The Not So Impervious US Equity Market

Image Source: Pexels

MARKETS

The seemingly impervious US equity markets have reached their limit this month in terms of quickly absorbing both the repricing of rates and geopolitical tensions.

The S&P 500 entered Friday on track for its most significant decline since the Powell pivot on October 19. And while critics have spent the past four months questioning Powell's stance, equities have faced very few challenges this year, with only a couple of weeks ago being the other instance where the index was down 2% week-to-date heading into Friday. While the recent 5% decline may not constitute a significant drawdown, it does suggest that equities' capacity to overlook the sudden hawkish shift in rate-cut expectations has reached its limits.

Whether this represents a longer-lasting shift in market dynamics remains uncertain, and one could argue that a pullback is healthy, given its overdue nature.

However, suppose this does signify the downturn that equity bears have been cautioning about for months; the sell-off could be steep if equities remain rates sensitive, especially given the prevailing sentiment among investors, who now believe they may be fortunate to witness even two Fed rate cuts before the year concludes.

The simple explanation is that if interest rates remain high for an extended period, it will likely lead to a correction in the valuation expansion. This expansion has fueled one of the most significant five-month equity rallies in recent history. However, there is another concern to consider. By encouraging or tolerating a "no landing" scenario currently, the Fed has increased the risk of a "hard landing" happening later on.

With big-tech earnings already carrying significant weight in the US, these upcoming US exports now hold even greater importance against the backdrop of current market conditions.

The Federal Reserve appears poised to maintain its current policy stance for an extended period, regardless of the debate surrounding the impact of higher interest rates on soaring home prices by keeping resales off the market or their contribution to the economic boom via money market fund interest income. This inclination will be especially apparent if the US economy surpasses expectations and core inflation remains robust. In recent statements, numerous Fed officials have emphasized that any anticipated rate cuts for this year are now more probable in the latter half, with uncertainty lingering over whether they will occur in 2024.

During remarks in Washington on Thursday, John Williams, not typically known for being hawkish, inadvertently introduced the possibility of two-way rate risk. This slip-up suggests that additional rate hikes are not out of the realm of possibility, adding a layer of uncertainty to the Fed's forward guidance.

Always Take The Win

Nearly 24 hours later, there is still a lack of detailed information regarding what precisely occurred in Iran early Friday. However, in this instance, the scarcity of details may be considered a positive development: Israel's response to last weekend's aerial barrage seems to have been limited in scope, making it less likely to provoke another direct attack from Iran.

There have been several high-profile assassinations in Syria since late December, which included the killings of notable figures such as Seyed Razi Mousavi, an arms trafficker, and Saleh al-Arouri, Hamas' de facto envoy to Hezbollah - both of whom were crucial elements in Iran's regional "resistance" network. Iran has responded to these assassinations by launching a counter-attack, but the response was telegraphed in a way that Israel and the US were able to intercept it. Israel, in turn, has now retaliated to Iran's response, causing Iran to avoid any further direct military actions likely.

Israel should take the win and move on.

Housing Bears The Brunt Of Fed Policy

U.S. home buyers wish the Fed was in more of a rush to reduce rates.

Soft demand is tempering the upward momentum of rising prices, although they remain nearly 5% higher over the past year due to a shortage of available listings. While 30-year mortgage rates exceeding 7% dampen demand, historically low rates below 3% and 4% from two years ago constrain supply by keeping homeowners tied to their current mortgages and residences. Additionally, sellers may be holding off on listing their properties until new regulations on realtor fees come into effect in July, which are expected to lower commissions. Similarly, prospective buyers may delay their purchases in anticipation of potential price declines.

Too Much Recency Bias?

Macroeconomic forecasters, including the Federal Reserve, are currently placing greater emphasis on data dependency than usual. Given the elevated levels of economic and financial uncertainty, they are closely scrutinizing each day's data releases to shape their perspectives on the Federal Reserve's policies, inflation trends, and consumer behaviour. However, relying heavily on real-time data can introduce a challenge: the risk of succumbing to recency bias, where recent events disproportionately influence forecasting.

The past two weeks of economic data have presented a significant amount of wood to chop for analysts to digest. March reports suggest that the inflation challenge is far from resolved, portraying the Federal Reserve's task of restoring price stability as an ongoing endeavour, with outcomes ranging from a work in progress to a potential battle being lost. The accuracy of these viewpoints will heavily rely on the trajectory of forthcoming data in the next few months.

A robust March retail sales report, coupled with upward revisions to previous months, indicates stronger real consumer spending growth in the first quarter, potentially nearing 3.0% annualized rate instead of the initially forecasted 2.3%. However, extrapolating this first-quarter strength into subsequent quarters proves challenging. Historical data reveals that a single quarter of robust consumer spending growth often fails to predict the growth rate in the following quarter. For instance, last year witnessed a scorching 3.8% annualized rate of real consumer spending in the first quarter, only to plummet to a lacklustre 0.8% rate in the second quarter.

While most forecasters have revised their 2024 outlook for inflation and economic growth to some extent, some have taken more drastic measures by eliminating all Fed rate cuts for this year and adopting a 'No Landing' baseline forecast for the economy. However, such a significant departure from prior projections based solely on a few months of unexpectedly high consumer inflation, payroll gains, and retail sales may be an exaggeration. Consequently, I’m still pitching my tent in the 'Soft-Landing' camp. To veer from this position would essentially contradict fundamental principles of economics and monetary theory. I expect a meaningful economic slowdown this year, albeit with the acknowledgment that it may take longer to materialize and may not be as severe as initially forecasted six months ago. Despite potential delays, the inevitability of a slowdown remains unchanged, and the Fed will assuredly cut rates this year.

Bank Commentary Of The Week

Below is a copy and paste of one of the best market summaries I’ve read in some time, which comes from Senior Economist Jennifer Lee at the Bank of Montreal.

Things That Make You Go Hmm

It seems like it takes a lot to raise an eyebrow. But, a few incidents this past week raised both brows or at least made one pause and reflect. Here are a few:

-

The IMF still used the word “resilient” to describe the global economy, though it did qualify it by saying there were “challenges ahead”. One would have imagined a more toned-down description given sticky U.S. inflation and deepening geopolitical tensions.

-

China beat expectations with a 5.3% y/y jump in Q1 real GDP. This wasn’t a shocker, but it was disappointing that all the gains were early on. Momentum faded as the quarter ended, as evidenced by the March data.

-

Currencies: The yen sauntered over the ¥154 mark, and still no MoF in sight. But officials in Indonesia and Vietnam jumped in to intervene when their currencies were slammed on Friday.

-

Inflation news… TSMC will charge more for chips made outside of Taiwan… and cocoa prices are at a record high.

-

Mother Nature’s weird sense of humour: Flooding in Dubai? Really?… Meantime, Spain could see its worst drought in 100 years this summer… and Yunnan Province in China is dealing with its worst drought in 60 years.

-

The ECB is still bent on a June cut, even though Slovenia’s Vasle warned that diverging from the Fed “has limits”. The BoE also doesn’t seem too concerned, as Governor Bailey said that U.S. CPI was driven by demand, which wasn’t as much the case in Britain.

-

2025? Hikes? Yes, the idea of delaying cuts until 2025 and the possibility of rate hikes entered the conversation, courtesy of the Minneapolis and New York Fed Presidents.

In Case You Missed It

FOREX

The USD's resurgence as a global concern echoes a scenario I wrote about two weeks ago: "duelling currency wrecking balls." Observations from the IMF-World Bank meetings in Washington hint the dollar's unyielding strength emerged as the central issue, drawing serious apprehension from officials, particularly in Japan and South Korea, where persistent currency devaluation has become a source of frustration.

Janet Yellen's acknowledgment of the "serious concerns" expressed by Japanese Finance Minister Shunichi Suzuki and South Korean Finance Minister Choi Sang-mok culminated in a joint statement. This statement, perceived as a signal for potential intervention, received cautious optimism from market participants. Masato Kanda, Japan's FX overseer and highly regarded in market circles, emphasized the gravity of the situation by distinguishing these concerns as "serious" rather than ordinary.

Reflecting on September 2022, a period marked by a distressing surge in dollar strength, parallels emerge, albeit not yet reaching the same severity when the world was forced to go “dialling for dollars.” Nevertheless, the prevailing strong dollar trend raises alarms, suggesting that the "US exceptionalism" trade poses escalating risks, potentially leading to significant disruptions for the global economy.

The primary driving force behind the strong dollar is the looming spectre of enduring monetary policy divergence. Specifically, while the US economy remains resilient and steadfast, it shows little sign of weakening compared to its primary G-10 peers.

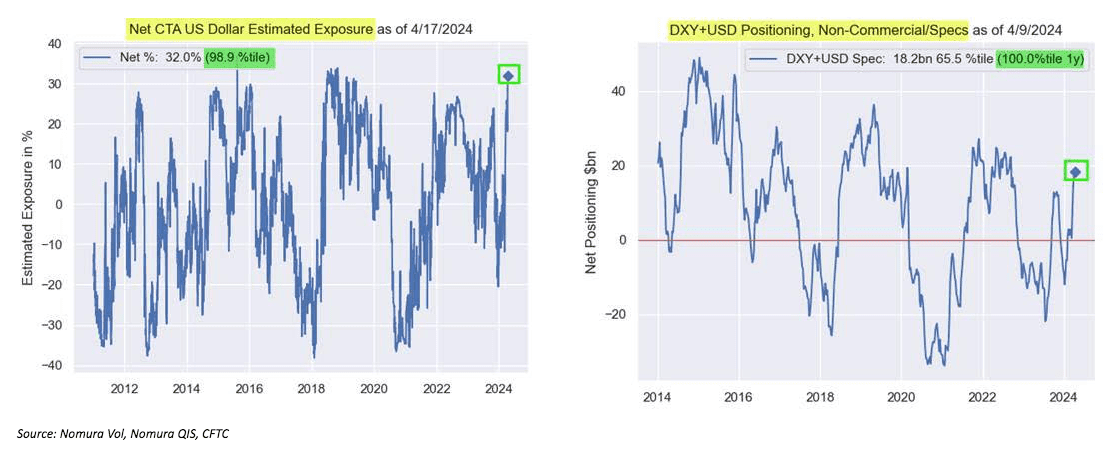

A significant worry for US dollar bulls is the apparent strain in dollar positioning. Both CTA exposure and CFTC net long figures suggest stretched positions. To elaborate, the CFTC net long positions are currently at the 100th percentile based on a one-year lookback period, while CTA exposure is approaching comparable extremes over a longer duration.

Simply put, this situation suggests a potential reversal, namely a pullback, in the event of coordinated intervention or any dovish US macro catalyst.

However, regardless of what unfolds in the immediate future, it's improbable that this will entirely undermine the multi-level case for a strong US dollar. Instead, intervention might offer the opportunity to buy into the US dollar at more favourable levels.

The US dollar appears remarkably resilient, almost impervious, amidst a notable global growth divergence.

Moreover, capital continues to flow into the allure of US exceptionalism, particularly given the proximity to US tech/AI companies, which are perceived as engines of perpetual growth. A newfound penchant for higher oil prices further bolstered the dollar's strength.

Furthermore, amidst escalating uncertainties, there's a flight-to-safety dynamic at play. In times of heightened risk, there's an increased demand for dollars, primarily manifested through benchmark Treasuries. Notably, individuals seek cash USDs to hide under the mattress during genuine major crises, eschewing all substitutes.

CHARTS OF THE WEEK

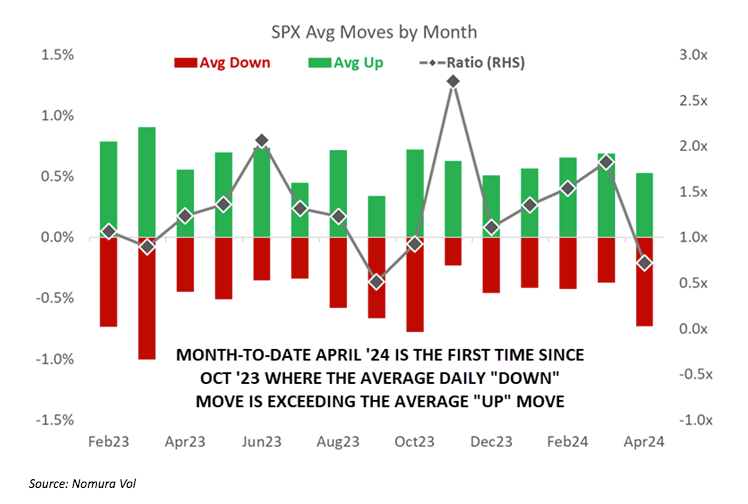

The figure below, from Nomura, shows that through mid-week, the average down day in April exceeded the average index move on up days. That hasn’t happened since October.

April’s BofA Global Fund Manager Survey suggested “no landing” odds have risen sixfold since December. By contrast, almost no one sees a hard landing.

More By This Author:

Asia Open: Billowing Clouds Of Apprehension

Netflix In Focus As Stocks Grapple With 'Higher For Longer' Mantra

US Stock Continue To Stumble As Traders Rethink Rates