Stocks And Precious Metals Charts - Blue Monday - How Are The Mighty Mispricings Of Risk Fallen

As you may have seen we had a rather stiff sell off today, on heavier volumes.

Stocks have pretty much given up all of their gains for 2018. I have included a year to date chart of the performance of a few financial assets below. Gold is outpacing most. Silver not so much.

You may have noted that I originally marked my stock charts with 'Blow Off Top In Progress?' and then a week or so ago dropped the question mark.There was no longer any question in my mind.

Stocks were so frothily mispriced to risk that the trigger event did not take much:a better than expected Jobs Report, and not by much, was enough to shock the markets into the realization that the continuous flow of hot money from the Fed almost directly to the Wall St Banks and wiseguys could not continue forever.

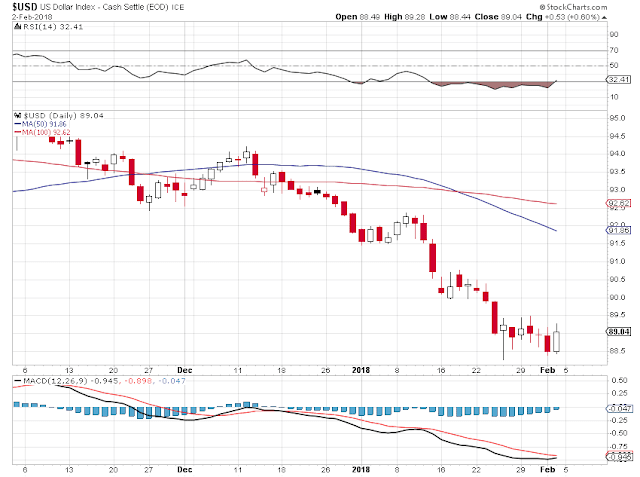

Today and Friday were definite flights to safety. Today in particular both gold and the US Dollar were higher. Silver was up by held back a bit by its industrial component.

The VIX, a measure of risk and volatility, rocketed higher.It was greatly aided by a short squeeze.The short interest on the VIX was profoundly malinvested against risk.And today that was corrected.

This was not an ordinary 'Blue Monday' and it went out on the lows.This was more of a 'Bad Monday.'

And contrary to popular thinking that sets up a strong possibility for a proper bull capitulation, and a relief rally from the lows.

Tomorrow is going to give us a lot of data.We blew out the short term correction metrics, and I have removed it from the charts. We have now pretty much completed a solid retracement of the meltup from the trendline, when stock risks were thrown aside with abandon, along with all the gains for 2018 and then some.

IF we continue to go lower, the beginnings of the 'Trump Rally' will start peeking their noses back up.Notice that I have never taken them off my charts.But I am not counting anything down to there yet. It will take an additional trigger event to bring that sort of price drop into play I imagine.

I hope you did not lose any money the last couple of days. I do wish everyone well.But if you embrace foolishness, and give yourselves over to the advice and leadership of the wicked, a downfall is not to be expected.

So let's see if tomorrow brings a sign that today was a proper capitulation of the bulls, and a cleansing of the excessive mispricing of risks.Or perhaps we will get a marked capitulation tomorrow intraday. We will know it because the relief rally that kicks in from the low will not fail like it did today.Today was a bull trap, to skin the dip-buyers.

"God has a way of standing before the nations with judgment, and it seems that I can hear God saying to America, 'You're too arrogant! And if you don't change your ways, I will rise up and break the backbone of your power, and I'll place it in the hands of a nation that doesn't even know my name. Be still and know that I'm God.'"

Martin Luther King

One thing of which I am almost certain is that if stocks find a footing tomorrow and rally, all of our cautions and reckonings of the day will be forgotten once again, and it will be back to pride in our exceptionalism and superiority, and the mispricing of risks all over again.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Video length: 00:02:14

None.

The VIX shows signs of life again. Some of us were wondering about it.