The Dow Stock Dogs Performed In 2022

With the market's close on Friday investors happily said goodbye to 2022. Very few investment categories generated a positive return in 2022.

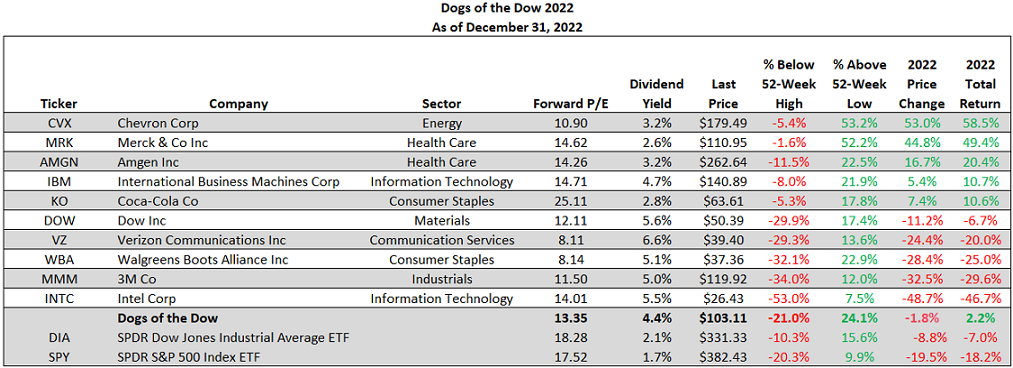

One area within equites that outperformed the broader market was stocks that had dividends associated with them. I have highlighted one specific strategy over the years, The Dogs of the Dow, that is focused solely on dividend yield. Over the years the Dogs of the Dow strategy has generated mixed results, but in a year like 2022 dividends mattered. In 2022 the total return for the Dow Dogs equaled a positive 2.2% versus the Dow Jones industrial Average return of -7.0% and the S&P 500 Index return, down -18.2%.

The Dogs of the Dow strategy is one where investors select the ten stocks that have the highest dividend yield from the stocks in the Dow Jones Industrial Index after the close of business on the last trading day of the year. Once the ten stocks are determined, an investor invests an equal dollar amount in each of the ten stocks and holds them for the entire next year. For 2023 two of the 2022 Dow Dogs will be replaced, Coca-Cola (KO) and Merck (MRK). The two Dow Jones stocks that qualify for the Dow Dogs in 2023 are Cisco (CSCO) and J.P. Morgan Chase (JPM). The dividend yields for CSCO and JPM at 2022 year-end are 3.20% and 3.00%, respectively.

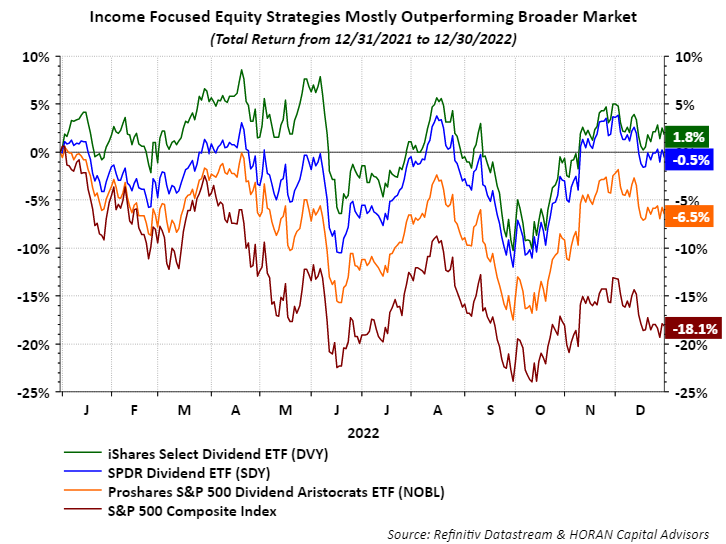

Investing in stocks that pay a dividend does not ensure positive equity returns. One benefit though is the fact high quality dividend paying stocks do tend to hold up better in volatile down markets like investors experienced in 2022. Below is a chart that displays the total return performance of three common ETF's that focus on dividend paying strategies along with the S&P 500 Index return for 2022. All three of the dividend strategies significantly outperformed the S&P 500 Index. The dividend payers and dividend growers do not outperform every year; however, incorporating stocks with favorable dividend characteristics into one's portfolio can reduce the portfolio's overall volatility.

Disclosure: Firm/Family long DOW, MRK, VZ, INTC, MMM, JPM, CSCO

More By This Author:

Equity Put/Call Ratio Above 2.0!

An Economy That Is Quickly Slowing

Equity Put/Call Ratio In Uncharted Territory

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more