Tame-flation Spike

The monthly CPI numbers came out, and even though prices are going higher, I guess the market was relieved. (CPI trend chart below from ZH):

The moment the news came out, everything spiked “bigly” higher. At the moment, there’s still green everywhere, but somewhat faded.

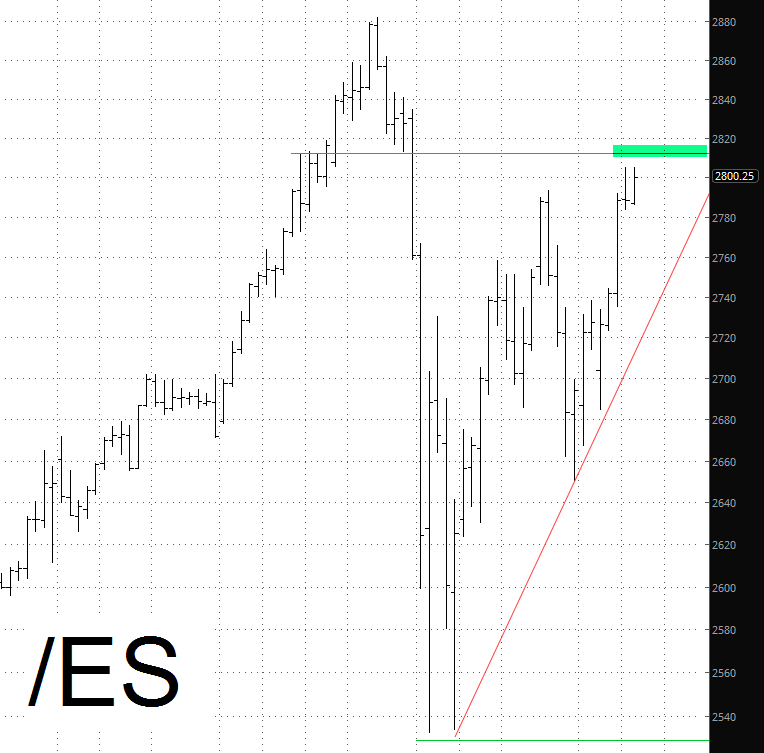

Looking at the daily picture, it’s not “lights out” for the bears, but boy the risk is there.

With inflation apparently not out-of-hand, bonds have been strengthening (and interest rates softening), leading to real estate escaping its congestion zone and making the gap from last month its next target.

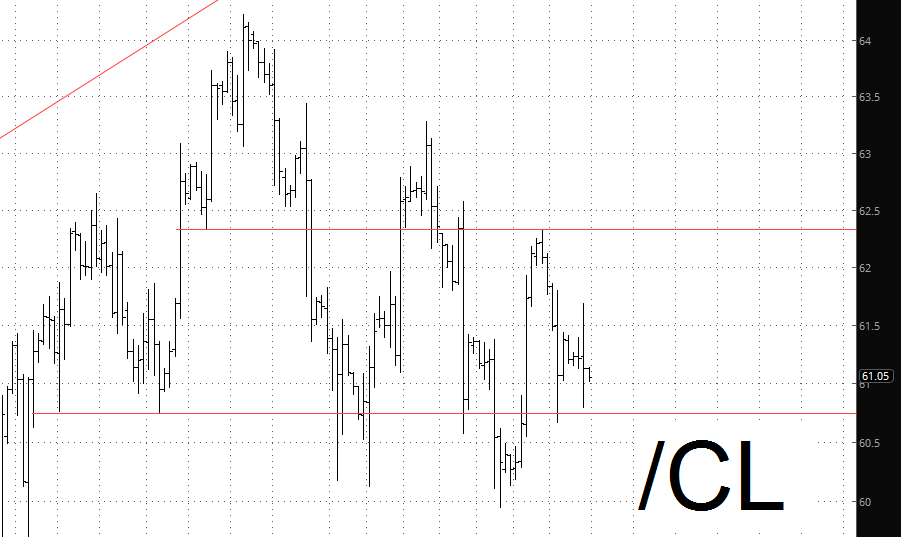

As a follow-up to yesterday morning’s “bearish on crude” post, we’ve made progress there. Not a hard break yet, but definitely moving in the right direction

Disclaimer: This is not meant to be a recommendation to buy or to sell securities nor an offer to buy or sell securities. Before selling or buying any stock or other investment you should consult ...

more

The economy is a little more resilient than it has been but not overly so. The inflation worries are overdone right now as is the screams about strong growth. It is liable to stay that way unless there is a trade war with Asia especially. With US bond rates rising growth is not likely to cause massive inflation. More likely a fall off of the dollar is likely to cause it which would not be a good thing no matter how much everyone will try to tell you that it is. They should read basic economics textbooks.