Stock Market Jenga

Image Source: DepositPhotos

We’ve discussed market divergences at length in recent weeks. From the observation that market performance has become dependent upon size, to the fact that advance-decline statistics no longer confirm major indices recent highs, I have been trying to come up with a metaphor for the narrowing market leadership. It occurred to me this morning: investors are playing Jenga with the stock market.

For those of you who are unfamiliar with this popular game, a tower is erected from 54 rectangular wooden blocks stacked in threes to comprise 18 square layers. Players then take turns removing blocks and stacking them atop the tower. The tower becomes increasingly top-heavy and unstable as parts of its foundation are used to make it rise.

Does this at all sound familiar? Although money appears to be flowing into the stock market, a contrary Bloomberg headline caught my eye. Apparently SPY, the SPDR S&P 500 ETF, had its sixth consecutive daily outflow. On Tuesday (the prior trading day), $1.23 billion flowed out of SPY, bringing the six-day total to $26.8 billion. For perspective, that represents about 4.9% of the fund’s assets. Some of that might be flowing into QQQ, the Invesco ETF linked to the Nasdaq 100 Index, but not enough. That fund has shown inflows on 6 of the past 7 days, but those totaled roughly $3.57 billion – hardly enough to make up SPY’s outflows. It is entirely possible that investors have decided that rather than owning exposure to an index that is roughly 1/3 weighted in mega cap tech they’d rather own one that is about 44% weighted in those names. Or simply pile into those stocks directly.

That sounds a bit like Jenga, no? Let’s remove money from the 500-stock index to focus on one that has 100 stocks. Or, let’s use that money to buy the stocks whose momentum continues to push them ever-higher, dragging market-capitalization weighted indices in their wake. We’re narrowing the foundation to push the tower ever-higher.

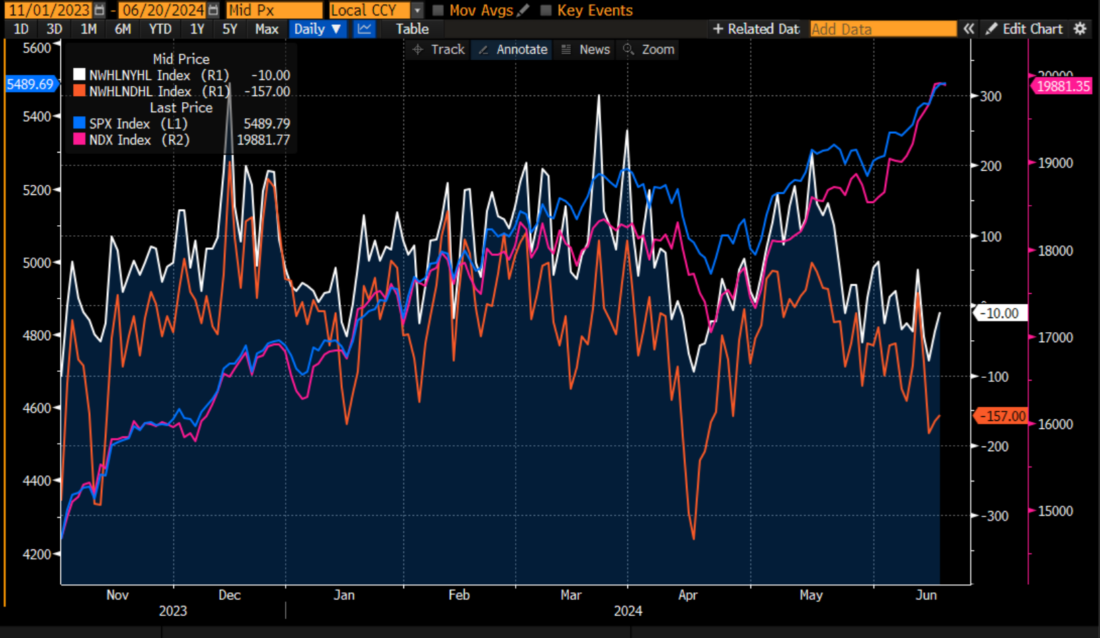

As a reminder, let’s take a fresh look at the cumulative NYSE and Nasdaq advance-decline lines vis-à-vis SPX and NDX. Since mid-May, neither has been keeping pace with the respective index highs, as they had done throughout the current leg of the bull market beginning at the start of November:

SPX (white) and NDX (yellow) Since November 1, 2023, with Respective Cumulative Advance/Decline Lines Below

(Click on image to enlarge)

Source: Bloomberg

The same can be said about net new 52-week highs vs. lows. Because the data in the following graph uses daily, rather than cumulative data, it needs to be interpreted differently from the graph above.But the message is the same:since mid-May, we have begun to see more stocks trading at year-lows than highs even as the key indices soar.

SPX (blue) and NDX (magenta) Since November 1, 2023, with Daily 52-Week New Highs – New Lows for NYSE (white) and Nasdaq (red)

(Click on image to enlarge)

Source: Bloomberg

Finally, there is an inconvenient feature about the way a game of Jenga ends.There isn’t really a winner.There is a definite loser – the unfortunate player who pulls the block that makes the tower fall.The outcome is defined by who avoided collapsing the tower, not by who best caused it to rise.Since the game can be played with more than two contestants, success is defined by avoiding catastrophic loss.In his book, The Indomitable Investor, my friend Steve Sears discovered that many great investors acknowledged that a key to their success was their skill at avoiding catastrophic losses.We all want to win – FOMO is a powerful factor driving this market – but maybe the best lesson from Jenga is that it’s perhaps more important to avoid losing.

More By This Author:

It’s Cheap To Hedge Now. Just Saying…

MoMo And FOMO Driving The Market

More Divergences

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment ...

more