Equity Put/Call Ratio In Uncharted Territory

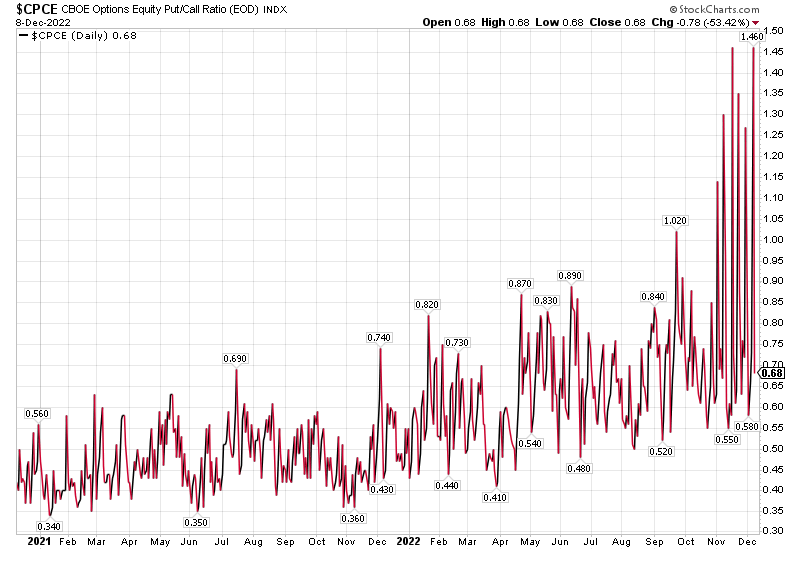

Recent levels for the equity put/call ratio suggest investors are exhibiting extreme equity market bearishness. A cluster of readings above 1.0 have occurred since November. The equity P/C ratio measures the sentiment of investors by dividing put volume by call volume. Investors purchase put options to protect an equity portfolio from market declines. At the extremes, this particular measure is a contrarian one; hence, P/C ratios above 1.0 signal overly bearish sentiment from the individual investor as put volume outpaces call volume. As the below chart shows elevated readings have been the norm of late.

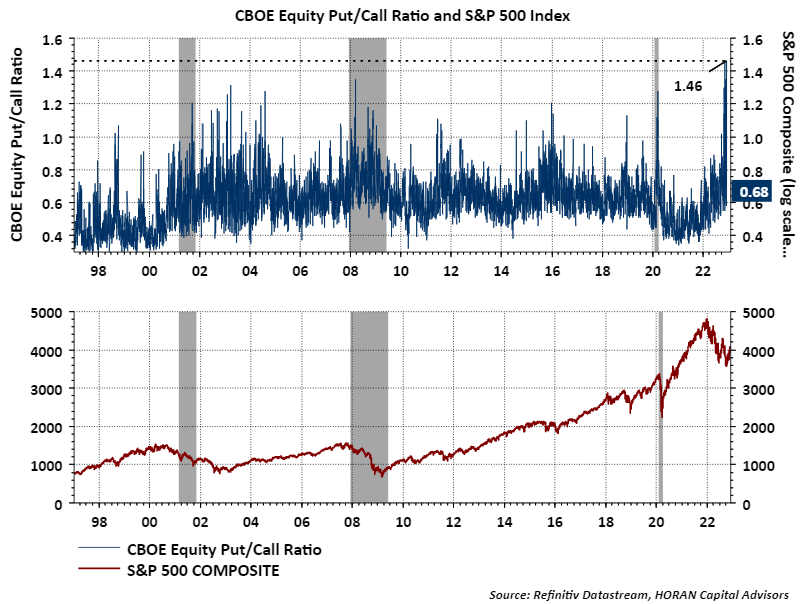

A longer-range view of the chart as seen below shows the extreme high level for the ratio going back to 1997.

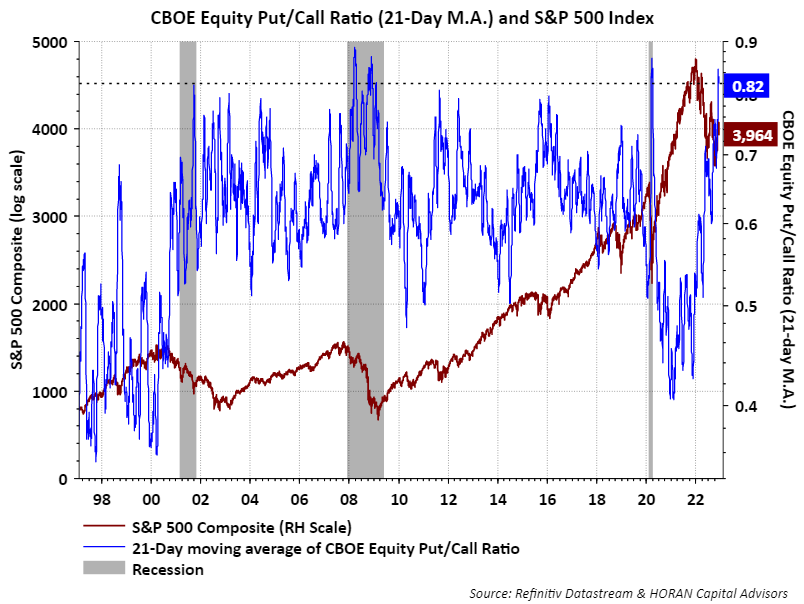

In order to smooth potential volatility in the P/C reading, reviewing the ratio's 21-day moving average can be beneficial. At a time when the average is trending higher, the equity market tends to face headwinds. As the average declines though, equities face less of that headwind in a sign investors are less bearish on the equity market.

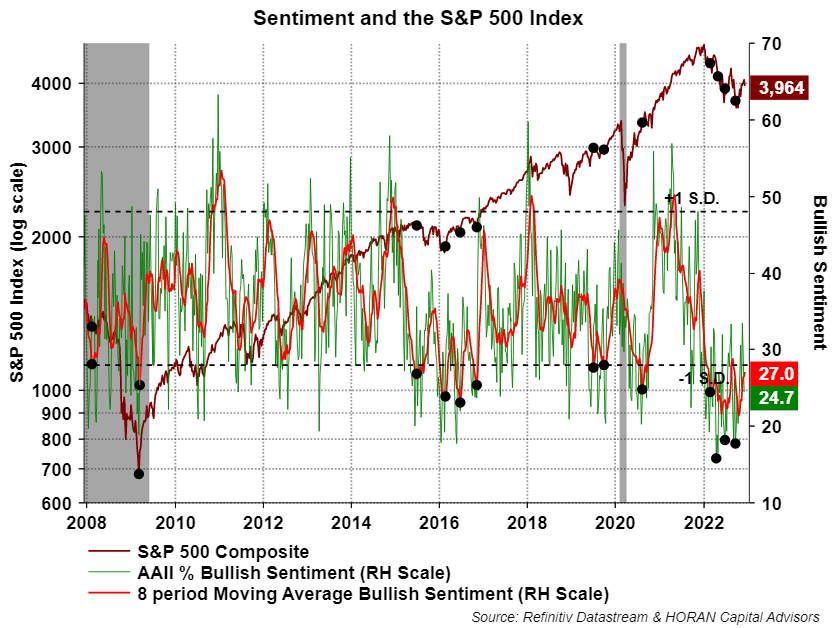

Lastly, sentiment data from The American Association of Individual Investors' weekly Sentiment Survey continues to indicate investors are expressing bearishness on the equity market. This week's bullish reading was reported at 24.7% versus the week earlier reading of 24.5. The bull/bear spread remains negative at -17.1%.

As noted in prior posts, these sentiment readings are viewed as contrarian indicators. In other words, if investors are expressing a low level of bullishness, stated another way, a high level of bearishness, then this is viewed as bullish for future equity market returns. No measure should be viewed in a vacuum; however, individual investor sentiment is leaning more bearish at this point in time.

More By This Author:

Eyes On A Fed Pivot This Week

Back To Normal

Housing Market Continues To Weaken

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more