Supply/Demand Concerns In U.S. Housing

Existing Trends

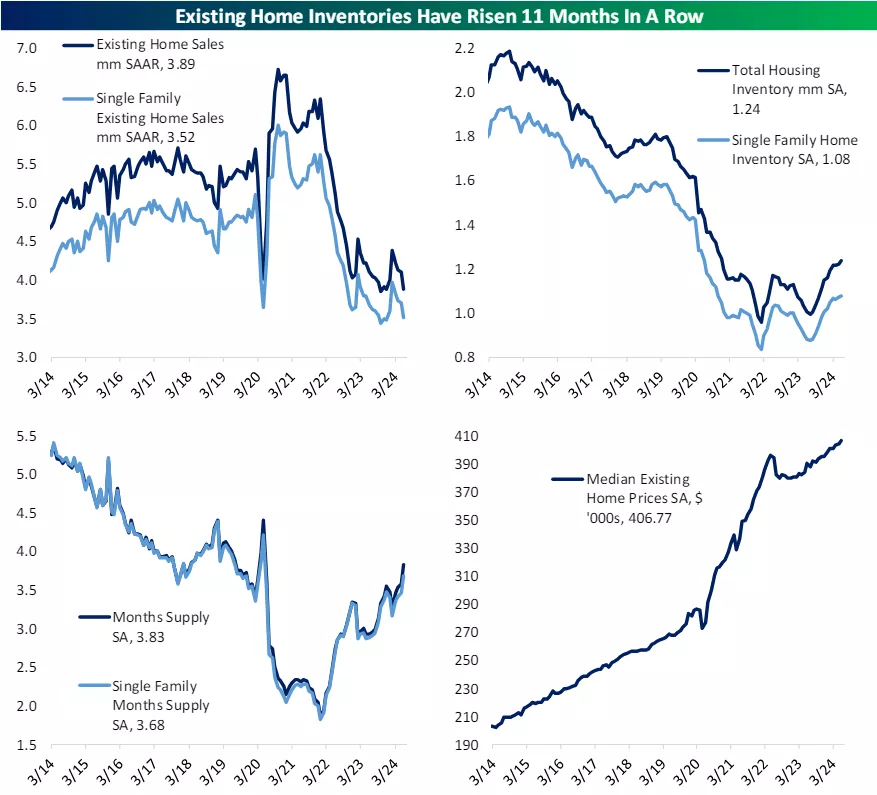

Existing home sales fell 5.4% MoM in June, more than the 3.2% MoM decline expected by analysts. As shown in the top left chart below, that sales drop takes the market back almost to the lows from 2023 in volume terms.

Back then, inventories were much lower than they currently are. In fact, the number of existing homes available for sale has risen every month for 11 straight months now, a sign that demand is not as strong as supply (see top right chart below). Of course, in the existing home market, demand and supply are correlated because most people buying (or selling) a house still have to find a place to live.

Over the last couple of years, prices have been able to defy very low sales volumes because the decline in sales volumes also meant lower inventory. That perversely helped push prices higher and it continued in the month of June with median prices reaching a new seasonally-adjusted level of $407k (see bottom right chart below).

However inventory-sales ratios have returned to normal and are rising rapidly. With low inventories, weak sales volumes can coexist with high (and rising) prices. But that’s much less true with ample inventory. We aren’t there yet; absolute levels of inventory available to purchase are still low compared to recent history (see bottom left chart below). But progress on availability is being made, slowly but surely.

(Click on image to enlarge)

More By This Author:

First Of The Mag 7 Comes Up Short

Streaky Stock Market

“Critical Error”

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more