The Biggest Bubble In History: Breakouts, Valuations, Bitcoin, Liquidity

Stocks have reached what looks like a permanently high plateau – Economist Irving Fisher, October 1929

Men think in herds; they go mad in herds and only recover their senses slowly and one by one – Charley McKay, Extraordinary Popular Delusions and The Madness of Crowds

2020 represents the complete triumph of liquidity over fundamentals – Matt King, Citigroup, 2021 Outlook

(The photo to the right is of an infamous book published on September 20, 1999, during the raging days of the Dot Com mania, calling for Dow 36,000 when the Dow was currently trading around 11,000).

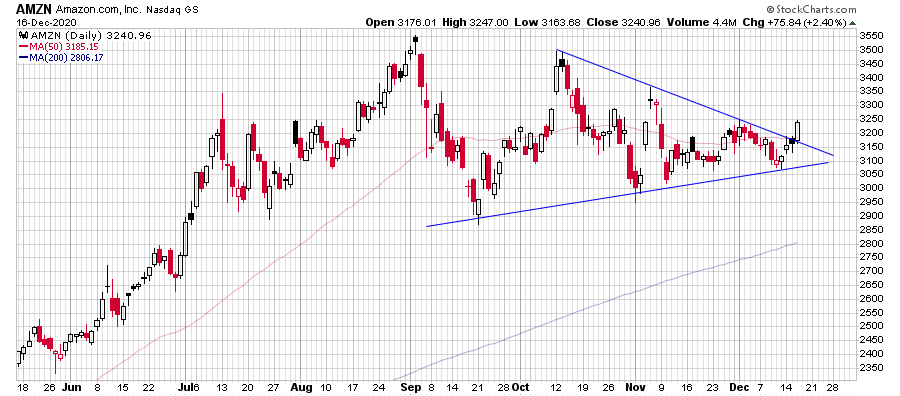

Despite the meager performance of the indexes yesterday (S&P +0.18% Nasdaq +0.50% Russell -0.36%), a number of important stocks broke out to new highs or from ranges that had been constraining them. Let’s start with Amazon (AMZN, market cap $1.66 trillion) which was up 2.4% on average volume yesterday (Chart Source: Rob Moreno Twitter, Wednesday December 16, 1:24pm).

(Click on image to enlarge)

This is obviously a bullish technical development, as we included a chart from JC Parets of All Star Charts yesterday of AMZN coiling and said that which way it broke would have important implications for overall market direction (see Section 4: “Mega Caps Lagging”, Top Gun Financial, Wednesday December 16).

The problem is that the move was not based on any news and only further stretches the stocks gap between price and intrinsic value as AMZN is trading at 95x trailing 12 month EPS of $34.15. I don’t care how good its growth prospects are: 95x is absurd!

Another important stock to break out was Shopify (SHOP, market cap $145 billion), up 7.75% on 2x average volume also on no news (Chart Source: Rob Moreno Twitter, Wednesday December 16, 8:58am).

(Click on image to enlarge)

Again, the gap between price and intrinsic value is being stretched beyond absurdity with SHOP trading at 413x trailing 12 month EPS of $2.80. 413x! No comment required.

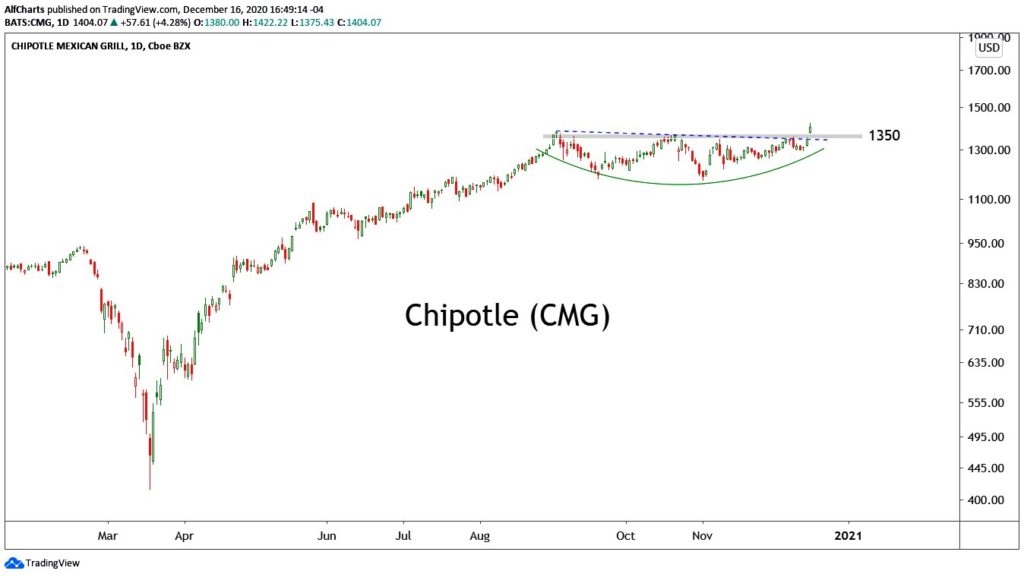

Chipotle (CMG, market cap $40 billion) also broke out +4.02% on 2x average volume (Chart Source: R. Alfonso Depablos Twitter, Wednesday December 16, 12:55pm).

(Click on image to enlarge)

Because CMG was hard hit by the pandemic, let’s use peak 2019 earnings of $14.07 to calculate its 100x P/E. I don’t care how good their burritos are; the stock is not worth 100x earnings!

Finally, let’s talk about Twitter (TWTR, $44 billion market cap) which was +2.29% on 1.5x average volume to new ATHs (Chart Source: 2kaykim Twitter, Wednesday December 16, 10:47am).

(Click on image to enlarge)

TWTR, also hard hit by the pandemic, is trading at 159x peak 2019 EPS of 34 cents.

I could repeat this exercise ad nauseum (For example, I did Disney (DIS) on Sunday: Section 2: “Case Study In Mania: DIS”, Top Gun Financial, Sunday December 13). I only picked these four stocks because I found nice charts of them by technicians on Twitter.

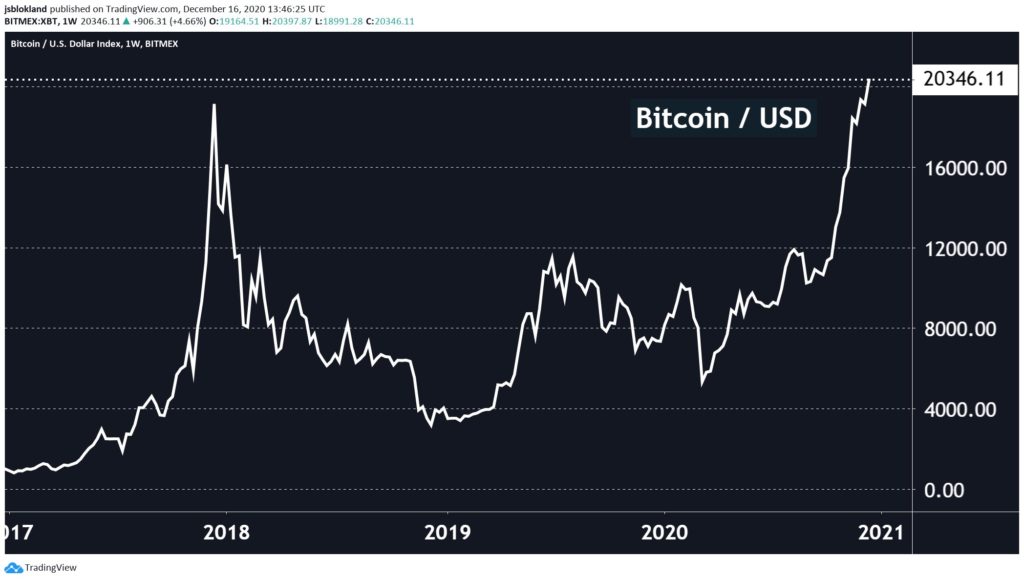

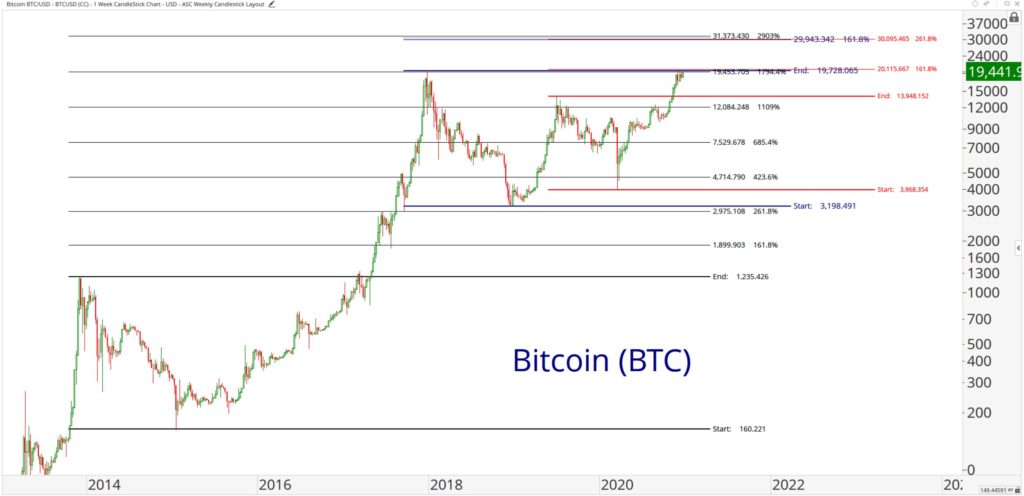

Before leaving yesterday, I must mention Bitcoin’s (BITCOMP) breakout to new ATHs (it is currently trading just below $23k)(Chart Source: Jeroen Blokland Twitter, Wednesday December 16, 5:47am)

(Click on image to enlarge)

This had All Star Charts Technician Steve Strazza putting a $30k target on Bitcoin based on Fibonacci Extensions (Steve Strazza Twitter, Wednesday December 16, 1:30pm). I’m not saying it’s not going to get there; I’m saying Fibonacci Extensions, like any technical analysis that forecasts future price rather than describing price in the present, are bad technical analysis (see “Kids Drawing Lines”, Top Gun Financial, Saturday December 12, for more of my views on Fibonacci Extensions and Measured Moved Breakouts, really any technical analysis that goes beyond describing price in the present to forecasting it in the future).

(Click on image to enlarge)

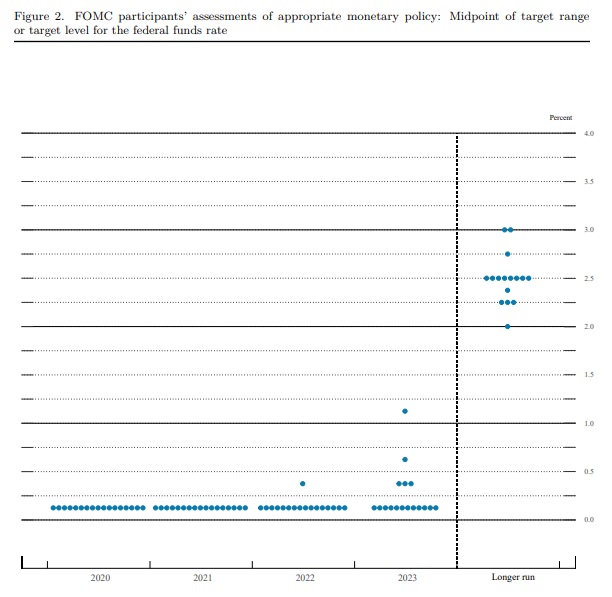

The backdrop to this madness is the extraordinary liquidity environment provided by global central banks which the Fed announced yesterday it will be maintaining by keeping the Fed Funds rate at 0% until at least 2023 and continuing to buy $120 billion of treasuries and agency backed mortgage securities a month (Source: FOMC Statement December 16, 2020).

(Click on image to enlarge)

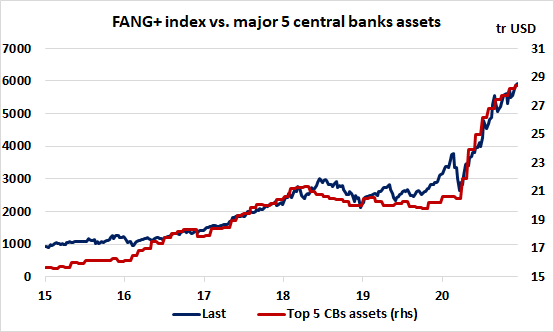

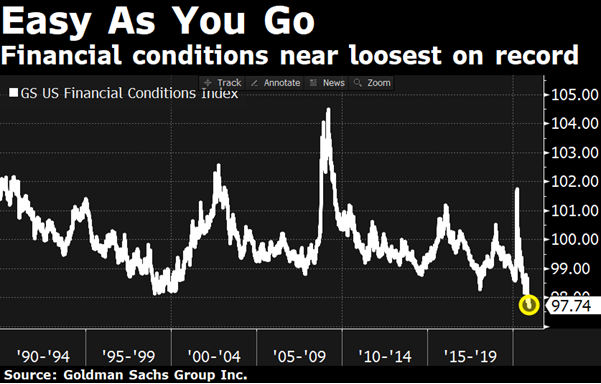

Take a look at these two charts from Rothko Research and SentimenTrader on liquidity.

I can’t say it any better than Citigroup’s Matt King: this has nothing to do with fundamentals and everything to do with liquidity.

I’ve said it before: This is the biggest financial bubble in world history – bigger than 2000 and bigger than 1929. When it pops, we will have an economic catastrophe on our hands like nothing so far in American history. Get your popcorn ready.

My problem with this is how to play it. Long puts are probably best but generally too expensive. I wish I could buy fractions of an option contract.

Good idea. There's still no way to do that?

Bitcoin may be headed to uncharted territory as replication comes to an end. Who pays for transactions then? Bitcoin will itself become more restrictive in multiplying than gold or any currency. This may lead to more cryptos being made which tends to cause their prices to drop because it is a synthetic/substitute depreciation that is happening to all crypto currencies. And it's already expensive with few people using it for exchange undermining its use as a currency.

That said, dollar devaluation will still happen, pushing up all assets that don't depreciate.

When the bubble pops? Of course it is going to deflate, but will it pop or just fizzle? And I can't believe that it will only hurt share holders. I am sure that there will be plenty of pain for those not involved, and probably it is the non-participants who will suffer the most. Of course that 1% may lose the most money, but if one has 100mn and loses $90 mn, the $10mn is still quite enough to live comfortably, even if they do need to sell that second Learjet. But when that bubble, created by other with the help of the fed, bursts, or just fizzles, my losses will be a much larger portion, and my pain will be quite real. AND, for those who caused it all, know that I will be very unhappy.

Good read, thanks.