Sudetenland Revisited

The deal being worked out over eastern Ukraine sounds like the 1937 Munich capitulation and unlike the British rush to defend Polish borders 75 years ago in Sept. 1939—right down to the presence of a supposed outsider in the deal (Hitler in 1937; Putin in 2014.) For Ukraine, not a member of Nato and in a bad neighborhood, some kind of settlement with Putin's invaders is the only out.

Putin claimed Russia could take over the whole country with a 2-week Blitzkrieg unless the Sudenten Germans (sorry, I mean the Russian-speaking eastern Ukrainians) were granted some protection from their Heimat (or Maht Radnaya, motherland.)

This is not a lasting solution but the stock markets of the world are rallying.

Hitler turned out to have a problem with oil. Putin has a problem with gas, his main hold on the Near Abroad (Ukraine) and beyond (Germany.) The US is now the largest producer of natural gas in the world, thanks to fracking, according to the BP 2014 Statistical World Energy Review. US production rose over 20% in the past 5 years and hit a record high of 328 bn cu ft/day making us world champs. Putin will eventually face a problem with his Siberian gas cuts strategy especially if the US removes obstacles to exporting crude oil we no longer need at home.

New share pick from our returning reporter, Harry Geisel, plus news from Jordan, Israel, Britain, Canada, Japan, Ireland, Australia, Netherlands, Finland, Russia, and Ukraine.

*We start with a new stock idea, to replace the China choo-choo sold yesterday. Here is Harry Geisel again writing for us:

Commercial payments can only take place when there is trust between strangers. In cash economies,

specie and paper money were issued by recognized third parties, usually governments. Bills of exchange and checks were drawn on banks belonging to recognized third parties (clearing houses or the US Federal Reserve System) so funds could be transferred between payer and payee accounts.

In yesterday's digital payments world, "trusted" pieces of paper have been replaced by "trusted" electrons. Trust is created by verifying three identities in a transaction: the creator of the desired money transfer; the creator's bank or credit/debit card issuer; and the vendor's financial institution receiving the money. Digital systems also are used to verify non-financial paper like passports, cell phone calls, or drivers' licenses.

Gemalto (GTO on Amsterdam's Euronext or its sponsored ADR, GTOMY, each ADR 1/2 a GTO share) is world leader in supplying chips and embedded software to protect and verify digital identity. They are also the world's biggest creator of platforms allowing secure ID access for services. GTO will soon acquire SafeNet, the world's leading private supplier of data encryption and the accompanying cryptological management. (Ed: It announced last month that it will pay San Francisco's Vector Capital $890 mn to buy 100% of SafeNet.)

Gemalto will then become an even more dominant player covering electronic transfers from beginning to end. GTO expects the acquisition to be earnings accretive. It expects earnings will triple by the end of 2016 because of greatly increased demand by US financial institutions for chips and software to convert to new "EMV"-compliant credit/debit cards and card processors. EMV (Europay, MasterCard, Visa) is more secure than the current US system based on an easily-compromised card magnetic strips.

Gemalto's H1 2014 earnings came in below expectations because of exchange rate fluctuations and slower government orders in an austerity era. The shares plunged more than 10%. However, they are still not "cheap." 2014 EPS will be euros 2.27 so the p/e is still in the low 30s.

But I believe that the advent of digital commerce will be as important as the automobile replacing horses and Gemalto may be the Ford or the Stanley Steamer for the digital highway. I hope the Ford. While I'm optimistic, a high p/e based on current earnings in a high market suggests that purchases should be in small amounts over time. (Vivian adds that the seller, private equity investor Vector Capital, a spinoff from Ziff Bros, has about $2 bn under management so the $890 it will get for SafeNet is a key profit component. SafeNet is based in Belcamp, Maryland. My NYC personal bank, HSBC, a global player, is in the process of issuing EMV credit and debit cards to customers.)

*A new deal to buy natural gas from Israel's Leviathan offshore field will be signed by Jordan. Amman wants to buy about $1 bn of Israel offshore gas per year for 15 years. The field holds 22 trillion cu ft of gas and is operated by Noble Energy of Texas, but Delek Group (DGRLY) is the controlling shareholder. This is important not just to Israeli business but also to Israeli-Arab relations. Attacks on the trans-Sinai pipeline bringing offshore Nile Delta gas to Israel and Jordan, led to the new combo. DGRLY also won from the Jerusalem regulator an extension under certain conditions of its license for offshore field Ruth C/360 to the end of Feb. 2016 while a decisions is still pending on Alon D/367. Two other Alon licenses are assumed to be valid.

*Origin Energy, a ute, is a 50% partner with AWE Ltd which found a major gas field offshore Perth. This boosted OGFGF in local trading to A$16+. An Origin director, New Zealand ex-banker Sir Ralph Norris who now heads Fletcher Building (the largest listed Kiwi company), doubled his investment in Origin to A$300,000 last Friday, at under $15, presumably not aware of the find.

*Teva won an English High Court case to defend its inhaler for its asthma drug single inhaler against a patent claim by Astra Zeneca this violated its Symbacort maintenance and reliever therapy (SMART) combined doser. The patent was called obvious and AZN's attempts to add matter criticized by the court. Teva will use the system to launch formoterol/budesonide DuoResp Spiromox to treat asthma and chronic obstructive lung disease with a dual drug device.

Teva will present 20 abstracts and data on Copaxone and Lquinimod, its multiple sclerosis bestseller and investigational replacement respectively, at the MS ACTRIMS-ECTRIMS conference in Boston Sept. 10 to 13.

*Bombardier has withdrawn from the bidding to take control of Finmeccanica's 2 Ansaldo railway units in Italy. Both companies have a lot of debt but BDRAF is more cautious. Hitachi is now the lead contender along with Thales (France), CAF (Spain) and a jv of CNR and Insigma Tech (China.)

*Ireland's Alkermes has completed enrolling patients in its phase 2 trial of its 3831 broad-spectrum atypical anti-psychotic drug, a combination of mu-opioid antogonist samidorphan and olanzapine (Zypresa). This is not ALKS's potential blockbuster, a long-acting version of Abilify (aripiprazol lauroxil) given by monthly injection, a potential blockbuster, but its backup. ALKS will present a the Morgan Stanley Healthcare Conference next Mon. at 11:05 am here in NYC and you can view it live at the www.alkermes.com website. Most of the presenters will have Boston accents rather than Irish brogues.

*Reckitt Benckiser made another new 52-wk high at GBP 53.7 this morning. RBGLY sells stuff in Russia..

*Seekingalpha contributor Chris Lau argues that Nokia stock has bottomed at just under $8 mainly because the deal it signed for Here with Samsung “validates” NOK's offering as an alternative to Google Maps.

*Relief rally for Dutch Yandex, seller of Internet search in Russia and Ukraine. YNDX is up 4.4% today.

*Raven Rus in Britain rose 3.2% in trading in London this morning hitting GBP 0.725 per share on optimism about Russia sales. RUS:UK

*OJSC Cherkizovo Group's GDR rose to $11.75 in London trading today, up 1.3%. CHE:UK. Same reason.

*Sold too soon. Guangshen Railway rose 3.5% to $20.79 in trading today. GSH was sold yesterday. To quote the first French Baron Rothschild, “I made my fortune by always selling too soon.”

*Sold because of insiderism. The Chilean securities regulator today imposed $164 mn in fines against SoQuiMich chairman and 8 affiliates because of insider block trading among the 8 holding companies where Señor Ponce's SQM stock was held. Ponce will have to sell SQM stock if his $70 mn fine is upheld by the Santiago appeals court.

Before I give you my trade here is a proposal:

The USA should get tanks and body armor off the cops on the streets of our cities and send the surplus military equipment to Ukraine along with any Uzi or Kalashnikov machine guns being used to train children in how to shoot. It's bad enough teens learn to use rifles at NRA financed summer camps under safe conditions. But not at a hamburger joint and not aged 9. Ukraine needs armaments more than Missouri.

I just sold Guangshen Railway at $20.13/sh as advised yesterday. The railway called the Red Rooster depends on export industries and their employees in the Pearl River Basin which are in a slump. GSH actually produced a modest gain.

Fund notes follow.

*Aberdeen Japan Equity (JEQ) top 10 holdings as of July 31 were:

Shin-Etsu Chemicals 5.3%

Keyence Corp 4.4%

Canon 4.3%

Fanuc 4.1%

Seven & I Holdings 4.0%

Japan Tobacco 4.0%

Nabtesco Corp 3.7%

Toyota Motor 3.7%

Chugai Pharma 3.7%

East Japan Railway 3.3%.

I am pleased that Fanuc, a robot-maker and top exporter, is No. 4. I own it outright but never was able to time it for the newsletter's readers to buy.

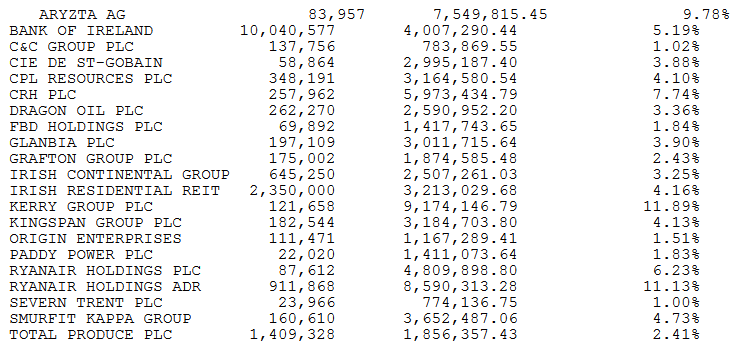

*New Ireland Fund issued a corrected release on its Sept. 19 distribution of capital gains and interest earnings to shareholders. The amount is $0.30245/sh to shareholders of record Sept. 9. But the IRL return is not 1.82% over the past year, but 8.74%. Numbers matter. It also reported its holdings at month end:

Alert readers will note that RYAAY is 17.36% of the fund if you combine its ADRs and Irish shares. And Paddy Power plc is barely there.

None

Putin has no problem with natural gas. He can sell all he wants to China and Japan, although perhaps later than sooner. What is/was the Point anyway of pretending that Russia could be punished by depriving western Europé of a valuable energy source?

- Fred Banks