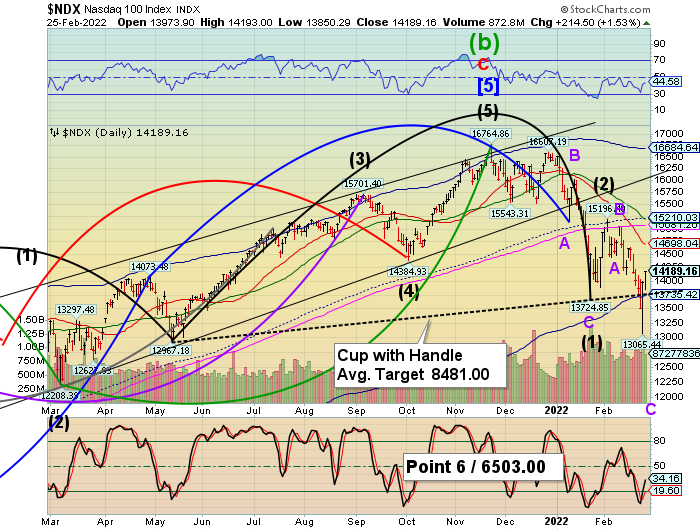

The Old Lip Of The Cup With Handle

7:45 am, February 28, 2022

NDX futures threatened the Lip of the Cup with Handle by declining to 13698.70 before a bounce. That’s nearly a 3.5% decline at the open yesterday. The die is cast, despite the 73% retracement. The Cycles Model calls for 4 days of decline.

SPX futures dropped to 4259.10 at yesterday’s open, then bounced to 4345 this morning, a 68% retracement. However, it has fallen away from the morning high and appears to be resuming its decline. In the options market, we are at Deja Vu all over again. Today’s expiring options are bearish beneath 4530.00, with short gamma beginning at 4300.00. The options market is the “tail that wags the dog” as dealers exercise pain management on a daily basis. But today may spin out of control. There is another observation, listed below.

Yesterday, ZeroHedge observed, “Most people don’t realize that the Crash of 1929 and the Crash of 1987 both occurred exactly 55 calendar days after the stock market had topped.

All prices in this article are closing prices on the day being referenced.

1929: the peak in the Dow was reached on September 3rd, when it closed at 381.17.

55 calendar days after September 3rd was (Monday) October 28th. That was the exact date of the Crash of 1929, with the Dow down 40.58 points, or 13.5%.

1987: the Dow topped out at 2722.42 on August 25th.

55 calendar days later was (Monday) October 19th when the Dow collapsed 507.99 points, or 22.6% in one day!

This year, the Dow topped out on January 4th, and…

55 days later is Monday (!) February 28th.

ZeroHedge reports, “Global stocks and US futures tumbled on Monday, although they were well off their worst levels as a fresh round of ceasefire talks kicked off on Monday morning offering a glimmer of hope that hostilities will end; sovereign bonds rallied and commodities surged amid heightened uncertainty after a new wave of sanctions against Russia for the invasion of Ukraine.

March contracts on the S&P 500 Index declined as much as 2.9% before trimming losses to 1%, or down 43 points as of 745 a.m. in New York. Futures on the Nasdaq 100 and the Dow were each down 1.4%. European stocks also recovered from an earlier as banks with exposure to Russia led declines, while utilities and defense stocks gained. Oil, natural gas, wheat and palladium jumped, as Brent crude soared to about $103 a barrel on fears of commodity-supply disruptions. Rallies in the dollar, gold and Treasuries underlined the demand for havens.”

VIX futures rose to 33.52 after yesterday’s open, but settled back as the morning progressed. The neckline of the Head & Shoulders formation is at 39.00. A crossing today is likely and sets the stage for reaching the target by the end of the week.

ZeroHedge observes, “VIXplosion is back

VIX is +18%, trading at 32.5 as of writing, highest levels since January 2021. What most people tend to forget is that buying protection in panic is usually an expensive strategy. Unless this crashes imminently (and 1.5% down on Spoos is not a crash) VIX is trading at very rich levels. Volatility is not a trending asset over time, and we have come up a lot lately…

TNX has declined beneath the Cycle Top support and may be headed for a deeper low. Last Thursday’s low was on day 258. However, today’s actions may extend the Master Cycle low later this week. The Ukrainian crisis may push TNX down to the 50-day Moving Average near 17.55.

Despite the 8% rally in BKX last week, it also is headed for a crash by the end of the week. It may make a deeper low in early April, according to the Cycles Model.

ZeroHedge reports, “In a remarkable show of force and unity, western powers cast aside all their previous concerns about Russian energy export dominance, and uniliaterally announced the nuclear option of imposing sanctions on the Russian central bank coupled with targeted exclusions from SWIFT of key Russian banks.

- *EU APPROVES BANNING ALL TRANSACTIONS WITH RUSSIAN CENTRAL BANK

The move has sparked a bank run in Russia, as locals scramble to pull out whatever hard currency they can get their hands on before it runs out, and is certain to trigger chaotic moves in FX and commodities when markets reopen on Monday. Already some Russian banks are offering to exchange rubles for dollars at a rate of 171 rubles per dollar on Sunday, compared to the official closing price of 83 on Friday before the European/US announcement about targeting the Russian central bank. In other words we are looking at a 50%+ devaluation of the Ruble. Additionally, widespread announcements of divestments in Russian equities by the likes of BP pls and the Norwegian sovereign wealth fund mean that the Russian market will be a bloodbath on Monday.”

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more