Tailing 3Y Auction Kicks Off Week Of Closely-Watched Supply

Image Source: Pixabay

There was some apprehension ahead of today's 3Y auction - the first sale of coupon paper this week - following some very sloppy global auctions around the globe, and certainly ahead of the 10Y and 30Y auctions later this week. In retrospect, the sale of $58BN in 3Y paper came in a bit on the weak side, but hardly enough to spark concerns about prevailing demand.

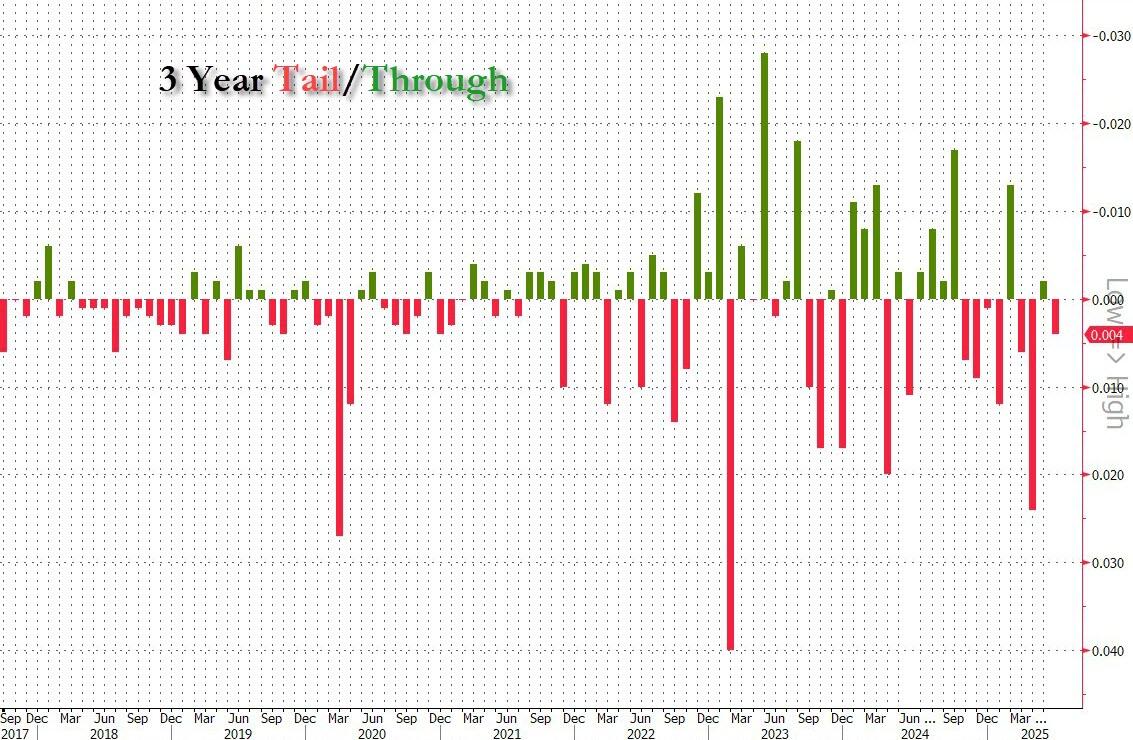

Just after 1pm, the Treasury announced that today's sale of 3Y paper priced at a high yield of 3.972%, upfrom May's 3.824% and the highest since February's 4.3%; the auction also tailed the When Issued 3.968% by 0.4bps and was the 7th tailing 3Y auction in the past 9.

(Click on image to enlarge)

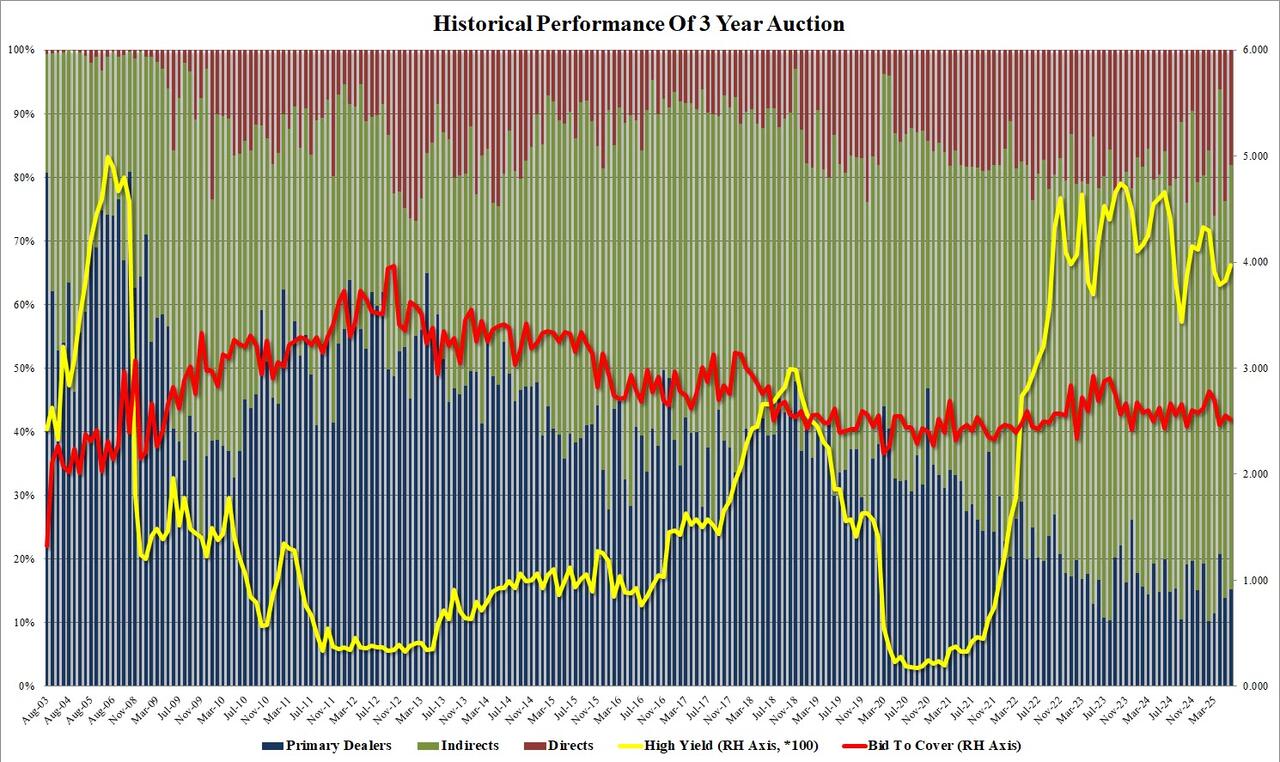

The bid to cover was also on the soft side at 2.516, down from 2.556 last month and below the 2.617 six auction average.

The internals were stronger, however, with Indirects rising to 66.8%, up from 62.4% and above the recent average of 66.2%. And with Directs dropping to 18.0% from 23.7%, in line with the average of 18.7%, Dealers were left with 15.2%, also right on top of the six-auction average.

(Click on image to enlarge)

Overall, this was a mediocre, if smooth, auction, and judging by the lack of market reaction, it was more or less what the market expected. Now attention turns to the balance of this week's auctions which at 10Y and 30Y may be more challenging.

More By This Author:

Exxon Mobil Stock Starts Cooling Off: A Technical Analysis

A Look At Camber Energy's Chart After The Stock Has Been Flying Lately

Bitcoin Could See A Bullish Run If These Few Things Happen

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more