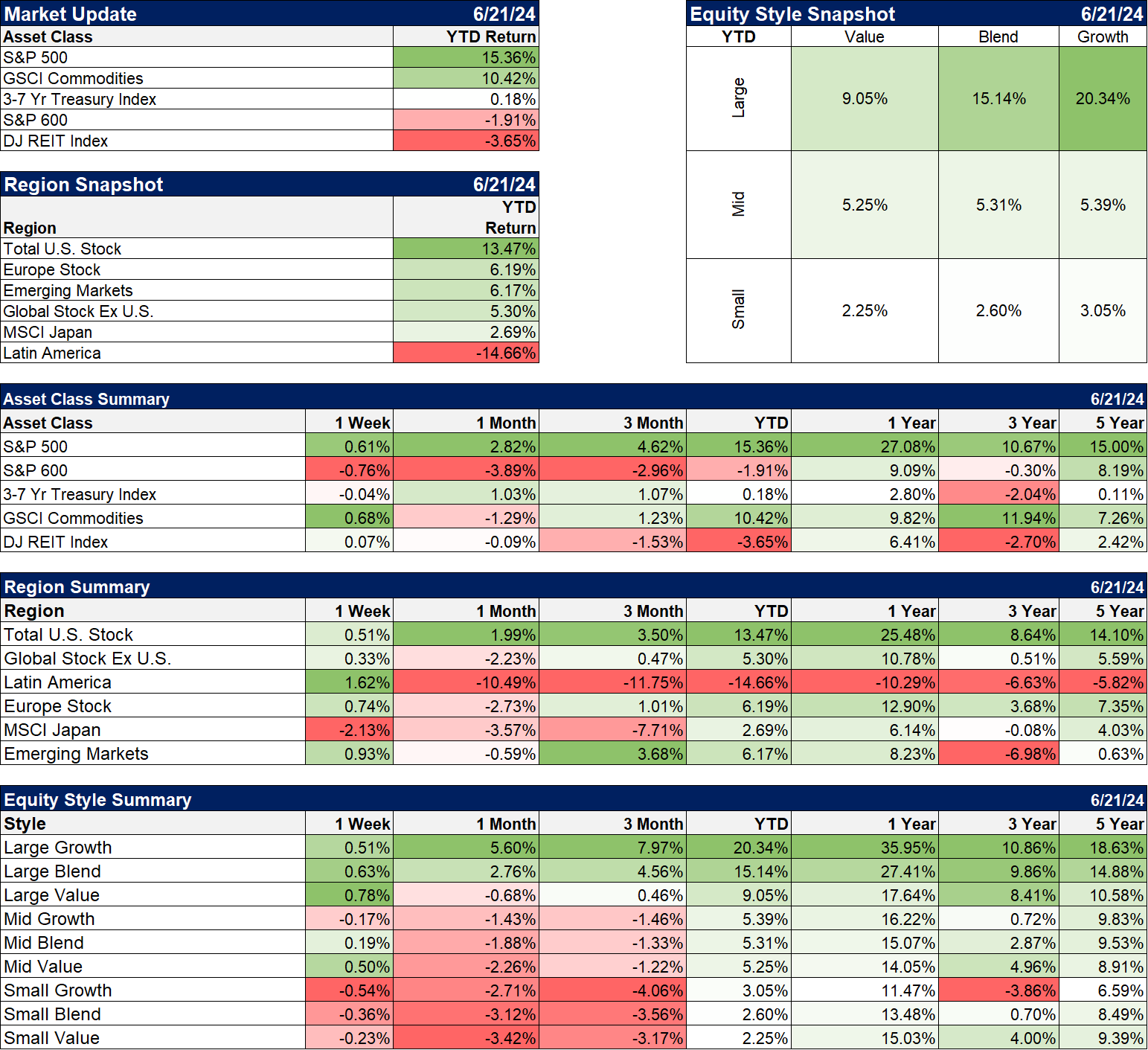

Large cap growth stocks and commodities continue to lead on the YTD basis with intermediate term Treasuries flat while small cap stocks and REITs are both down modestly. That is also true over the last 3 years which have been very difficult for diversified investors. US stocks overall have offered a below average return but still better than anything outside the US. Emerging markets are down, Europe is up less than half the US and Japan is flat. Bonds and REITs are both down 2% or so annually over that time. It doesn’t improve much over the 5 year time frame with bonds flat and REITs up a little over 2% a year and non-US stocks providing mid-single digit returns.

When will doing the “right thing” – diversifying your portfolio, i.e. not putting all your eggs in one basket – pay again? How long can a small slice of the US stock market continue to defy history and common sense?

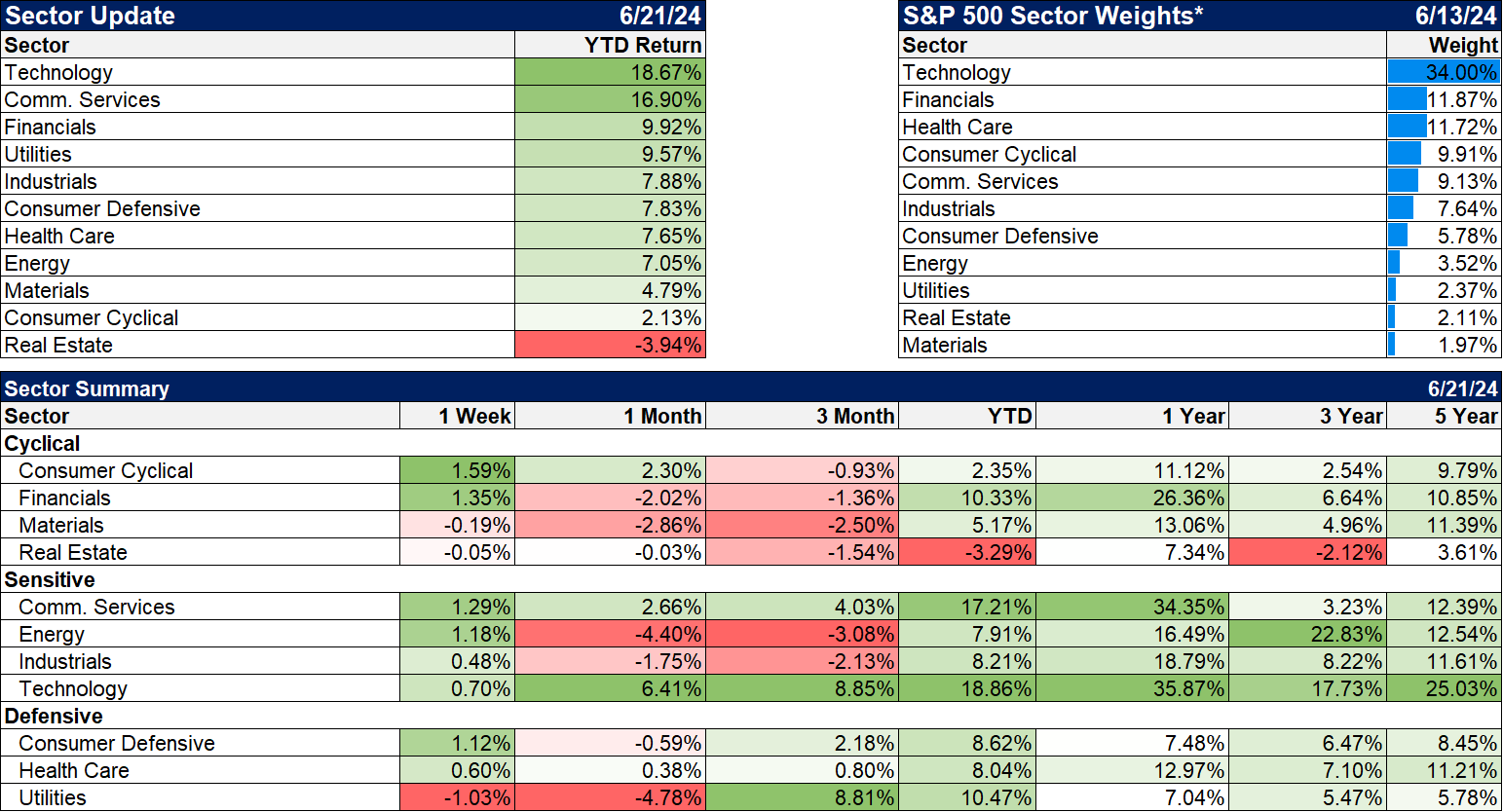

Sectors

There are only two sectors that have annual returns over 10% in the last 3 years – energy and technology. Will either of those lead over the next 3 years? If I had to bet on one, it wouldn’t be technology.

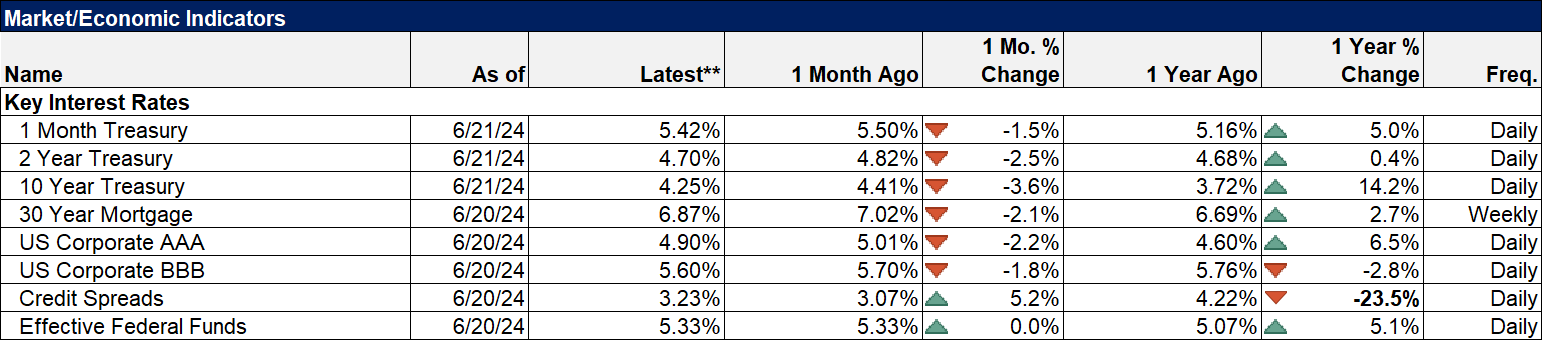

Market/Economic Indicators

The economic data last week was mixed with retail sales and housing data on the weak side and manufacturing showing some recovery:

- Empire State manufacturing index was better than expected but continues to improve (-6 vs -15.6 last month)

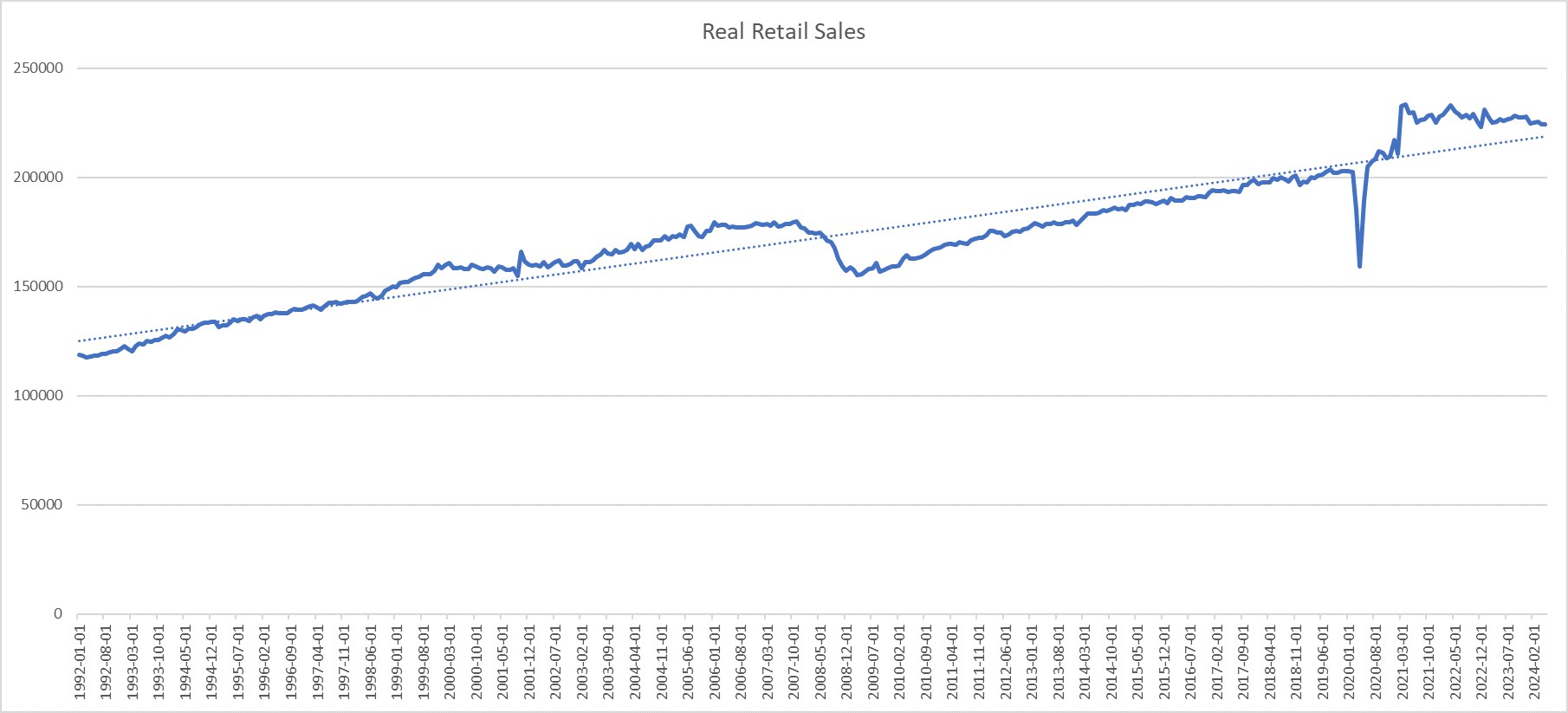

- Retail sales were up less than expected (0.1%). Year over year retail sales are up just 2.3% which is negative after inflation. That sounds bad but real retail sales are just coming back down to their pre-COVID trend:

- Industrial production was up 0.9%, much better than the expected 0.3%. The manufacturing sub-index was also up 0.9%.

- The Housing market index fell again this month to 43 from 45 last month

- Building permits and housing starts were both down when they were expected to rise

- Philly Fed manufacturing index was positive at 1.6 but less than the expected 5. Still, June was the fifth consecutive positive month in a row.

- S&P Global US PMIs: Composite 54.6, manufacturing 51.7, services 55.1, all better than expected

- Existing home sales down slightly from last month but about in line with expectations; inventory is finally rising

Notable reports this week:

- CFNAI – Chicago Fed National Activity Index

- Case Shiller home prices for April

- Consumer confidence

- Richmond Fed manufacturing index

- New home sales

- Durable goods orders

- Final revision to Q1 GDP

- KC Fed manufacturing index

- Pending Home sales

- Personal income and spending; PCE price index

Credit spreads have recently risen modestly but at 3.2% are still very low

More By This Author:

Market Morsel: A Top Heavy MarketMarket Morsel: How “The Market” Is Really Doing

Big Stock Swings; High Dispersion

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more