TalkMarkets Words For Wednesday: A Crash-Stop For The Markets

When the weather gets too hot there's nothing like a good thunderstorm to cool things off which is certainly what happened to the major indices yesterday after the big tech stocks tumbled from their recent overheated highs. Not a crash, but a crash-stop, as index futures are green this morning with the Nasdaq 100 currently about 1.35% higher at 11,213, the Dow up about .45% at 27,645 and the S&P at 3,357, about .65% higher. Though Asian markets ended lower today, both the DAX and the FTSE are up.

Adam Vettese in Tesla Suffers Worst Day In History As Tech Names Continue To Rout gives the rundown on the fiercest of the recent tech tumbles. He notes that Tesla (TSLA) suffered a setback yesterday when the S&P 500 Index committee decided not to add the company to the index. Tesla was down 21% for the day. Had the committee decided in the affirmative several S&P 500 linked funds would have been lining up to buy Tesla stock.

Vettese notes that Softbank had a hand in yesterday's tech turmoil as well: "Investments made by Japanese investment giant Softbank (SFTBY) have raised questions about the fragility of tech stocks’ mega run over the past several weeks. Per The New York Times, Softbank bought billions of dollars-worth of tech stocks, betting that prices would keep rising. As the stocks soared, the firms that sold Softbank the options became forced buyers in order to hedge their risk."

General Motors (GM) purchase of an 11% stake in high tech truck manufacturer Nikola (NKLA) sent GM stock nearly 8% higher. Interesting news which helped to send the indexes in the other direction. This is an investment that could give Tesla some good competition. Investors and traders alike will stay tuned for further developments in this space.

In A September Stock Market Crash?, TalkMarkets contributor Michael Snyder says, "I am not too excited about this current downturn just yet...I think that I will wait until the Dow falls below 25,000 before I start hyperventilating."

Still Snyder is convinced that the markets will crash, he just does not know when, "Of course, I am among those that are entirely convinced that a stock market crash is definitely coming at some point. At this moment in history, stock prices are absurdly overvalued. Back in 1990, the total value of all U.S. stocks was sitting at a level that was approximately 60 percent of U.S. GDP, and these days that number has been hovering around 200 percent."

Snyder makes some good points about where the markets are right now and his short piece is worth a further look. As for Tesla he says, "I understand that people like to make money flipping Tesla stock, but to me, the entire company is a giant mirage that will eventually collapse in spectacular fashion."

Michael Kramer minces no words in Stocks Get Slammed On September 8, And The Worst May Be Yet To Come.

"There is nothing like watching a month of gains evaporate in 3 days. It is just brutal to be in these markets. The algo’s seemed to have flipped, and the danger now is that we have reversed on gamma as well. The flip zone on the SPY came and went today at $338. That means the lower the S&P 500 falls; the more short dealers have to get; it is the exact opposite of what we just went through."

Looking at the chart plotting PE vs Long Term EPS Growth in the S&P (see chart below), Kramer has this to say:

"The other problem is that there are no fundamentals to support this market, none. Please don’t kid yourself into thinking second-quarter results were betting then expected, and that other garbage you have been spoon-fed or how low rates expand multiples infinitely, they don’t. Even if the S&P 500 prints $163 in earnings next year, the S&P 500 was trading at 21 times earnings. Adjust those numbers for long-term earnings growth expectations, and we are more expensive now than at any point in 40 years. Yes, that includes the 2000 bubble."

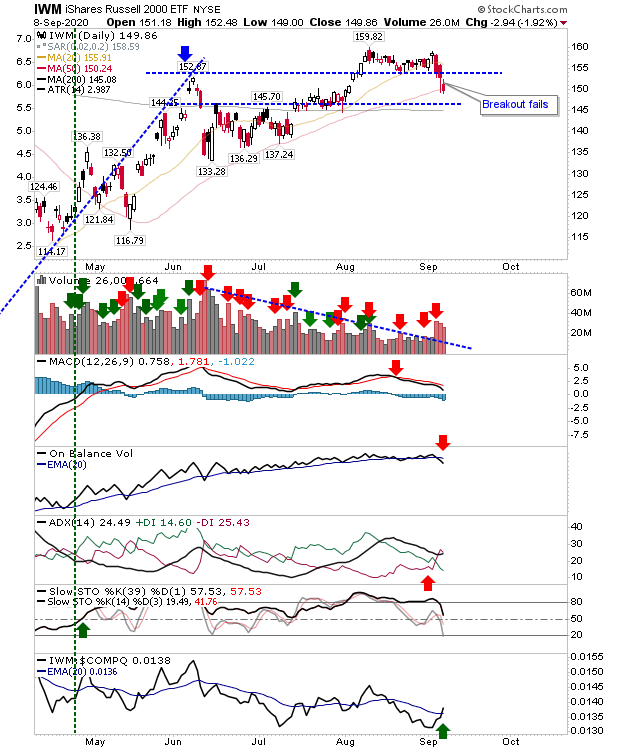

TalkMarkets contributor Declan Fallon is adept at looking at the charts to cut through the fog. I suggest to take a look at what he sees in his article Third Day Of Selling In A Row. He does not believe the markets are oversold, "Despite the sizable losses, most of the indices have yet to reach an oversold condition. However, there is a shift in relative performance between the indices." And that includes the Russell 2000 Small Cap Index (chart below):

Fallon concludes on a relatively optimistic note: "With the markets having suffered three sizable sell-off days we are now in a position to consider what will happen when buyers next return. Bulls will not want to see a double top, which is a distinct possibility now that existing holders will be kicking themselves for not exiting sooner. The loss of the breakout in the Russell 2000 (IWM) is disappointing but not hugely damaging, with a trading range the most likely outcome from this. Again, until markets are oversold we can't consider a cash scenario."

It's a short trading week, but with three days left to go some silver lining is needed to smooth out the current turbulence. David Templeton finds some in his article Small Business Optimism, And Importantly Hiring Plans, Remains Favorable. He notes that the NFIB Small Business Optimism Index for August is 1.4% higher than reported in July and that it is slightly above the 47 year average for this index. More importantly, "is the fact 21% of small businesses that responded to the survey are looking to increase employment levels. This is up from a meager 1% in April. It is the job market that needs to see improvement at the juncture of the recovery and this small business hiring indication is a positive that can give a boost to further economic growth. Broadly, the NFIB report is a favorable one and can serve as a catalyst for further economic growth."

Maurice Setter, an English footballer, said: "Too many people miss the silver lining because they're expecting gold." Optimism from small business owners is a silver lining indeed. Have a good week.

Quite a collection of comments, that is for certain. I had not been aware that I was "following" particular contributors, so that assertion is interesting. I read articles with titles about subjects that are interesting, or that I think are useful to be informed about. I comment about things that I have opinions about, or information to share, and I tend to warn about dangers that I see, or at least believe I see.