The Return Of The Economic Undead

One shows that they are economic fraudsters over and over, with discredited ideas, but they keep on coming back. From WaPo:

…his top economic advisers … to map out a trade-focused economic plan for his presidential bid…. including former senior White House officials Larry Kudlow and Brooke Rollins, as well as outside advisers Stephen Moore and former House speaker Newt Gingrich…

Two observations:

- The main “big idea” seems like a pretty bad idea.

“I think when companies come in and they dump their products in the United States, they should pay automatically, let’s say a 10% tax.” (Business Insider)

If you feel a sense of deja vu, you could be excused. Did the imposition of Section 232 and Section 301 tariffs “win the (trade) war”? Just a reminder of what happened to the non-oil trade balance/net exports (the total trade balance looks similar):

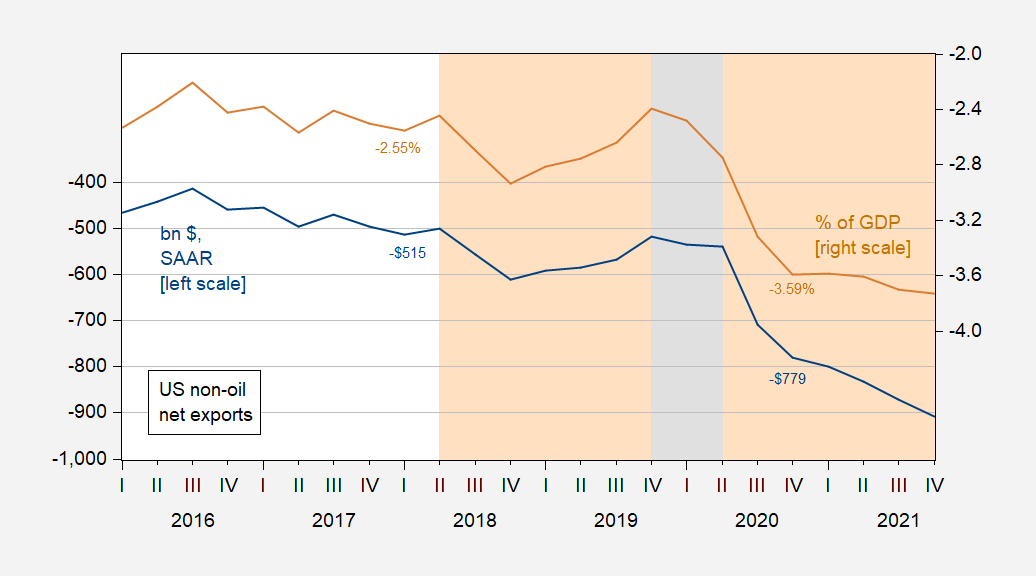

Figure 1: Net exports ex-oil, in billions $, SAAR (blue, left scale), and as ratio to US GDP, % (tan, right scale). Light orange denotes imposition of Section 232 and Section 301 tariffs. NBER defined peak to trough recession dates shaded gray. Source: BEA 2023Q2 advance release, NBER, and author’s calculations.

For discussion of the other counterproductive aspects of the Trump tariff war, see for instance here.

2. If the idea was to run on the lousy economic performance under the Biden administration (maybe lousy to come), this might be a hard slog. Consider the latest forecasts and nowcasts of US GDP.

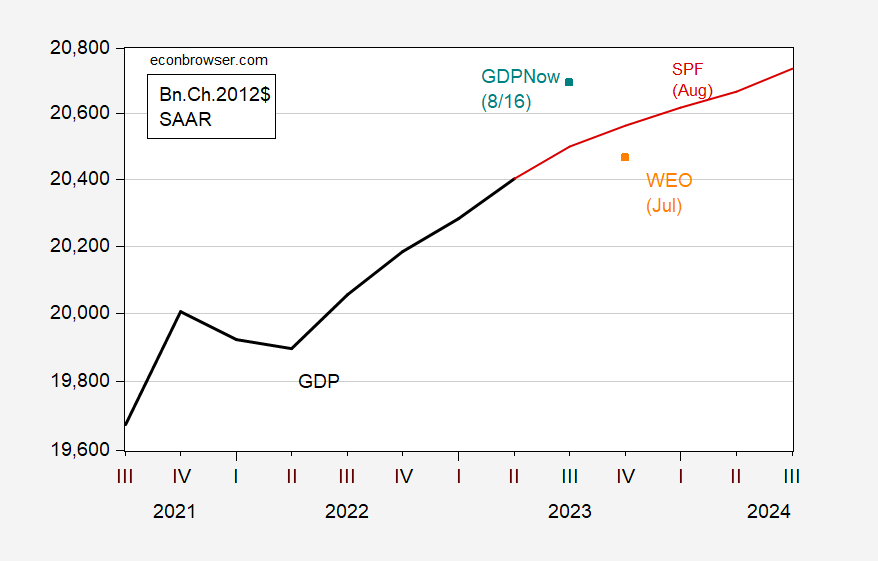

Figure 2: GDP (bold black), SPF median (red), WEO forecast (orange square), and GDPNow of 8/16 (teal square), all in bn Ch2012$, SAAR. Source: BEA 2023Q2 advance release, Philadelphia Fed, IMF July WEO, Atlanta Fed, and author’s calculations.

As noted elsewhere, negative GDP growth quarters have dropped out of consensus views as time has progressed. Obviously, since all data are going to be revised, perhaps substantially especially when considering GDP data, the fact that the outlook is improving as more data comes in (and inflation falls) indicates that a really hard landing scenario is less likely (conditional upon no big negative surprises).

What about the negative term spread. That indicator is still signalling a recession. Interestingly, the implied y/y growth rate of industrial production is stil pretty modest.

More By This Author:

US GDP Deflator, Broad Money, And VelocityRussia’s Current Account Surplus Disappears

China Downside Surprises