DBS Group Holdings: A Singapore Bank That Stands Out In This "Trade War" Market

Image Source: Unsplash

As markets continue to weigh tariff and trade risks, we will continue our efforts to protect assets through portfolio rebalancing while remaining alert to trading opportunities. Our diversified and global Explorer stocks are doing well, including DBS Group Holdings Ltd. (DBSDY), explains Carl Delfeld, editor of Cabot Explorer.

International investors will be important at the margin since they account for 18% of US stock ownership. The retreat of the US dollar, down 10% in the last six months, and the emerging premium for US bond markets have been leading to higher yields (interest rates).

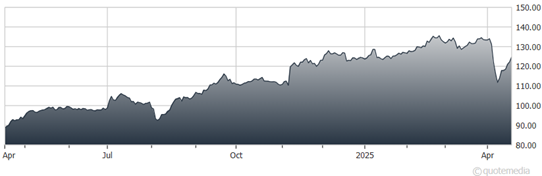

DBS Group Holdings Ltd. (DBSDY) Chart

Short-term, the bond market volatility is unlikely to threaten the greenback’s status since central banks hold almost $7 trillion in US dollars in reserve, almost three times as much as euros. Furthermore, the $28 trillion Treasury market is the world’s largest and most liquid. In comparison, there are only $1.4 trillion in German government bonds outstanding.

Japanese officials have been in Washington to negotiate away the proposed 24% tariffs and the additional auto tariffs. I assume both Japan and South Korea will be dealt with quickly since they are way too strategically valuable to be left hanging. Both markets are opportunities, and I join Warren Buffett in liking the Japanese trading companies.

How the US-China tariffs work out this year is the million-dollar question. Both sides are dug in, both have leverage, and both seem confident they will prevail. This will likely take time and there will be considerable collateral damage and opportunities.

That said, DBS Bank shares were up 6.9% in the most recent week, reflecting the bank’s stellar reputation in Southeast Asia. Headquartered in Singapore, DBS Group Holdings is the largest constituent of the Singapore Straits Times Index.

About the Author

Carl Delfeld is chief analyst of Cabot Explorer published by Cabot Wealth Network. He is also the managing editor of Far East Wealth and chairman of the William H. Seward Center for Economic Diplomacy. Over the past three decades, he has held senior positions in business, finance and government, was a Forbes Asia columnist and author of Red, White & Bold: The New American Century.

More By This Author:

GBX: A Railcar Supplier Whose Shares Are Too Cheap To Pass Up

Inflation: Where To Find Tariff Impacts In PPI, CPI Reports

AEG: A High-Yielding, Deep-Discount Play In The Financial Sector

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more