It’s All Happening Here

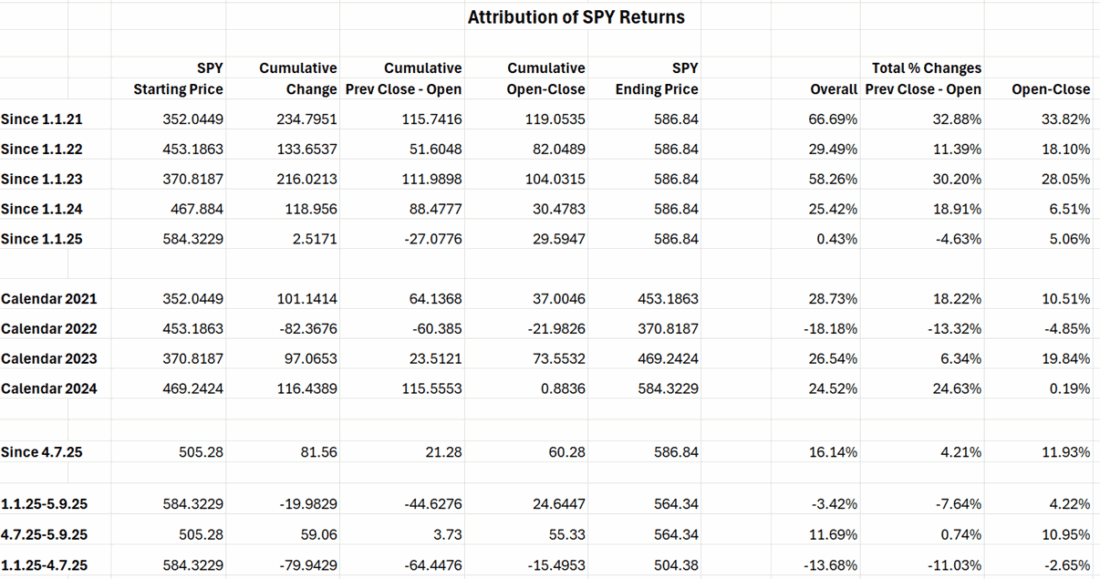

About three weeks ago we did a study that attributed whether gains in the S&P 500 (SPX) were coming primarily during US or overnight trading hours. We learned that for the course of the year to that date, we had gains during regular trading hours and losses overnight. This was in sharp contrast to the prior year, when nearly all the index’ gains occurred during overnight sessions. (See the “Since 1.1.25” and “Calendar 2024” lines in the table below). After a few days where SPX staged rallies throughout the main session, in some cases after some quick pullbacks, we wanted to see if this pattern held.

For reference, here is the original table below, published on May 15th, with data through May 9th.We used SPY, an ETF based upon SPX, because it has better defined opening levels than the index itself:

(Click on image to enlarge)

Source: Interactive Brokers

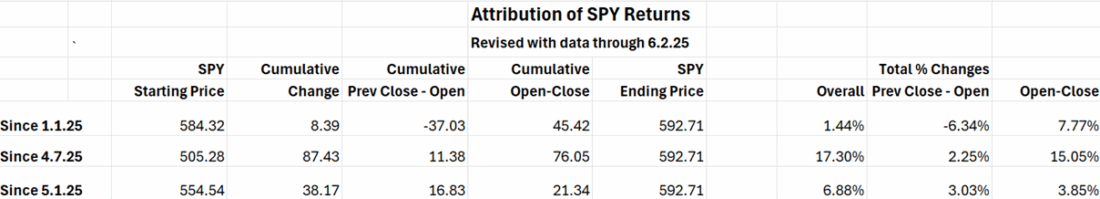

After updating the some of the most recent data, we see that the gains are becoming a bit more balanced in the past month.Note the contrast between the “Since 4.7.25” row and the results since May 1st in the table below:

(Click on image to enlarge)

Source: Interactive Brokers

Had we included today’s intraday results, it would have skewed the numbers somewhat more to the Open-Close column, since we opened roughly flat, then steadily rose throughout the session.Regardless, we can see that while the bulk of the gains this year have come from regular day trading – indicating that US buyers were in charge – the imbalance improved markedly in May.

Adding to the “US buyers in charge” idea was a question posed by reader in a comment to yesterday’s piece:

Here is another pattern for Steve to explain: Please deconstruct the flurry of activity at 3:50 PM Eastern time. It happens precisely at that time – down to he second. And why, at least initially, is it filled with massive index buying at least 87% of the time?

I haven’t been able to verify those exact statistics yet, but I have noticed the tendency of SPX to rise just before the end of the session.That is the result of market-on-close orders from funds that have been seeing inflows in ETFs and other funds that are either linked directly to SPX, or that contain a heavy weight in SPX components.Funds that are linked to an index are marked at that index’ close.Also, the performance of institutional buyside traders is often linked to some combination of the volume weighted average price (VWAP) and the close.Thus, if the fund has been seeing steady inflows, it behooves the institutional trader to leave some extra buying ammunition for the close.

Because institutional market-on-close orders must be received well before the close, the NYSE and Nasdaq publish market-on-close imbalances at 3:40 each day. This allows all market participants to get a sense about whether there is likely to be a final surge of order flow in one direction or another.The logic is to allow traders to be able to get prepared ahead of potential market volatility and hopefully dampen its effect on the close.In practice, however, some traders of course try to game the system.On a day like yesterday or Friday, the first trading day of the new month and the last day of the prior, it is reasonable to expect either more inflows or some window dressing of positions.Yesterday, the bounce was very late, starting at about 3:57. On Friday, the bounce started at 3:00, with the final trades actually falling from the 3:57 level, but finishing nicely above the 3:00 level. Either way, the late bounces don’t occur unless funds are seeing inflows.

More By This Author:

New Month, Same PatternSentiment Improves, Though Still Not Great

The “Newhart” Tariffs

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment ...

more