The Retail Investor Has Been On The Sidelines

Image Source: Pixabay

I think this is a function of the news media. Those who watch cable news (or any news for that matter) tend to be more depressed and far less optimistic.

Psychological Effects:

- Anxiety and Stress: Continuous exposure to negative or alarming news can increase anxiety levels. The repetitive nature of news cycles, particularly during crises, might contribute to heightened stress.

- Perception of Reality: There’s a phenomenon known as “mean world syndrome,” where heavy viewers of news, particularly when it’s crime or conflict-focused, might perceive the world as more dangerous than it statistically is.

- Depression: The constant barrage of negative news can lead to feelings of helplessness, despair, or depression, especially if viewers feel they have no agency over the events reported.

It is not a huge stretch, given what has happened with the current presidential campaign, which has caused people to watch more news than normal, and thus, the above effects are more pronounced.

It’ll be very interesting to see what the next 3-6 months have in store, but if this pessimism turns, the market can ride it up fast.

“Davidson’ submits:

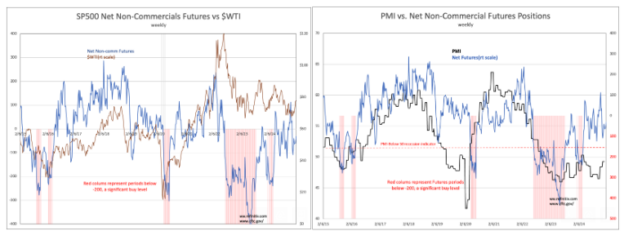

At their most fundamental analysis, each of the seven series in these charts are market psychology indicators. They are not the economic indicators commonly used and spoken of by the consensus even though they exert some economic impact when at key levels. The prices of everything traded in markets has this characteristic. Price reflects the profit anticipation of investors and especially when WTI (West Texas Crude Oil Price) or interest rates rise and fall costs to businesses do the same. But, when examined over time, high oil prices and high interest rates have only been a problem when consumers were already pushing debt delinquencies to financially destabilizing levels. When consumers had not overextended their financials, economic growth continued even with the consensus claiming the end. Financial corrections only begin after consumer delinquencies had reached critical levels. We are now just exiting a period of extreme negativity as has been reflected in these indicators one way or another and consumer delinquencies have remained and continue to remain at safe levels.

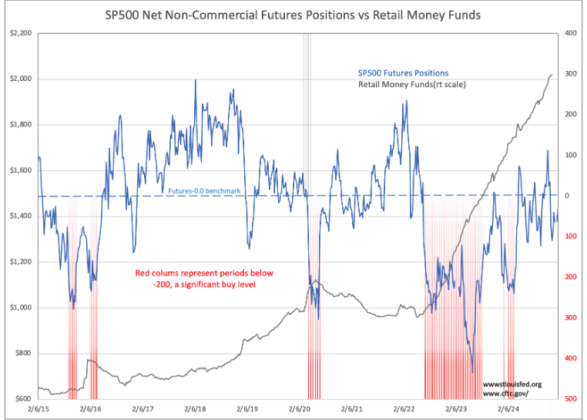

Net SP500 Non-Commercial Futures Positions have come off record lows and have been above -200 since April 2024. The two Yield Curve indicators, the 10yr minus 3mo & 30yr minus 2yr Treasury rates, have turned positive with the latter positive since early July 2024. WTI and manufacturing PMI appear almost ready to push above the low ranges of the last ~3yrs. It has been a very slow and arduous turn of general investor psychology while economic activity has continued forward at a slower pace running a gauntlet of recession forecasts. Throughout this period, consumers never reached threatening delinquency levels, and we never entered a financial correction. It has been a tough period for investors and Retail Money Funds, a lagging sentiment indicator, continues to post new record highs.

The underlying financial news remains positive as we continue to exit the COVID lockdown period 2020-2022. Investors should be heavily invested in companies with a history of sound leadership but selling at discounts to historical financials.

This has been an unprecedented period of pessimism which is why it remains such a good investing climate.

More By This Author:

Lots Of Oil Headlines…. The U.S. Is Self-Sufficient

Industrial Production (Data) Vs PMI (Sentiment)

The Dollar Rises

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more