The Market’s Expectations Of Inflation And Real Rates Over The Next Five Years

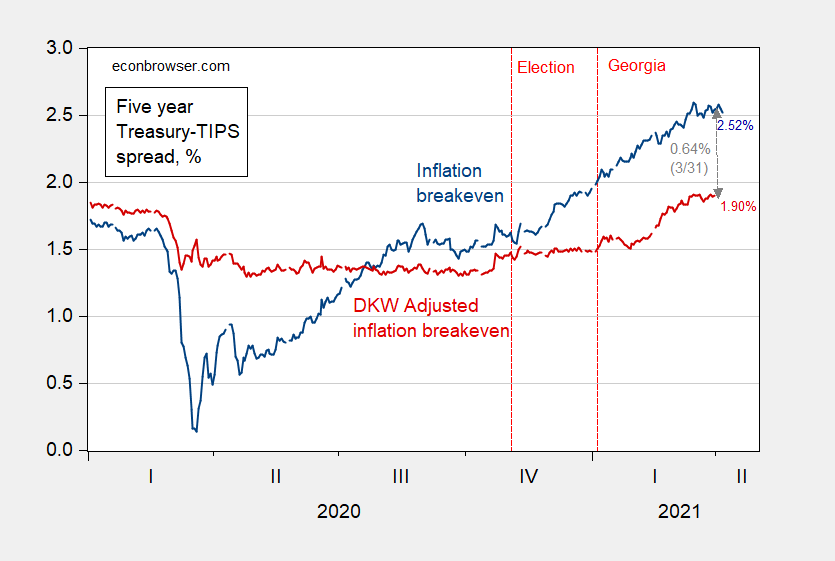

As of today, the five-year constant maturity Treasury yield has stabilized for the last month at about 0.9%. The inflation breakeven implied by the spread between Treasurys and TIPS has plateaued at 2.52%. After accounting for the estimated term premium and liquidity premium, the implied inflation rate is 1.90%.

Figure 1. Five-year inflation breakeven calculated as five-year Treasury yield minus five-year TIPS yield (blue), five-year breakeven adjusted by term premium and liquidity premium per DKW, all in %. Source: FRB via FRED, KWW following D’amico, Kim and Wei (DKW), and author’s calculations.

The unadjusted 5-year Treasury-TIPS spread is:

Where tp is the term premium on the Treasury yield, and the lp is the liquidity premium on the TIPS yield. Using the DKW estimates of the Treasury term and TIPS liquidity premia as reported by Kim, Walsh, and Wei (2019, data 2021), one obtains the following estimates of expected inflation show as the red line above.

As of 3/31/2021, the unadjusted series is 0.64 percentage points higher than the adjusted. If the gap between the two premia has remained constant for the subsequent four business days (no reason that would be true), then expected inflation remains below 2%.

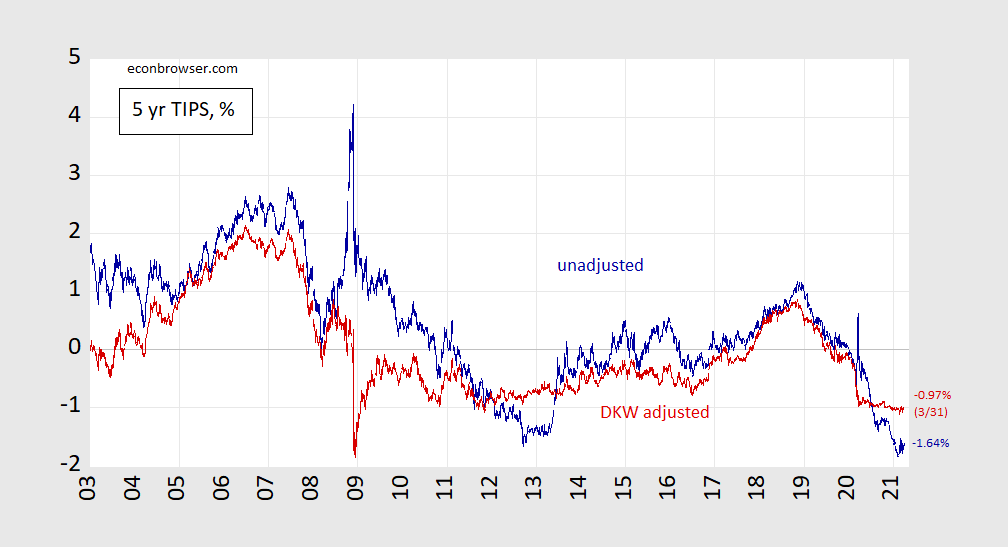

An interesting side point is that while the TIPS 5 year yield is at record low levels (-1.64% on 4/6), the expected average real interest rate over the next five years is about -1% — unchanged over the past year.

Figure 2. Five-year TIPS yield (blue), five-year TIPS yield adjusted by liquidity premium per DKW, all in %. Source: FRB via FRED, KWW following D’amico, Kim and Wei (DKW), and author’s calculations.

Disclosure: None.