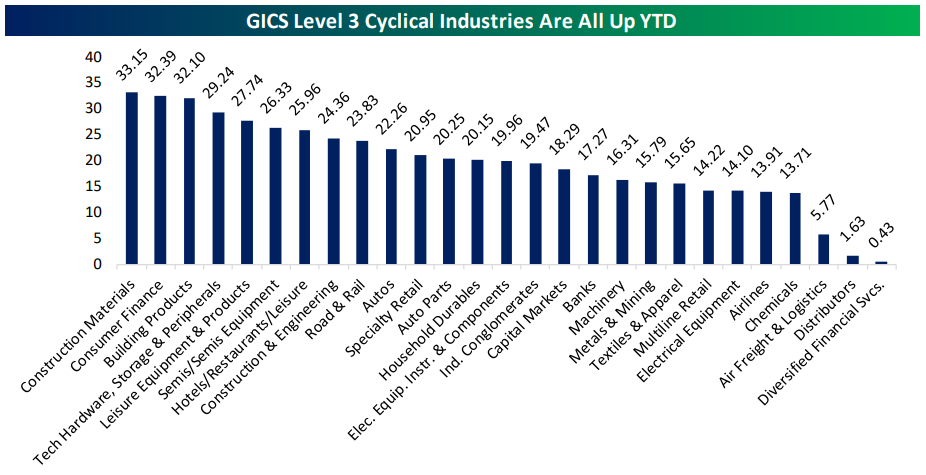

Strong Cyclicals Breadth Bodes Well

Last night, we noted strong breadth among the 27 GICS Level 3 Industries that we classify as cyclical. As-of yesterday’s close, all 27 were up on the year, with performances ranging from +30% gains for Construction Materials, Consumer Finance, and Building Products to weaker sub-2% gains from Distributors and Diversified Financial Services. Below, we show price returns by industry.

(Click on image to enlarge)

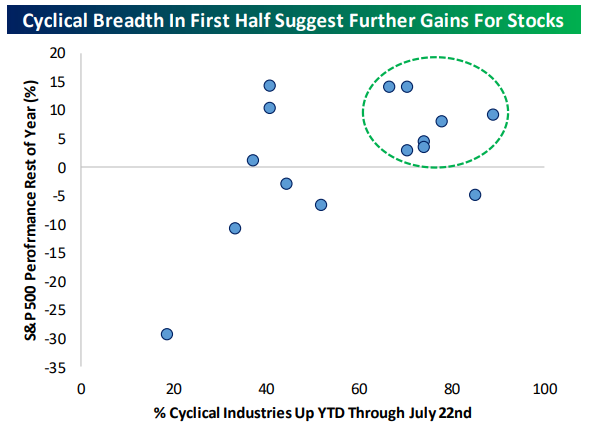

The strong cyclicals breadth bodes well for returns the rest of the year. Since 2004 (full data for all 27 industries starts in that year) there has never been stronger breadth at this part of the calendar. Generally speaking, strong cyclicals breadth is a positive sign for returns the rest of the year. There have been 8 previous years where at least two-thirds of cyclical industries were up through July 22nd. The market as a whole was up through the end of the year in seven of those eight instances, suggesting smooth sailing through the end of 2019.

Disclaimer: Read our full disclaimer here.