The Dollar Rises

Image Source: Pixabay

“Davidson” submits:

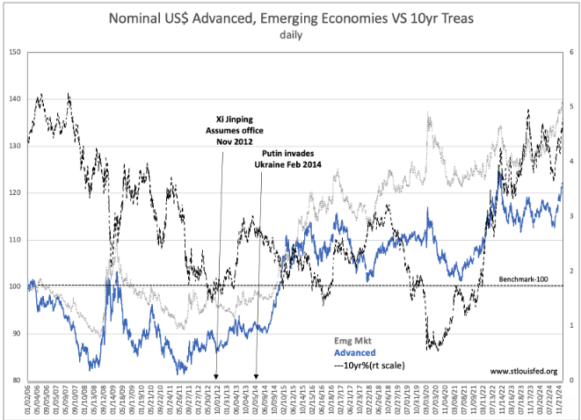

The US$ (US Dollar) reached a new high in the Nominal US$ vs Advanced and Emerging series incepted 2006. There were patterns correlating US$ strength to lower 10yr Treasury rates which inferred that capital pooling in the US partially preferred this security along with driving US real estate prices higher, another favorite. Today the narrative is reshoring which along with geopolitical instability and clear economic challenges elsewhere has continued to drive the US$ to record levels in this series. This time however the 10yr Treasury rate is rising.

By my analysis, the major recession hedge short-3mo/long 10yr Treasuries is being more rapidly unwound than new capital pooling in the US can drive rates lower. This has reversed the earlier correlation. The meaning inferred is that optimism for US equities is increasing. I believe US industrials will be preferred. Some larger capitalized issues have already benefited but there remain many small-mid cap issues with decent COVID recovery that have been ignored I expect we will see capital flows to benefit these issues the next 3yrs.

More By This Author:

Employment Data QuestionedRetail Money Funds: A Top Contrary Indicator

Construction Spending At Record Levels

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more