Tariffs: Why Stocks Should Surge In The Long-Term Regardless Of Them

Image Source: Unsplash

Tariffs will have zero long-term impact on the stock market. There, I said it. Don’t believe me? Basic math says I’m correct. If you’re scared of tariffs, you won’t be after reading this, argues Gav Blaxberg, CEO of Wolf Financial.

In a healthy economy, tariffs should have a long-term impact on the stock market. But we don’t live in a healthy economy. We live in a currency-debasing world.

Regardless of what any politician does to the stock market, the Federal Reserve can add digits on a computer screen, and your stocks will skyrocket. And that’s exactly what they’ll be doing soon. Not necessarily because they want to, but because they have to.

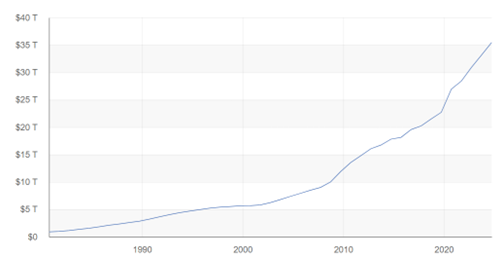

US Debt Outstanding (1980-2024)

Source: Treasury.gov

Here’s the situation. The US is $36.6 trillion in debt. Some $9.2 of that $36 trillion needs to either be refinanced or paid this year. Printing money (Quantitative Easing) is the only logical choice to facilitate that.

The government collected ~$5 trillion in taxes last year. Which means we’re still $4 trillion short. Plus, President Trump is preaching zero income taxes. So, raising taxes to collect $4 trillion more? Political suicide. Paying off the $9.2 trillion with taxes is off the table.

Next, the government can cut spending elsewhere and reallocate funds. Such as the military, federal programs, etc. But that wouldn’t work either. Military = $900 billion. Social Security = 1.4 trillion. Medicaid and other health insurance programs = $1.6 trillion. Even if I tally up all government expenditures, it still doesn’t pay off the debt.

And finally, I present the only possible choice: The Federal Reserve will perform QE. Which is a fancy way of saying they’ll print money out of thin air. This money will be used to purchase bonds from the US Treasury. This directly injects cash into the financial system. If the Fed creates $9.2 trillion, it’s practically impossible for stocks not to rise.

The other possible option? Refinancing the debt at new interest rates. Basically kicking the can down the road. The problem with refinancing at new rates is that interest rates are relatively high right now. And the US is already paying ~$1.2 trillion in yearly interest. If we refinance $9.2 trillion at current rates, that $1.2 trillion in yearly interest would soar. Not good.

So what’s the solution? Cutting rates, of course. Afterwards, the debt will be rolled over. Bottom line? Stocks will rise – regardless of Trump’s tariffs. All roads lead to the money printer.

About the Author

Gav Blaxberg is the CEO of WOLF Financial, a financial media brand dedicated to providing daily live audio education to 300,000+ stock market, real estate, and crypto investors. With a professional background in PWM at Goldman Sachs and PE at Versa, this dynamic speaker engages his audience in high-energy conversations, featuring accomplished speakers worldwide as the hallmarks of WOLF’s daily Twitter spaces.

More By This Author:

Energy Transfer LP: Should You Buy this Energy Play that Yields Almost 8%?DBS Group Holdings: A Singapore Bank That Stands Out In This "Trade War" Market

Phillips 66, SPX, & European ETFs: What I'm Watching Now

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more