Tech Massively Outperforms In March, Internals And Small-Caps, Sow Doubts

In March, The Nasdaq 100 jumped 9.5 percent. In contrast, the S&P 500 only managed to rally 3.5 percent, while the Russell 2000 small cap index gave back five percent. Tech’s outperformance comes at a time when economically sensitive small-caps are massively lagging. As are tech-related internals.

Investors suddenly gravitated toward tech in March. The Nasdaq 100 shot up 9.5 percent, even as the S&P 500 rose 3.5 percent, while the Russell 2000 dropped five percent.

Small-caps inherently have a large exposure to the domestic economy – much larger than large-caps who also have foreign exposure. Small-caps therefore are treated as one of the ways to take a pulse of the domestic economy. And they are not acting well.

Tech’s relative outperformance in this regard is sending a confusing message. That said, right here and now, the price action is strong – duration and magnitude notwithstanding.

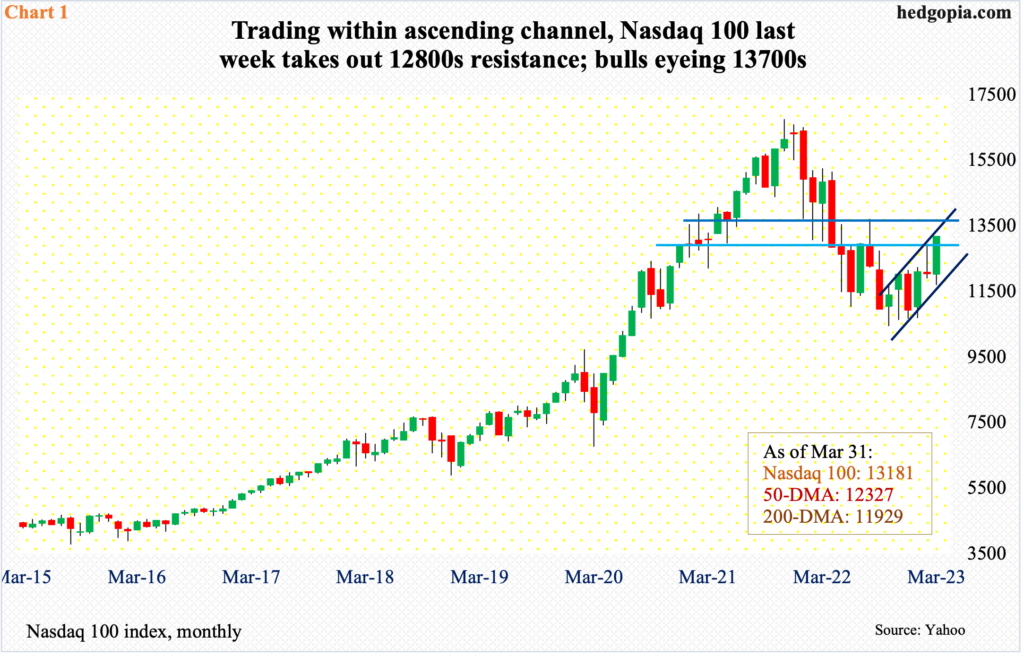

Last Friday, in a bullish marubozu session, the Nasdaq 100 decisively took out 12800s, building on Thursday’s action. It has been an area of interest for both bulls and bears going back to December 2020.

Immediately ahead, there is horizontal resistance at 13700s, which also lines up with the upper end of a rising channel from last October (Chart 1). The tech-dominated index closed last week at 13181.

Tech’s outperformance obviously has a positive impact on the S&P 500. The top five tech companies – Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN) and Nvidia (NVDA) combined accounts for 21.2 percent of SPY (SPDR S&P 500 ETF), and 43.6 percent of QQQ (Invesco QQQ Trust).

For the most part, as goes the tech so goes the large-caps. Last Friday, as did the Nasdaq 100, the S&P 500, too, rallied in a bullish marubozu session. Up until Tuesday, the large cap index was essentially unchanged for the week. Then, it surged 3.5 percent in the next three sessions, recapturing the now-slightly-rising 50-day moving average.

When it was all said and done, the S&P 500 (4109) closed Friday essentially at 4100 horizontal resistance (Chart 2). This also represents a test of the underside of a rising trendline from last October when the index bottomed at 3492. A break to the upside opens the door toward 4200.

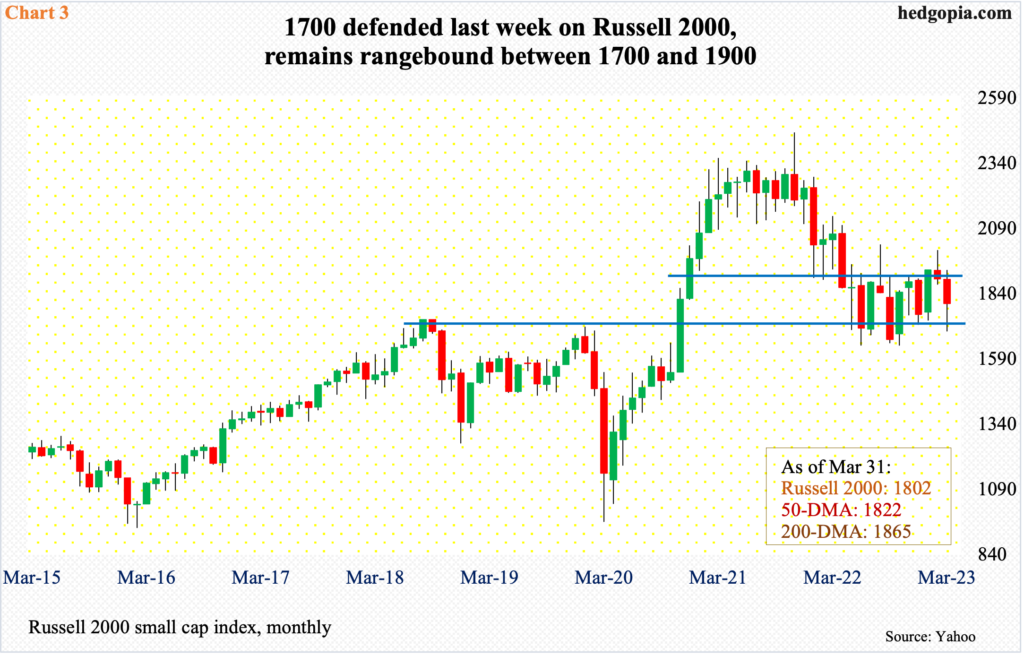

The Russell 2000 (IWM) had a poor March, declining five percent, but fared well last week, rising 3.9 percent. Encouragingly for small-cap bulls, 1700 was defended last week. This level goes back to August 2018, with the index breaking out of it in November 2000, followed by a new high of 2459 in November 2021. The drop from that high bottomed at 1640s last June and again in October.

Importantly, the Russell 2000 (1802) has remained trapped between 1700 and 1900 for the last 14 months. It closed out last week right in the middle of the range (Chart 3). Both the 50- and 200-day lie above (1822 and 1865 respectively). The way the index is behaving, these averages are likely to attract bears.

Investors are facing difficulty as to if to heed the message coming from the small caps or the tech sector. The fact is that tech is leading but the internals are struggling to conform.

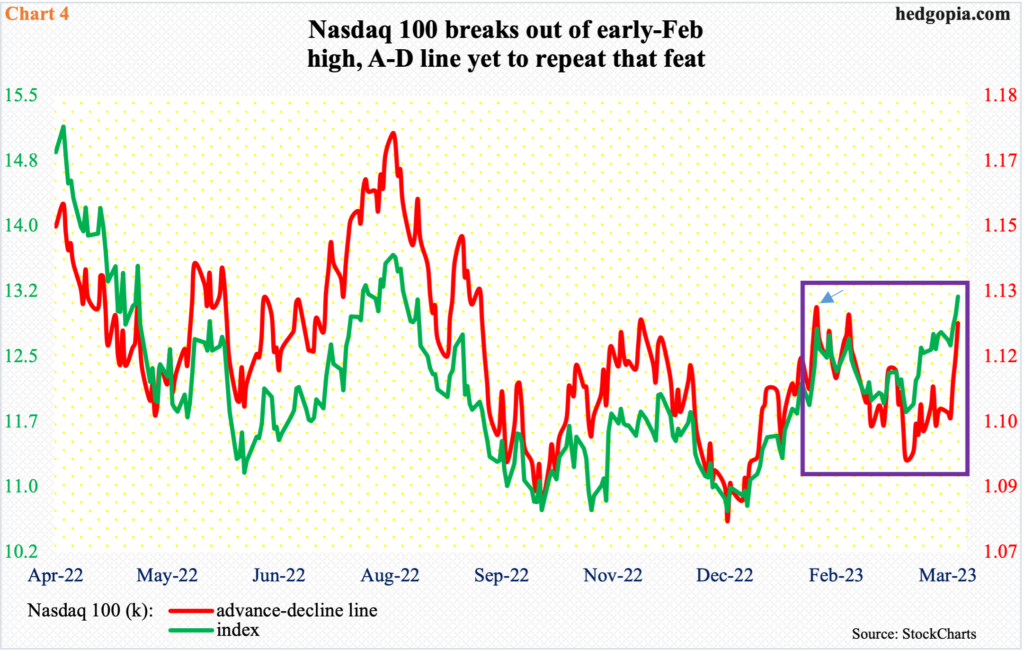

Behind the Nasdaq 100’s strength lurks non-confirmation from the advance-decline line. Last week, the index rallied past the early-February high, but not the A-D line (arrow in box in Chart 4).

The same is true with equal-weights versus heavy-weights. As shown above, the five tech outfits comprise 43.6 percent of QQQ. The Nasdaq 100 is a market cap-based index, so the large companies exert an inordinate influence. The Nasdaq 100 equal weighted index, on the other hand, as the name suggests, treats each company equally.

In Chart 5, the Nasdaq 100 index is pitted against the Nasdaq 100 equal weighted index. And as is the case with the A-D line, the equal-weights are failing to confirm the move made by the heavy-weights. Last week, the Nasdaq 100 rallied past the early-February high but the equal weighted index is yet to do so (arrow in box). The generals are leading, but the soldiers are falling behind.

Besides the lagging small-caps, this is yet another knock against tech’s outperformance, which probably is built on shaky foundations.

Thanks for reading!

More By This Author:

CoT: Future Through Futures, Hedge Funds Positioning

Small-Caps Likely To Drag Tech/Large-Caps Lower In Months/Quarters Ahead

Analysis Of CoT Report: What Noncommercials, Hedge Funds Are Buying