The Energy Sector’s Blowout Quarter

After three abysmal quarters in 2020 — due to the triple whammy of an oil price war between Saudi Arabia and Russia, demand destruction as a result of the COVID-19 pandemic, and perceptions that oil is giving up its dominance to renewable energy and electric vehicles — the energy sector has dramatically picked up over the past two quarters.

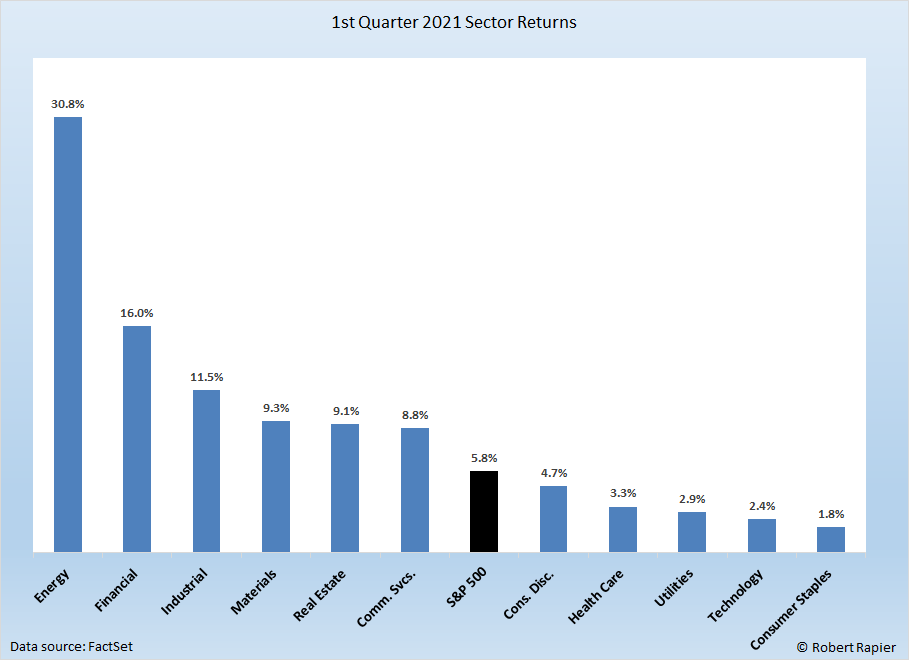

The energy sector grossly outpacing the other S&P 500 sectors in Q4 2020, and the sector started off 2021 the way it ended last year.

Image Source: Unsplash

The Energy Select Sector SPDR ETF tracks an index of energy companies in the S&P 500. The XLE represents the stocks of large energy companies from different sub-sectors (e.g., integrated, oil production, equipment services). It is, therefore, a good benchmark for conservative energy investors. Some of the XLE’s biggest holdings are ExxonMobil (XOM), Chevron (CVX), ConocoPhillips (COP), EOG Resources (EOG), and Schlumberger (SLB).

As the energy sector plunged in February and March 2020, at one point the XLE was down more than 60%. The XLE bounced back strongly in the fourth quarter with a sector-leading return of 28.2%, but still ended the year with a loss of 32.7%. Among the Select Sector SPDRs that divide the S&P 500 into 11 sector index funds, the energy sector was by far the worst-performing sector in 2020. (Note that all returns discussed here are total returns, which include the effect of dividends paid during the year).

After the strong Q4, the energy sector reeled off an even better 30.8% return in Q1 2021. Through the end of Q1 2021, the Energy Select Sector SPDR Fund had returned 78% over the previous 12 months.

(Click on image to enlarge)

No segment of the energy sector was spared in 2020. According to data provider FactSet — which I use to analyze companies — the average midstream company was down 31.9% in 2020. These are the companies that transport and store oil and gas.

But in Q1 2021, the 57 companies that FactSet classifies as “midstream” returned an average of 25.6%. There were a number of outstanding midstream performers in Q1, including Summit Midstream Partners LP (SMLP) (+88.7%), Martin Midstream Partners LP (MMLP) (+73.2%), and PBF Logistics LP (PBFX) (+64.6%).

Every integrated supermajors declined in 2020, with the group averaging a loss of 32.5%. But all turned in solid gains in Q1 2021, with an average gain across the group of 21.4%. ExxonMobil set the pace with a quarterly return of 35.7%, with Chevron coming in second at 25.8%.

The 20 largest upstream companies were down an average of 33.6% in 2020. Nearly every upstream company was down for the year. But in Q1 2021, the Top 20 returned an average of 38.0%.

The Big Three refiners — Marathon Petroleum (MPC), Valero (VLO), and Phillips 66 (PSX) — were down an average of 32.3% for 2020, but the group was up 25.8% in Q1. Marathon was the best performer with a gain of 30.8%.

Demand for oil and petroleum products has nearly recovered to pre-pandemic levels. At the same time, U.S. oil production is down sharply. That helps explain the 50% rise in the price of crude since early fall. That, in turn, has lifted the entire energy sector.

For the rest of the year, it’s hard to imagine that the energy sector will maintain this momentum. That would likely require oil prices to return back to the $70/bbl level, which seems unlikely any time soon.

Follow Robert Rapier on Twitter, more