The Fuel For The Next Rally

Image Source: Pexels

It’s rare for retail funds to grow like this and for the market not to continue higher. I do believe people were and still are skittish around the elections and what comes next. When they get comfortable, it could get very interesting.

“Davidson” submits:

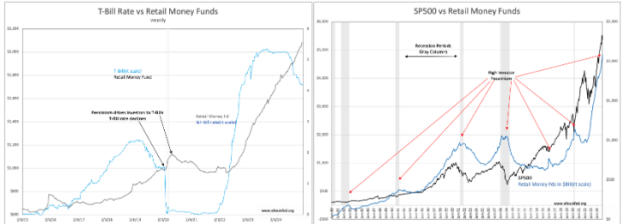

Retail Money Funds posted a new high. The correlation with market pessimism during recessions is shown from Jan 1980 vs the SP500. The historical rise in Retail Money Funds has always correlated with a decline in equity markets and a decline in T-Bill rates as investors sought safety in short-term Treasuries. This is pattern seen as recently as during the COVID lockdowns. However, a period of pessimism beginning Jun 2022 saw T-Bill rates rise with the rise in Retail Money Funds. This was opposite of the historical pattern. Clearly something different was going on.

Late in 2022 institutional investor commentary referenced that along with their rising pessimism of recession they decided to shift strategically to bet on falling rates as well as focus on only those equities that would benefit from recession as they just had during COVID i.e., the Magnificent 7. We watched in awe as the Mag 7 soared driving the SP500 to new highs while at the same time T-Bill rates rose over 5.5% and the 10yr minus 3mo Treasury Yield Curve Indicator plunged to record lows of -1.89% 12mos later. Albeit a recession did not occur as employment, personal income, retail sales and consumer delinquencies refused to cooperate.

The last 6mos has seen institutional commentary reverse this recession fear and gradually T-Bill rates began to decline. The interpretation voiced here reflected the commentary that institutions had hedged portfolios for a rate decline by shorting T-Bills and buying longer maturities i.e., 10yr Treasuries which indeed matched the market pattern that was present. Now, that recession fears are abating, they must buy back the T-Bills (lowering T-Bill rates) and sell the 10yr Year(causing 10yr rates to rise). This is also the pattern we are seeing.

Meanwhile, retail investors had a period of selling equities but also took savings out of bank accounts with near zero returns to buy money funds at 5%+. This has produced an abnormal surge in Retail Money Funds but it does not likely hurt this as a contrarian signal for equities. While the Mag 7 dominated SP500 pricing and news headlines the last 2yrs, only in recent months have most industrials of the mid-to-small cap variety begun to receive investor interest. Throughout this entire period, the economy has been growing slowly as shown by the Real Private GDP. So slowly in fact that this was the first time on record that a rise in government spending had depressed the Real Private GDP below that of the reported Real GDP.

The last 4yrs of oppressive government is now being reversed and I expect to see a rebound in the Real Private GDP above Real GDP over the next 12mos. Retail Money Funds should decline as retail investors begin to recommit to equities and the institutional rate-hedge brings T-Bill rates lower.

More By This Author:

Government Spending Distorts GDP

The Retail Investor Has Been On The Sidelines

Lots Of Oil Headlines…. The U.S. Is Self-Sufficient

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more