Housing Market Continues To Weaken

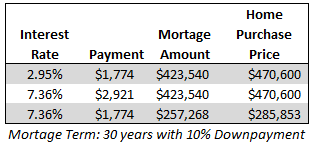

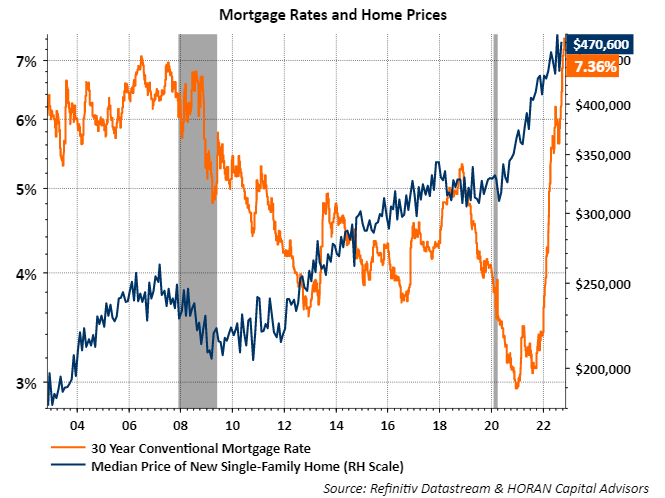

The Federal Reserve's aggressive push higher in the Fed Funds rate has resulted in mortgage interest rates following suit and rapidly moving higher as well. Less than two years ago a home buyer looking to finance a home purchase with a conventional 30-year mortgage could do so at an interest rate of 2.95%. Fast forward to today and the interest rate on a 30-year conventional mortgage is 7.36%. The below table shows the change in one's monthly payment if financing the purchase of a home at the median single-family home price of $470,600 and putting a down payment of 10% of the purchase price. The payment on the mortgage financed with an interest rate of 2.95% equals $1,774. That same mortgage financed at 7.36% results in the monthly payment increasing to $2,921. That represents almost a 65% increase in the monthly payment as a result of a mortgage interest rate that has more than doubled.

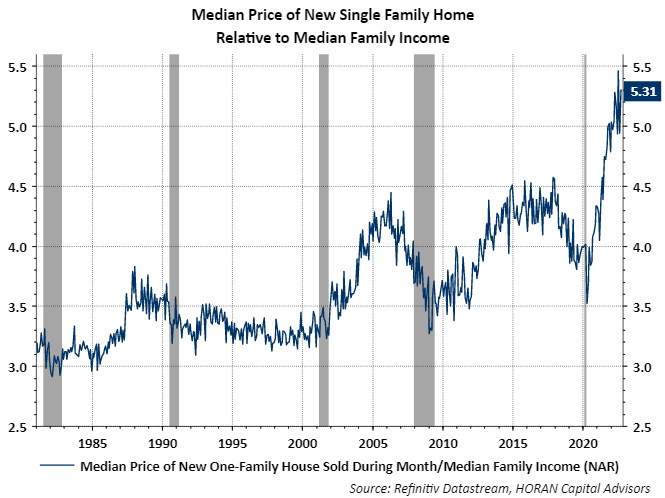

Another way to evaluate the rate impact on affordability is to compare the mortgage amount that a $1,774 monthly payment would qualify for but calculated at the 7.36% mortgage interest rate. As the above table shows, the mortgage amount would be $257,268 and this is less the 10% down payment, so the market value of the home would equal $285,853. With the same monthly payment and higher interest rates, the house price one can afford with the $1,774 monthly payment declines by almost 40%. The below chart shows the median price of a new single-family divided by the median family income. This chart would be supportive of downward pressure on home prices.

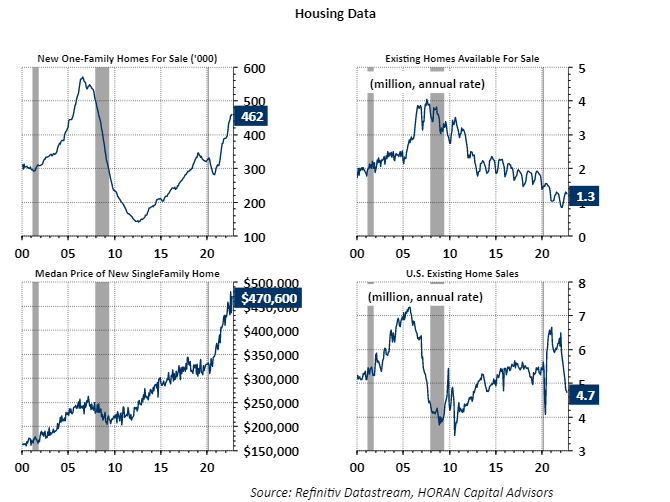

One factor that might insulate home prices from declining significantly is the lack of supply of existing homes available for sale. The chart displayed in the right quadrant below chart shows existing homes available for sale is a low 1.3 million units, a near-record low.

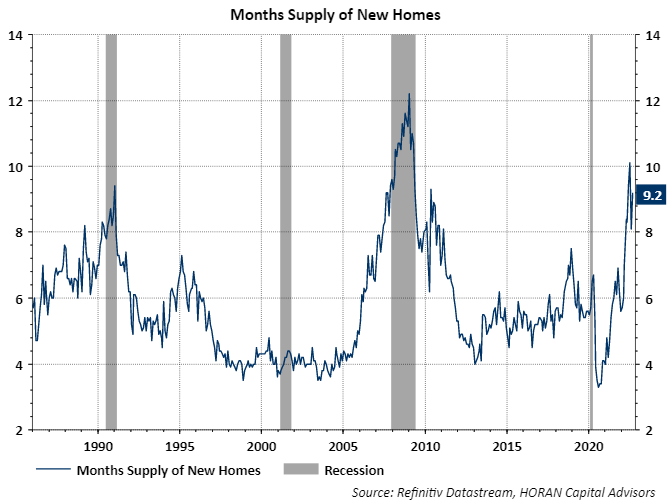

The chart in the lower righthand quadrant above shows the declining pace of existing home sales. This is partly attributable to higher mortgage financing rates as well as a lack of housing inventory. The chart in the upper lefthand portion of the chart shows new home inventory is rising though. In terms of months of supply, the below chart shows there is currently over nine months of new home supply on the market, and this likely places downward pressure on home prices.

The issue with a weakening housing market is the fact housing is a strong multiplier on the overall economy. A growing housing market has a positive impact on other economic sectors, e.g., the construction trade, appliance market, furniture market, and other segments. The current soft housing market is just another factor contributing to the weaker economic environment currently in place.

More By This Author:

Employment Data Nearing Recession Signal

Dogs Of The Dow: An Outperforming Strategy In 2022

Dogs Of The Dow: A Leading Strategy In 2022

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more