Stocks Succumb To Profit-Taking As August Winds Down

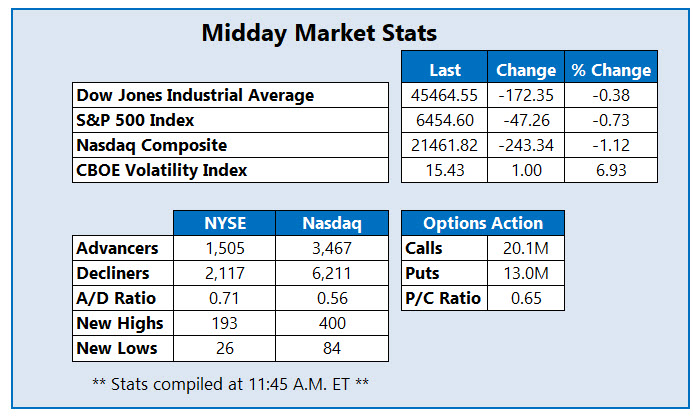

Stocks are lower across the board, with profit-taking in play even as the PCE report -- the Fed's preferred inflation gauge -- met estimates. Meanwhile, the University of Michigan's consumer sentiment survey showed a dip in sentiment for August, month-on-month. The Dow Jones Industrial Average (DJIA) and Nasdaq Composite (IXIC) are both off by triple digits at last check, with Nvidia (NVDA) a notable laggard. The S&P 500 Index (SPX) is notably in the red as well, with each major index poised to snap a three-day win streak. Despite all three sliding into the red for the week, the Dow, SPX, and Nasdaq are all heading for monthly wins.

Ulta Beauty Inc (Nasdaq: ULTA) is getting attention in the options pits today. At last check, 17,000 calls have changed hands, volume that's 18 times the average intraday amount. The weekly 8/29 527.50-strike call is the most popular, with new positions being bought to open. ULTA is down 5.6% to trade at $500.97, pivoting into the red at the open despite the cosmetics retailer reporting an earnings triple play. The stock is up 15% year to date despite today's pullback, with support stepping up at its 50-day moving average.

(Click on image to enlarge)

Affirm Holdings Inc (Nasdaq: AFRM) stock is trying to prop up the Nasdaq today, last seen up 12.4% to trade at $89.90 after the 'buy now, pay later' fintech company reported a top-line beat for the second quarter. No fewer than eight brokerages hiked their price targets in response, the highest coming from Jefferies to $110 from $95. Affirm stock is now 51% higher in 2025 and up 121% year to date.

Marvell Technology Inc (Nasdaq: MRVL) is dragging the tech hardware sector today, last seen down 17.1% to trade at $64.02. Despite earnings and revenue beating estimates for the second quarter, a lackluster third-quarter guidance and data center outlook is weighing. No fewer than 11 brokerages have issued price-target cuts in response, the worst coming from Melius Research to $70 from $76. MRVL is now nursing a 42% deficit in 2025.

More By This Author:

S&P 500 Breaks Above 6,500 As AI Keeps Growing

Stocks Subdued By Nvidia's Post-Earnings Reaction

S&P 500 Nabs Record As Stocks Settle Quietly Higher