The Recovery Has Reversed: What Goldman's Real-Time Indicators Reveal About The State Of The US Economy

In its latest weekly activity update, Goldman Sachs (GS) looked at a real-time economy indicator focusing on consumer and export activity, the labor market, and inflation, and found that while the overall state of the economy is far stronger than where it was in March, the upward momentum has reversed. And worse, signs of permanent scarring are beginning to emerge.

Here are the details:

Consumer activity

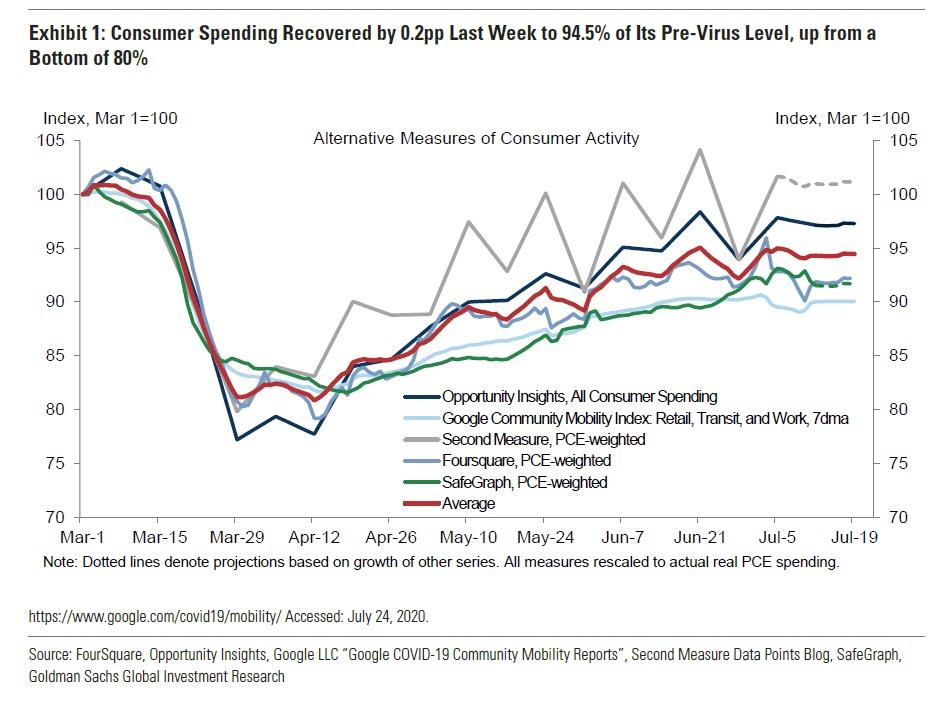

Consumer spending measures rose by 0.2pp to 94.5% of the pre-virus level over the last week, up from an April bottom of 80%.

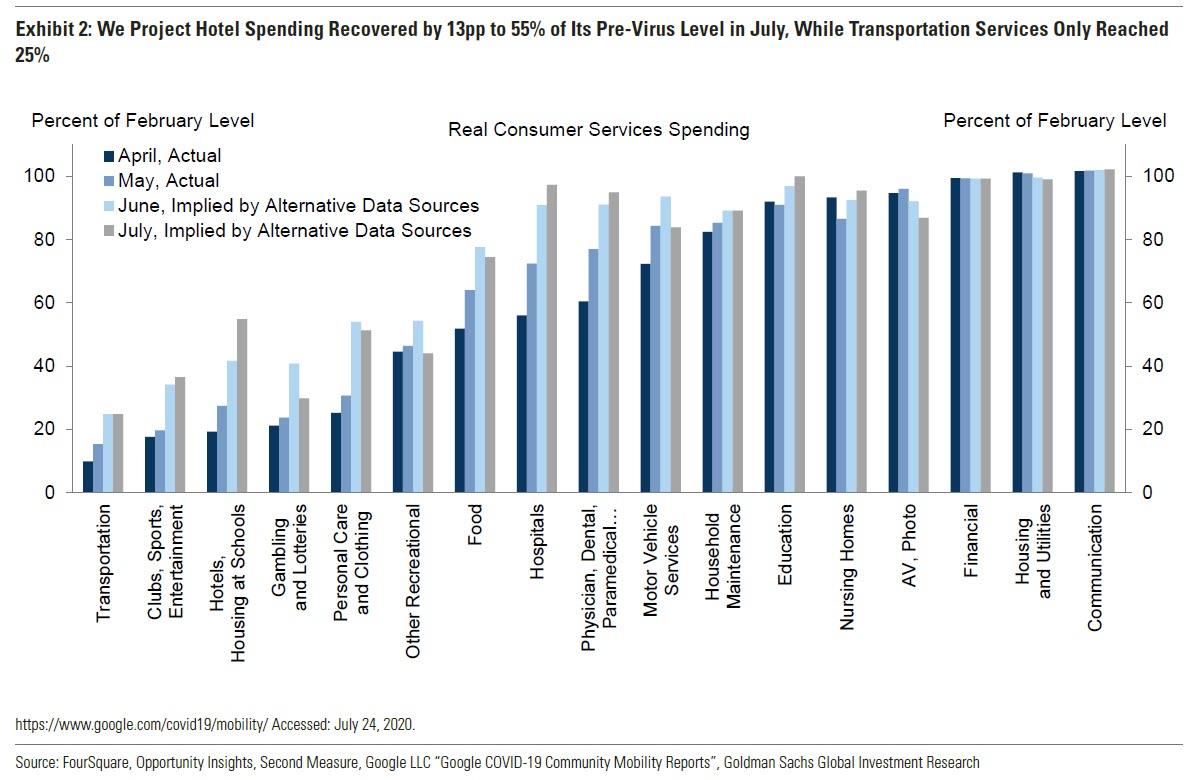

Of the highly-impacted consumer services industries, the hotel industry recovered the most in July, with foot traffic increasing by 13pp to 55% of the pre-virus level.

Meanwhile, the transportation industry remains the most depressed, now only back to 25% of the pre-virus level.

Export activity

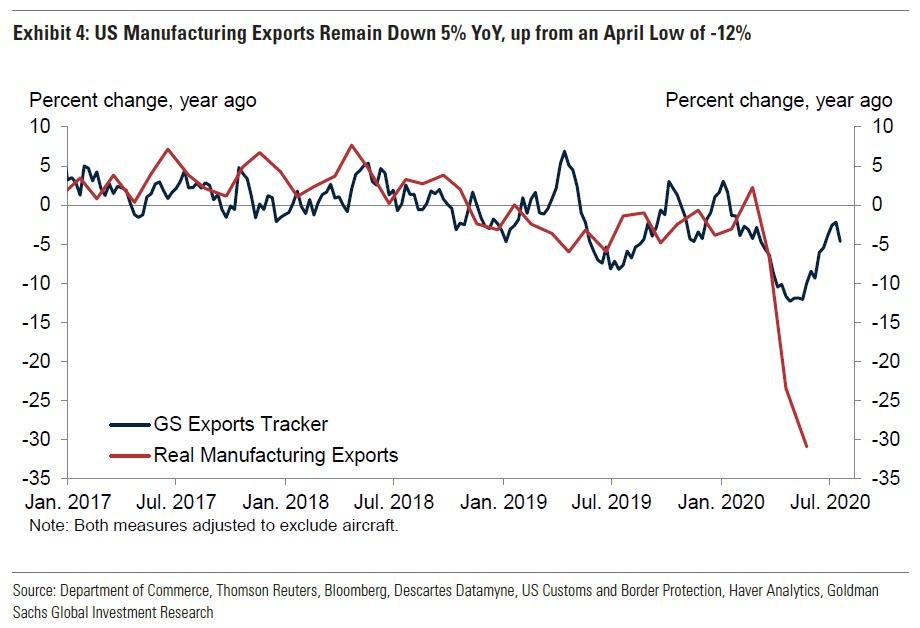

Goldman's export tracker indicates that manufacturing exports (ex-aircraft) partially rebounded over the early summer, after declining sharply in the spring. Hinting at a possible reversal in activity, over the last four weeks, the tracker declined 5% year-over-year to 90% of the pre-virus level.

Labor market

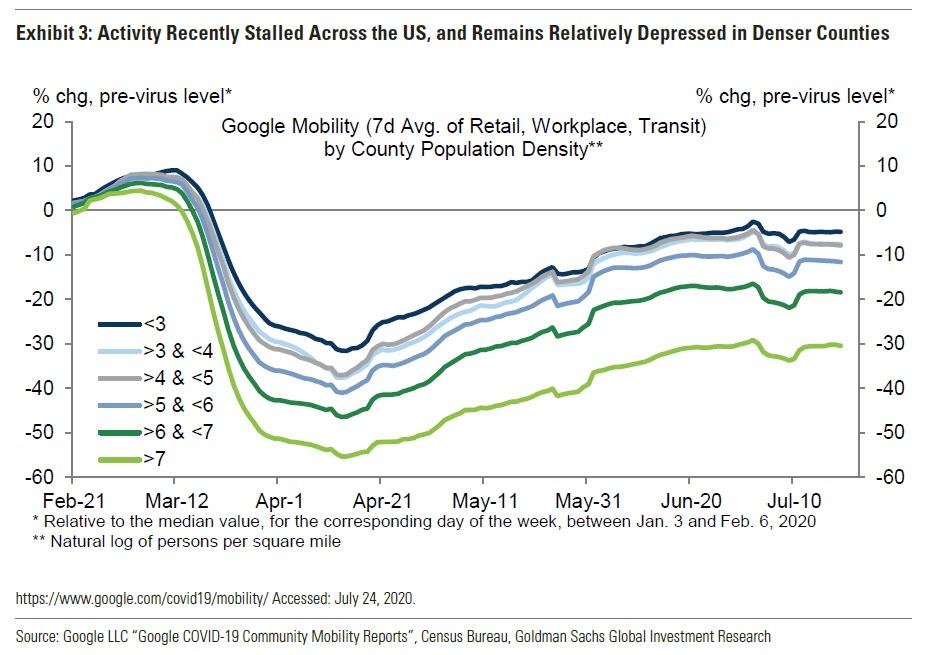

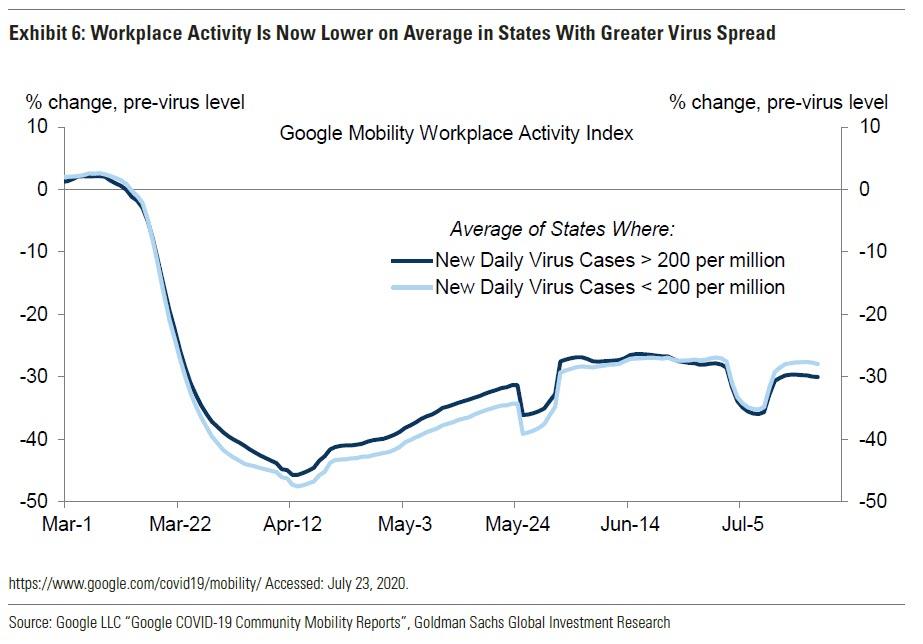

High frequency data suggests that the labor market recovery is stalling due to the worsening virus situation. Workplace activity measures have declined in the states hit hardest with virus spread, and moved sideways in others since late June.

Goldman's trackers suggest that current household employment is roughly unchanged from the June survey, and that, as of July 7, the unemployment rate had risen back up to 10.8% after falling to 10.5% in late June (vs. 11.1% in the June survey).

![]()

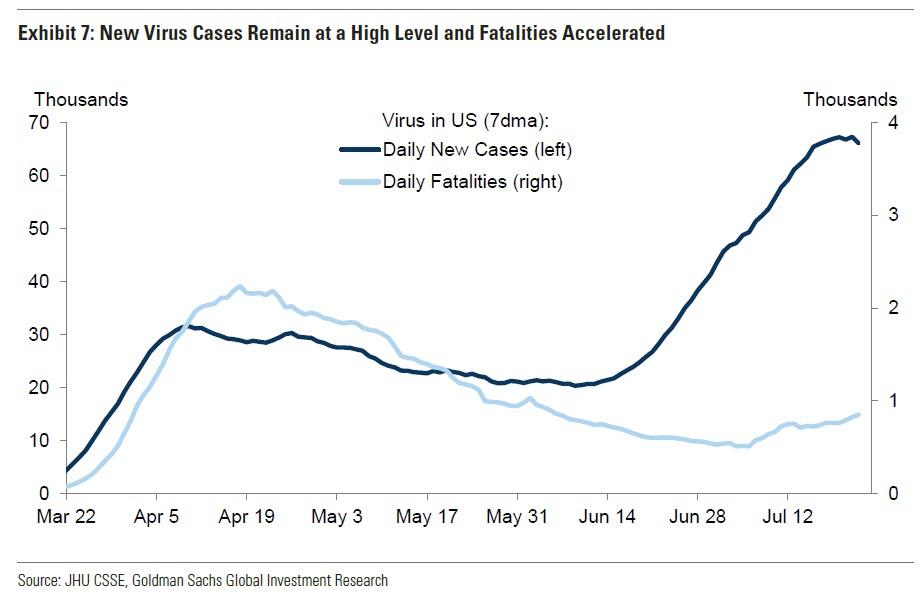

Virus spread

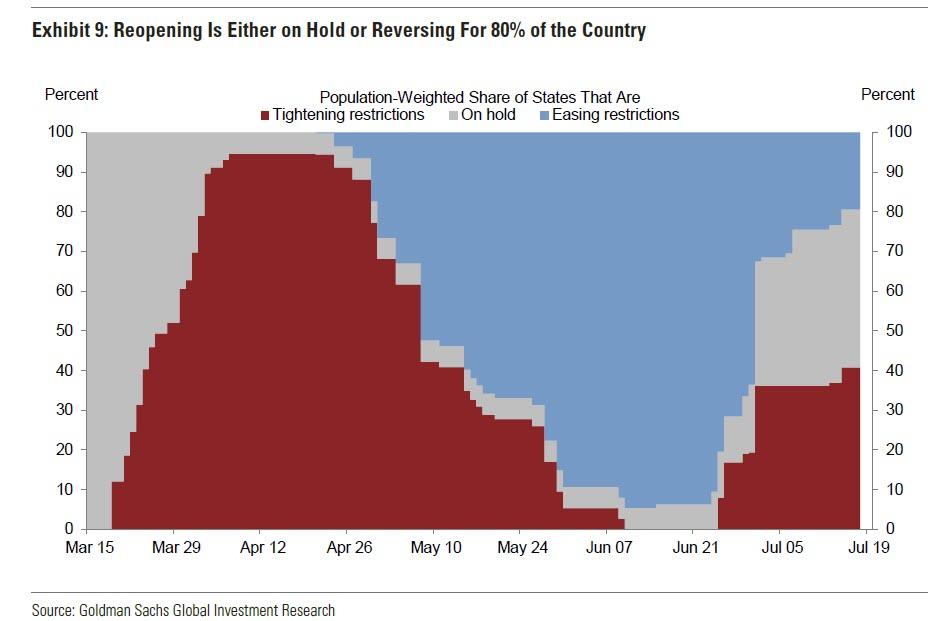

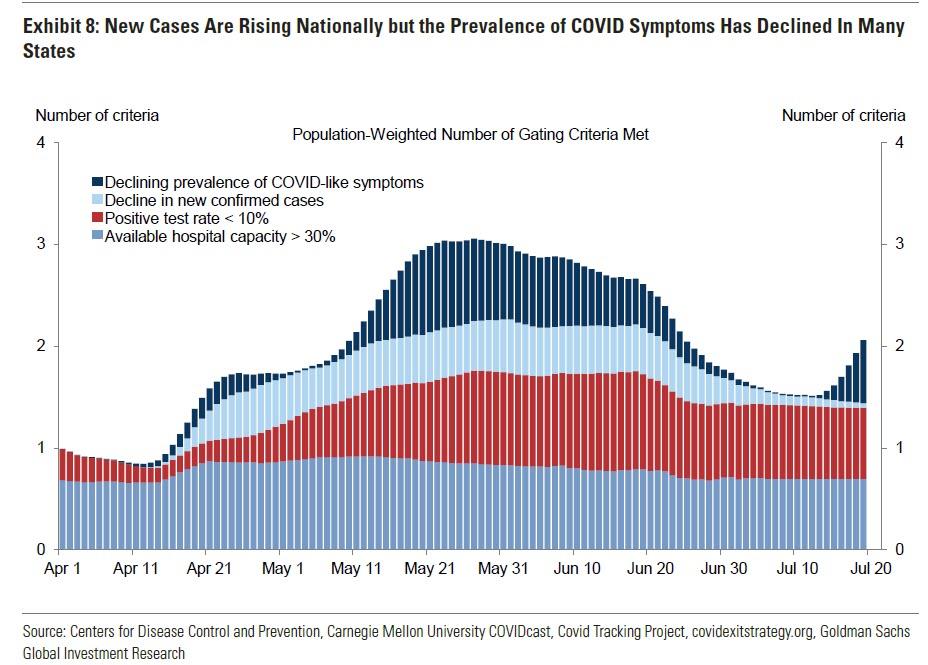

As we noted on Friday, when Goldman published a report discussing that the number of new COVID-19 cases is starting to flatten, the average number of the four gating criteria the federal government recommends for proceeding with reopening has risen over the past few days, as prevalence of COVID-like illness symptoms has declined in several states, potentially suggesting downward pressure on case growth.

But with the level of new cases already very high in several states and on average nationally, state government officials may remain reluctant to push forward with reopening.

Scarring effects

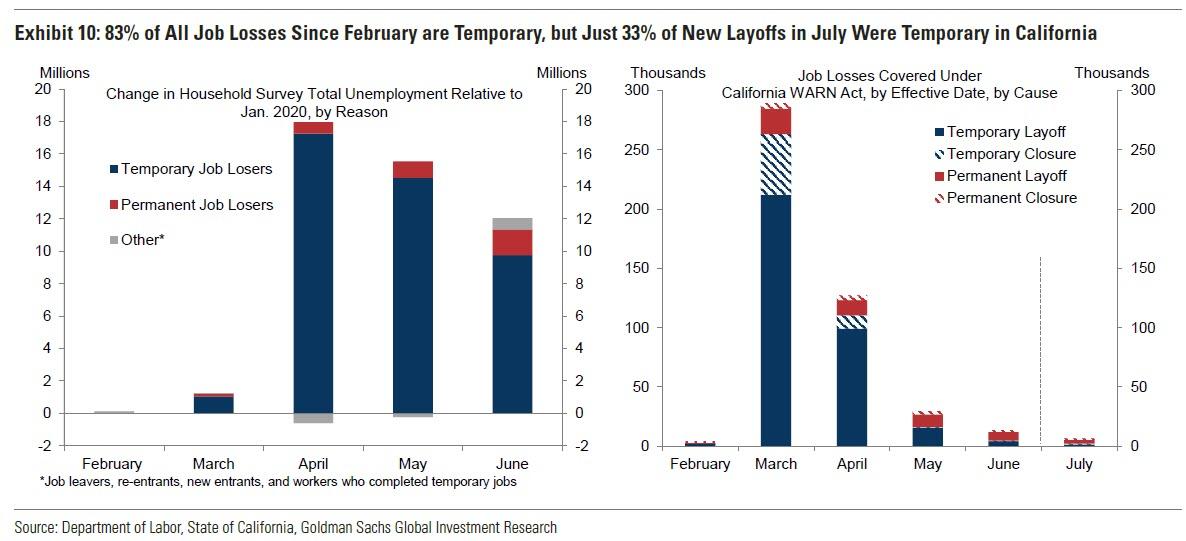

Signs of long-term damage to the economy are mixed. As of June, 83% of job losses since February are deemed temporary, though only 33% of new layoffs in California in July were temporary.

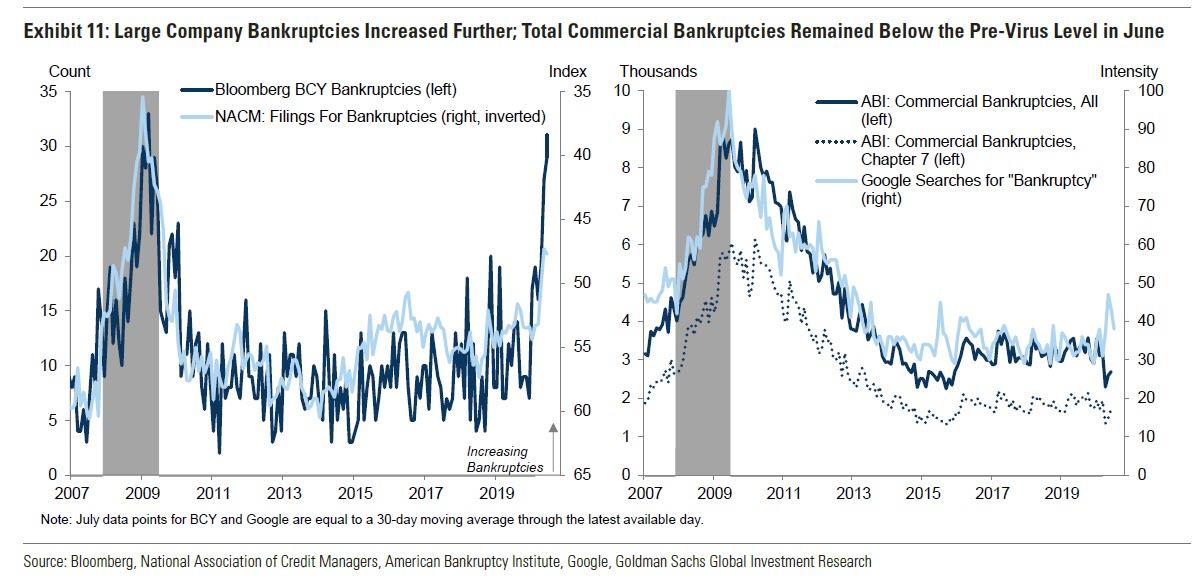

Large-company bankruptcies remain elevated in July.

Inflation

Prices of virus-affected services, such as hotels and airfares, retrenched over the last two weeks and are now down 20% from pre-virus levels, but remain well above the bottom of -48% from the beginning of April.

Finally, perhaps confirming the recent negative reversal in upward trends, consumer sentiment edged lower over the last week, with negative sentiment stubbornly high.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more