The 2020 (US) Recession

Summary: This post is based on a research note I wrote asking whether low unemployment is sustainable. The answer is a clear no for the US. Low level of unemployment are good predictors of the tail risk event of a recession, a sharp increase in unemployment rates. These dynamics are related to the build up of financial and macroeconomic imbalances. If this pattern is to be repeated, and given the current level of the unemployment rate, a US recession must be around the corner. For details on the analysis, the research note including additional results is available on my web site: Fatas (2019).

A few months away from the longest US expansion

The US economy is a few months short of beating the longest expansion ever, which took place from March 1991 to March 2001. As we approach this milestone, there are increasing concerns about the possibility of a recession in the coming years.

Do expansions die of old age? The empirical evidence suggests that this is not the case. There is no clear correlation between the length of an expansion and the probability of a recession (Rudebusch (2016)).

An alternative definition of age

There is an alternative way of thinking about the age of expansion, in terms of how much economic slack there is left. Expansions are periods where the economy is returning to full employment. As unemployment becomes low and reaches levels around or below the natural rate of unemployment, is it possible to maintain this state for a number of years? Or does “full employment” automatically lead to imbalances that represent the seed of the next crisis?

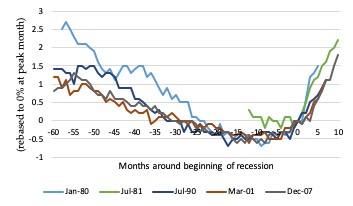

In the case of the US, history suggests that “full employment” is not a sustainable state and that once we reach such a level a sudden increase in unemployment is very likely. In the figure below I plot unemployment rates around the peak of each of the last five cycles (where zero represents the month the recession started). I plot 5 years before the recession started and 10 months after the recession.

Unemployment Rate Around Recessions (US)

All cycles display a V-shape evolution for unemployment. Unemployment reaches its lowest point around 12 months before the recession and, in most cases, unemployment is already increasing in the months preceding the recession. What is interesting is the absence of a single episode of stable low unemployment (or full employment). It seems as if reaching a low level of unemployment always leads to dynamics that soon generate a recession. Recessions die of old age if “age” is measured in terms of how much economic slack is left. If this pattern was to be repeated, the US must be today very close to an inflection point, a recession.

The result might sound obvious and mechanical: once unemployment rate is low, there is only one way for unemployment to go: up. This is true but what matters is whether a persistent period of low and stable unemployment is possible. In the case of the US, the answer is no. One way to visualize this possibility is to look at other countries. A good example is Australia that has recently sustained a low unemployment rate for decades. After a recession in the early 1990s, unemployment increased and then started a decline through a path similar to any US expansions. By the year 2000 unemployment reached a low level that has remained mostly flat for years. In other words, the unemployment rate does not display V-shape dynamics but looks more like an open L-shape.

Unemployment Rate (Australia)

Growth at risk and quantile regressions

We can quantify this intuition by relating this result to an academic literature that analyzes the determinants of the tail risk of unemployment (or GDP) changes. This literature looks at the determinants of worst potential outcomes over a specific time window. Some examples: Cecchetti (2008), Kiley (2018) Adrian, Boyarchenko, and Giannone (Forthcoming).

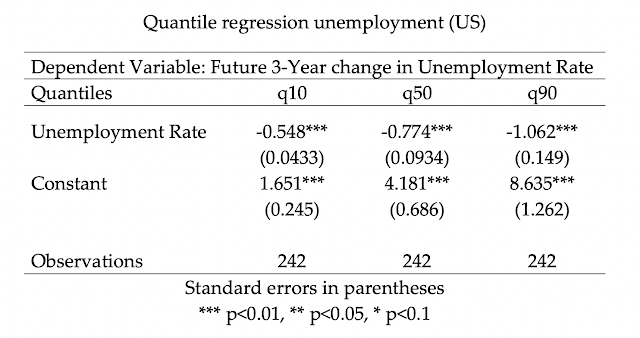

Empirically this is done with the use of quantile regressions. In this case, we are interested in the tail risk of sharp unemployment increases, which are associated with recessions, and I will capture that by coefficient on the 90th percentile of the distribution in a quantile regression (Fatas (2019)).

The results of such a regression are displayed in the table below. All three coefficients are negative (which is what one would expect as there is a reversion to the mean in unemployment rates). But the interesting part is that the size of the coefficient increases as we move from small changes in unemployment to large changes (from q10 to q90). This means that low unemployment rates are particularly good at predicting the tail risk of large increases in unemployment (recessions)

Interestingly, the same phenomenon is not present in other countries (such as Australia). See Fatas (2019) for those results.

Why is full employment unsustainable?

The pattern of US unemployment recessions suggests that low levels of unemployment are a strong predictor of sudden increases in unemployment, associated to crises. We do not observe in the data any sustained periods of low unemployment. But why is low unemployment unsustainable? What leads to a recession?

The academic literature tends to emphasize two set of variables: those associated to macroeconomic imbalances (such as inflation) and those associated to financial imbalances. Interestingly, the introduction of these variables in the quantile regressions above makes the above effect go away (see Fatas (2019)). In particular, once we control for credit growth, it is not any longer the case that low unemployment is a good predictor of the tail risk associated to recessions (we still observe a reversion to the mean but we do not obtain a larger coefficient for the p90 quantile).

This result suggests that recessions follow periods of low unemployment because imbalances are built during those years. What is interesting is that the evidence shows that this is always the case, that the US economy has never managed to sustain a low rate of unemployment without generating the imbalances that lead to a recession. If history is an indicator of a future crisis, and given the current low level of unemployment, a recession is likely to be around the corner.

References

Adrian, Tobias, Nina Boyarchenko, and Domenico Giannone, Forthcoming, Vulnerable Growth, American Economic Review.

Cecchetti, Stephen G., 2008, Measuring the macroeconomic risks posed by asset price booms, Asset prices and monetary policy (University of Chicago Press).

Fatas, Antonio, 2019, Is Full Employment Sustainable?, Manuscript.

Kiley, Michael T., 2018, Unemployment Risk. Finance and Economics Discussion Series, Board of Governors of the Federal Reserve System (US).

Rudebusch, Glenn D., 2016, Will the Economic Recovery Die of Old Age? Federal Reserve Bank of San Francisco Economic Letters.

Disclosure: None.