The Slide In The U.S. Dollar Threatens Its World Dominance

Image Source: Pixabay

As with so many of President Trump’s policies it is nearly impossible to divine the ultimate goal. This is no less true than in the case of the US dollar, as the world’s most important reserve currency. Is a strong dollar better or worse for Trump’s trade policy? Well, it depends.

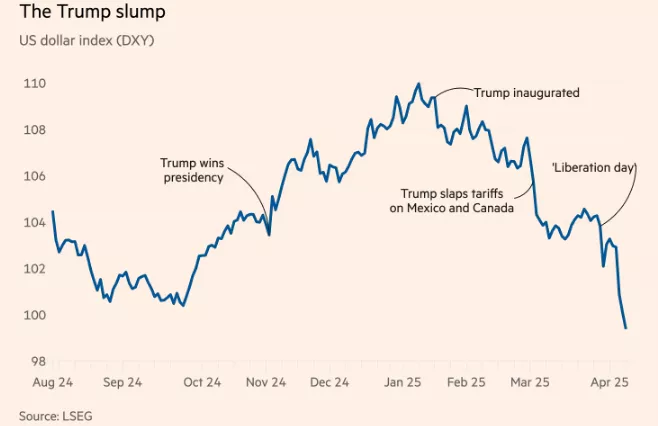

Trump unleashed a tariff policy, worse than that experienced in the 1930s. The financial markets went into a dive as both stocks and bonds loss considerable value. The US dollar would normally attract investors as a safe haven. This time is different as the USD just headed south in a hurry. Reacting to the swoon in the financial markets, Trump put a 90-day hold on tariffs worldwide, with the exception of China . This failed to placate currency traders who continued to sell dollars.

Some within the Administration welcomed the decline in the dollar on the grounds it will make US exports cheaper and US imports more expensive, working in tandem to reduce US trade balances. However, given the size ofthe US trade deficit, few trade analysts really expect any meaningful reduction.

The bigger picture on the dollar’s decline is whether the US dominance is disappearing faster in the first 100 days of Trump’s presidency than anyone would have foreseen a few months ago. This decline is having an outsized impact on investor portfolios. FT.com reports that foreigners own $19tn of US equities, $7tn of US Treasuries and $5tn of US corporate bonds. No escape is possible without suffering significant losses. Furthermore, selling in order to minimize losses only contributes to further USD weakness.

Commodities and international loans are widely conducted in USD. Should the USD lose its pre-eminence, one or more other major currencies need to step into the void to allow trade and investment to transact smoothly. The relative strong USD position has allowed the U.S. to borrow at very favourable rates. On the flip side, the strong dollarhas made it easier for foreign exports to penetrate the US domestic market.

Many point out that the USD decline is more a reflection that its trading partner no longer trust the U.S. The damage done from an erratic tariff policy is irreparable. Hence, the USD has loss ground to the euro, Swiss franc, and the Japanese yen, its competitors in the currency markets. Even the Canadian dollar has gained nearly 5% in the past month. None expect the USD to lose its reserve status, given that more than half the world’s trade is invoiced in USDs and its liquidity is second to none.

Meanwhile, the investment community continues to expect further declines in the dollar amidst the chaos experienced so far. Goldman Sachs argues that a worldwide trade war will erode confidence in the USD and that the weakness in the US government and its institutions will hurt the USD assets.

So, we still don’t know whether the Trump Administration wants a strong or weak dollar.

More By This Author:

Uncertainty Dominates The Decision Making At The Bank Of CanadaTrump’s Assault On The Canada-US Bilateral Trade Continues In Full Swing

What Lies Behind The Israeli Economic Recovery, Post October 7