The Real Reason The US Dollar Is About To Roll Over

I’ve received a number of emails from readers asking me how I can be so certain that the USD will be dropping hard going forward.

The answer is simple… neither the US Government, not the US corporate sector can afford an extremely strong USD.

The Trump administration has proven itself to be Keynesian on steroids… and is planning to run $1 trillion deficits despite the roaring economy.

A strong USD would make this very difficult to do.

It would also have a highly negative impact on US corporations that derive nearly 50% of revenues from overseas. We are already seeing C-level executives discussing the negative impact on recent $USD strength during conference calls.

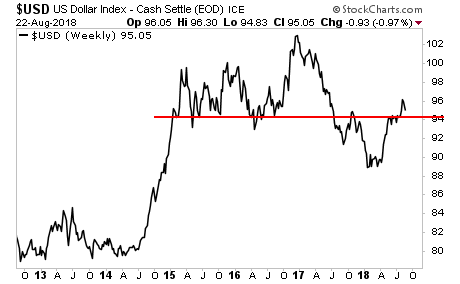

This happens any time the USD approaches the mid-90s… which we call “the line in the sand.” There is a reason we had an “earnings recession” in 2015-2016: it’s the fact the USD was in the upper -90s/ low 100s crushing profit margins.

Put simply, both the Government and the Corporate sector want the USD to roll over here and now.

So we expect the USD to roll over hard soon. But I want to be clear here… I’m calling for the USD in the mid-80s… not some full-scale collapse.

Why?

The Fed NEEDS the USD to remain strong enough to attract capital so the US can continue to fund its deficits and debt issuance… but not strong enough that it actively hurts the economy.

If the USD were to collapse rapidly it could cause a crisis of confidence in the currency. That is the LAST thing you want if you’re attempting to run $1 trillion deficits.

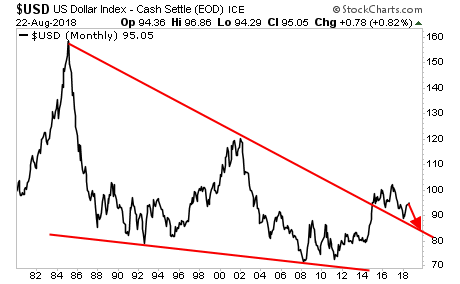

The long-term chart paints a nice picture for what I’m expecting. The USD has in fact been forming a series of lower lows since 2014. The next low will take us to the mid-’80s (see the red arrow).

That’s a heck of a “tell” from the markets. And it’s “telling” us that we’re about to see a major inflationary move as the $USD drops hard.

For more market insights and investment ideas, swing by our FREE daily e-letter at www.gainspainscapital.com.

The US could engage in a soft dollar policy if it was not already causing inflation by raising tariffs and engaging in trade wars. One must go.

Can you explain what a "soft dollar" policy is?

Soft dollar policy is where you let your currency slip so prior dent devalues and your exports get cheaper. It is what China did a while back although right now it is fighting to keep their currency up which negates the Chinese currency manipulation argument some propose. This usually includes increasing deficits (which we are), lowering interest rates and engaging in QE, and talking down the currency.