Stocks Not Fretting Payrolls

Image Source: Unsplash

Earlier this morning, when we actually had a negative sign in front of the day’s change for the S&P 500 (SPX), I got a few questions about why we might have been trading lower. Concerns about the economy seemed to be the answer after yesterday’s weak ADP and ISM Services reports combined with higher Jobless Claims and Unit Labor Costs this morning. Despite the run of bad news on the labor front, options traders nonetheless still appear to be sanguine ahead of tomorrow’s monthly jobs report.

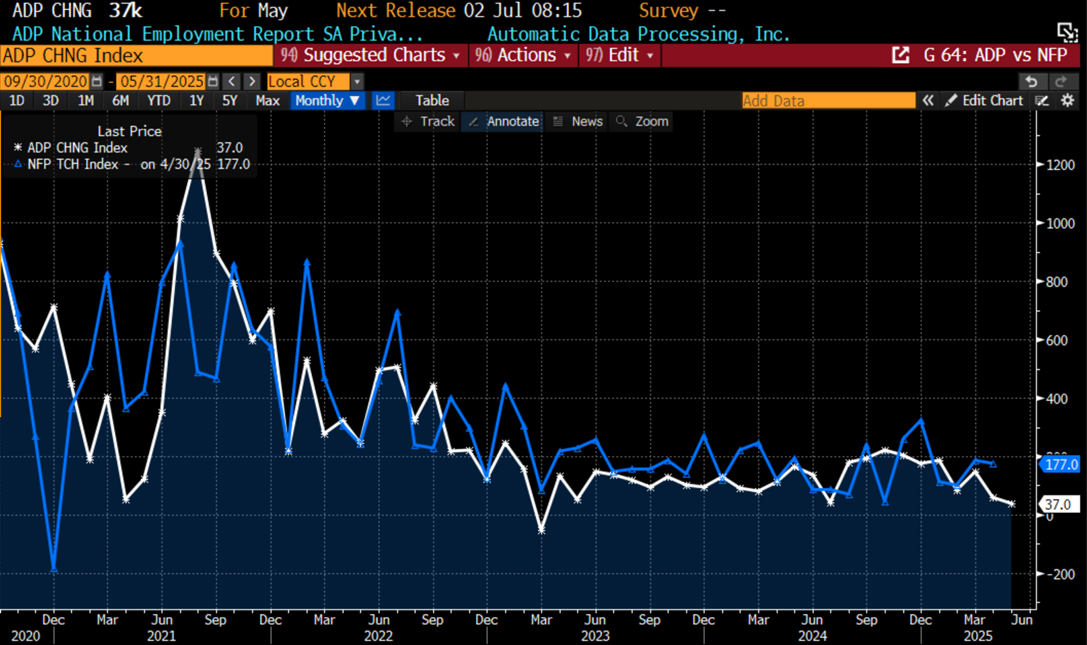

About that prior bad news: it is hard to read anything particularly positive into yesterday’s numbers. The ADP Employment Change was a mere 37k increase, below both last month’s 60k and far below the 114k consensus estimate. That could be glossed over somewhat because ADP is at best an imperfect predictor of Nonfarm Payrolls (see graph below), but the ISM Services Index fell into contraction at 49.9, below last month’s 51.6 and the 52.1 consensus, and the ISM Services Prices Paid component rose relatively sharply to 68.7, well above the 65.1 level which was both the prior month’s reading and the consensus estimate. Bonds charged ahead on those reports, with yields falling about 8bp across the curve, as those traders focused more on the slowing economy than the higher prices paid. Stock traders seemed confused, with dip buyers stepping in on cue shortly after each report’s associated dip, but unable to sustain positive momentum.

5-Years, Monthly Data: ADP Employment Change (white), Nonfarm Payrolls Change (blue)

(Click on image to enlarge)

Source: Bloomberg

Today’s numbers were not great either. Nonfarm Productivity fell by -1.5%, below the -0.8% consensus and prior, while weekly Initial Jobless Claims rose by 247k, up from 239k, and Q1 Unit Labor Costs rose by 6.6%, above the 5.7% consensus and prior reading.Had it not been for some positive reports of a meeting between Presidents Trump and Xi – a legitimate reason for a bounce – it appeared as though stocks could be headed lower.

In light of all that negative economic news, one might expect some nervousness reflected in options prices ahead of tomorrow’s report.In a word, “nope”.

Superficially, we note that the Cboe Volatility Index (VIX) is near recent lows at 17.19.Clearly there is not much demand for institutional hedges.Furthermore, the version of that calculation that uses 9-day instead of 30-day SPX options (VIX9D) is only 15.68.Not much volatility is being priced into the market in the near term.

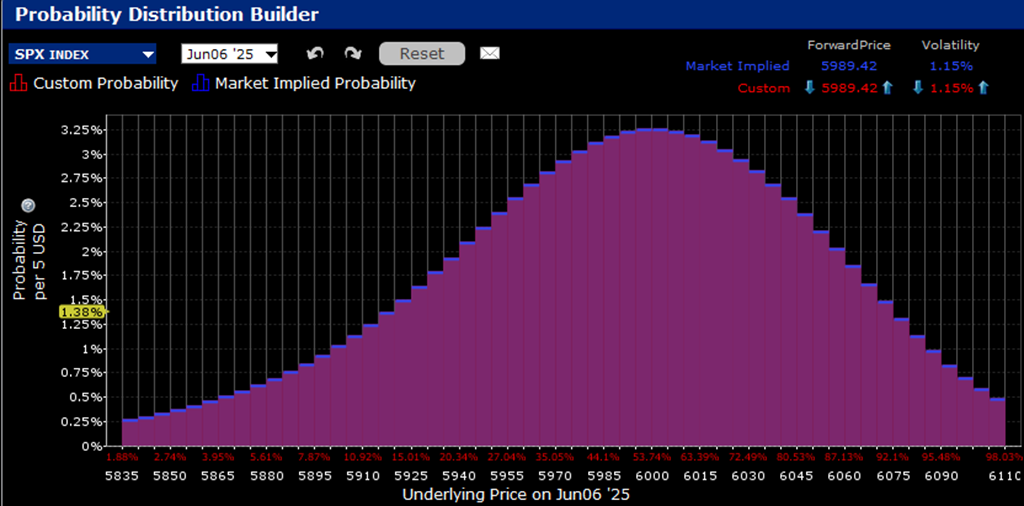

The IBKR Probability Lab for SPX options expiring tomorrow shows a peak outcome in the 6000-6005 range, slightly above the current 5989 level.That isn’t wildly bullish, but hardly showing a great deal of concern:

IBKR Probability Lab for SPX Options Expiring June 6, 2025

(Click on image to enlarge)

Source: Interactive Brokers

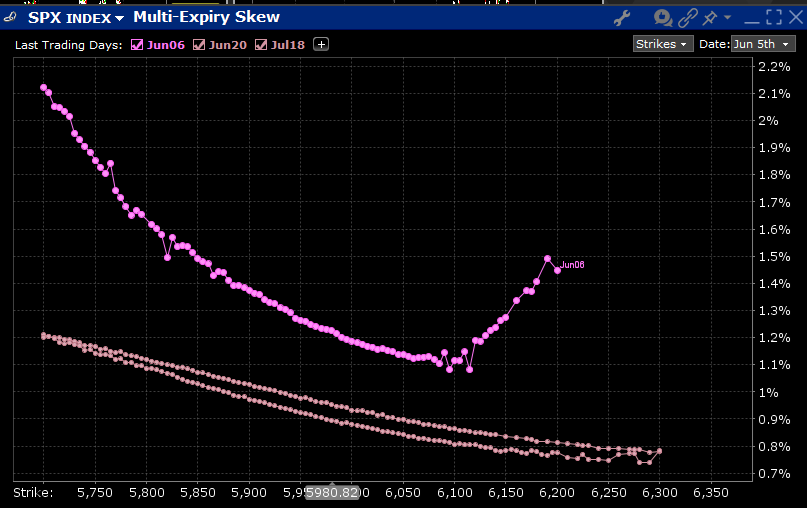

Skews are not showing any particular signs of distress either.Indeed, there is some discernible steepness in options expiring tomorrow compared to those expiring at the regular June and July monthly expirations, but there is also a solid bid for upside strikes as well.Call that a “FOMO bid”:

Skews for SPX Options Expiring June 6th (top), June 20th (middle), July 18th (bottom)

(Click on image to enlarge)

Source: Interactive Brokers

Should we therefore be concerned? I’ve often taken the contrarian view when things get a bit too sanguine, thinking that we have nothing to fear of the lack of fear itself. I don’t think we’ve gotten to the point of abject complacency, but we’re closer to complacency than concern. And at some level, that concerns me. But it will all depend upon the numbers we get tomorrow.

More By This Author:

It’s All Happening Here

New Month, Same Pattern

Sentiment Improves, Though Still Not Great

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do ...

more