Nasdaq Gaps Lower On Tariff, Stagflation Fears

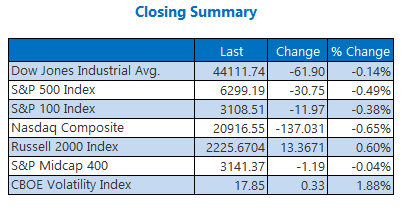

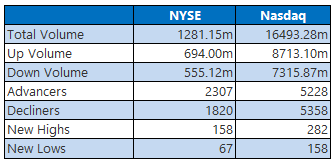

Dismal services data for July and tariff turmoil pushed stocks back into red territory on Tuesday. The Dow finished below breakeven after yesterday marking its best day since May, while the S&P 500 saw its fifth loss in the last six sessions. The Nasdaq shed 137 points after President Donald Trump teased new duties for the semiconductor and pharmaceutical sectors "within the next week or so,” adding levies for the latter could reach up to 250%. Amid swirling stagflation fears, the Cboe Volatility Index (VIX) pivoted higher.

OIL EXTENDS PULLBACK AS GOLD HOLDS FIRM

Oil prices fell on Tuesday, as investors weighed the Organization of the Petroleum Exporting Countries and its allies' (OPEC+) decision to hike crude outputs and U.S. threats against India over its Russian oil purchases. September-dated West Texas Intermediate (WTI) fell $1.13, or 1.7%, to close at $65.16 per barrel.

Gold prices edged slightly higher, even as the U.S. dollar gained strength. Wall Street is also assessing support for a potential interest rate cut, with President Trump expected to announce new Federal Reserve appointments. August-dated gold futures added 0.1% to settle at $3,430 per ounce.

More By This Author:

Dow Marks Best Day Since May After Friday's Selloff

Dow Up 486 Points As Stocks Start New Week Strong

Wild Wall Street Selloff Stalls Investor Optimism