The Fed Tries To Cool Inflation Worries - But Will It Work?

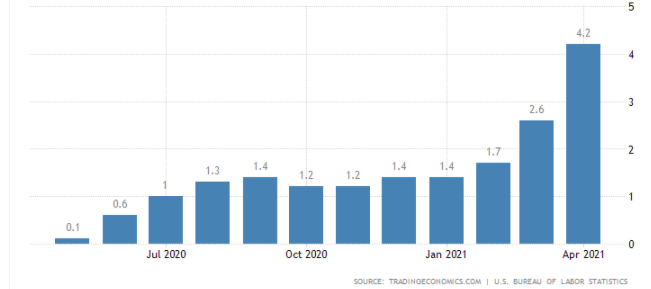

“The annual inflation rate in the US soared to 4.2% in April of 2021 from 2.6% in March and well above market forecasts of 3.6%. It is the highest reading since September of 2008, amid a surge in demand as the economy reopens, soaring commodity prices, supply constraints. There is also a base effect weighing as the coronavirus pandemic dented economic activity bringing the inflation rate to 0.3% in April 2020.” (Trader Economics, May 12, 2021)

Even as the American economy rebounds away from its pandemic related restraints, the Fed has repeatedly cautioned investors to expect inflation to rise above 2% this year

Indeed, for some time now the Fed’s official stance has been that it would tolerate inflation rising moderately above its 2% desired target pace.

Moreover, Fed chairman Powell has repeatedly assured markets that if inflation looks like it will escalate out of control, that policymakers would use its tools to guide both inflation and inflationary expectations back down to 2%.

Clearly, the public’s view of the future course of inflation is a key component in this task.

Currently, Powell seems to have the financial markets on his side, since five-year inflationary expectations embedded in treasury yields are in the 2% annual range. But of course, things do not always work out to plan.

Powell is of course correct when he argues that the recent spike in the consumer price index (for example, the 4.2% y/y increase in the CPI in April) surely can be regarded as a temporary phenomenon. The spike was so clearly associated with the reopening of the economy as it moves away from its pandemic restraints.

In other words, it is assumed that this rather unusual, one-time price increase will not translate into a sustained increase in consumer inflation.

In fact, the 4.2% surge in the CPI in April was very unusual. That is, a big reason for the twelve-month spike in the CPI was the base effects – that is, in April 2020 the US economy was struck with the worst impact of the Covid pandemic, and as a result, inflation was unusually low in that month.

Another distorting element in the twelve-month calculation can be seen from excluding the volatile components within the CPI index. When volatile food and energy prices are excluded from the CPI, the so-called core CPI increased 3% from the same period in 2020, and 0.9% on a simple one-month change.

For these two reasons alone, policymakers and many economists are dismissing the current round of inflation numbers as transitory, with the expectation that inflation will settle down later this year in around the 2% range targeted by the central bank.

Nonetheless, with the re-opening of the US economy still accelerating, economists are still expecting some potentially high CPI increases in the coming months, though most believe that the indicators of core inflation will remain substantially below 3%.

Finally, bear in mind when considering Fed policy reactions to the inflation threat, that the US central bank has watched inflation persistently undershoot its inflation target over the past ten years. That experience cannot be erased too easily.

Indeed, it is important to note that the Fed’s median set of economic projections has both the PCE inflation index and the core inflation index increasing at close to 2% for both 2022 and 2023.

The following chart illustrates the unusual 4.2% spike in the US CPI.

The US CPI, Annual Rates Of Change

Either we are being lied to or else a whole lot of folks have no clues. My guess is the lies being done to avoid a panic. And I do not like it one bit. And probably a lot of others do not like it either.

Worse yet, it appears very much that the Chinese Military HAS WON the biological weapons race, but has not yet announced their requirements for the world to surrender. My sympathy for that one who made the premature announcement.

So just wait a bit, and learn that what is happening to the markets will not matter at all in a while.