Stocks Steady As Tech Earnings Take Center Stage

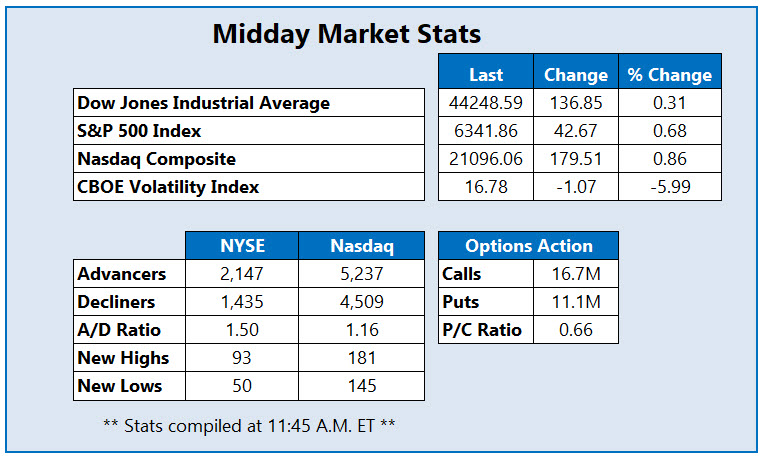

Stocks are firmly higher today, as Wall Street sorts through several earnings reports. The Dow Jones Industrial Average (DJI) is sporting a triple-digit midday lead alongside the Nasdaq Composite (IXIC), while the S&P 500 Index (SPX) is also in the back despite an ugly semiconductor selloff. Apple (AAPL) is helping prop up the tech sector, after the company agreed to invest another $100 billion in the U.S. On the tariff front, President Donald Trump announced another 25% levy on India for Russian oil purchases.

Options traders are blitzing Advanced Micro Devices Inc (Nasdaq: AMD) stock today. So far, 856,000 calls have exchanged hands, volume that's double the average intraday amount. The weekly 8/8 165-strike call is the most popular, followed closely by the 160-strike put in the same series. AMD was last seen down 6.6% to trade at $162.77, after the chipmaker's second-quarter earnings fell short of estimates amid declining China sales. Though the chip stock is taking a breather from its July 31, 52-week high of $182.50, it sports a 33.9% year-to-date lead.

(Click on image to enlarge)

Shopify Inc (Nasdaq: SHOP) stock is near the top of the Nasdaq today, last seen up 19.4% to trade at $151.61. The e-commerce concern reported a top-line beat for the second quarter, as well as upbeat guidance for the fiscal third quarter. SHOP earlier surged to a three-year high of $156.39,and is now 43.7% higher year to date.

Rivian Automotive Inc (Nasdaq: RIVN) stock is on the other end of the spectrum, last seen down 2.4% to trade at $11.87. The electric vehicle (EV) company reported steeper-than-expected second-quarter losses, prompting at least eight price-target cuts from analysts, the steepest from JPMorgan Securities to $9. RIVN is now down 9.8% for 2025, and 19% year over year.

More By This Author:

Nasdaq Gaps Lower On Tariff, Stagflation Fears

Dow Marks Best Day Since May After Friday's Selloff

Dow Up 486 Points As Stocks Start New Week Strong