Steve Hanke Says The Recession Cometh

See here.

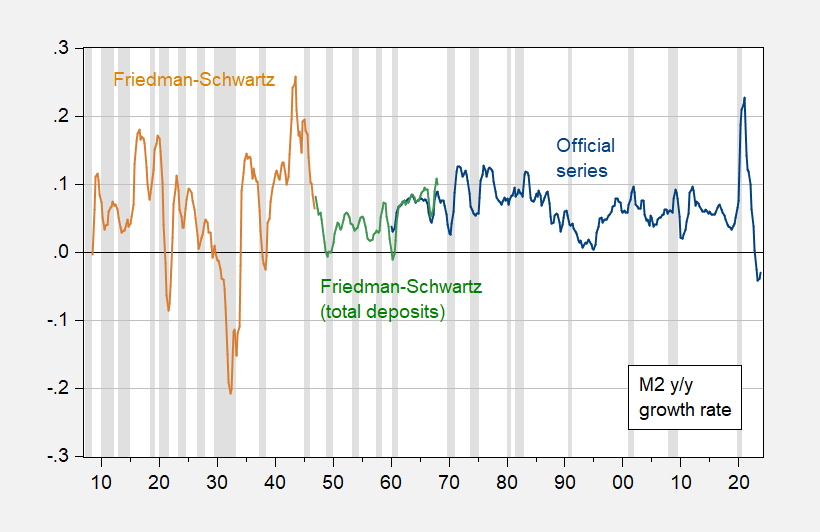

with a 4.2% contraction in the US money supply (M2) since Mar-22, all signs are pointing to a recession late this year. There have only been four contractionary episodes of the money supply since the Fed was established in 1913. With a lag, they all produced a RECESSION.

That’s true:

Figure 1: M2 from Friedman-Schwartz (tan), total deposits in commercial banks (green), and M2 from FRB (blue), year-on-year change. 2024Q1 is based on average of first two months. NBER defined peak-to-trough recession dates shaded gray. Source: NBER MacroHistory database (m14144a, m14145a), FRB via FRED, NBER, and author’s calculations.

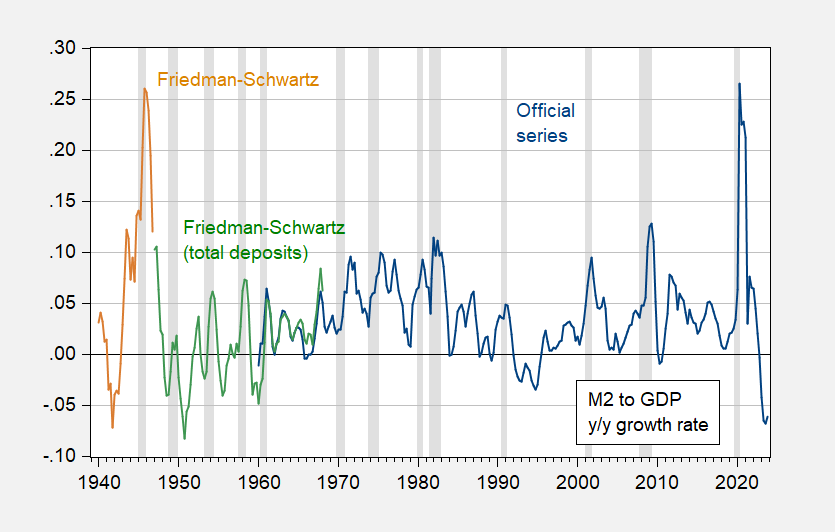

On the other hand, one might think M2 to economic activity (supply relative to one determinant of demand) might be more appropriate.

Figure 1: M2 from Friedman-Schwartz (tan), total deposits in commercial banks (green), and M2 from FRB (blue), all divided by GDP, year-on-year change. 2024Q1 M2 is based on first two months, and GDPNow as of 4/5. NBER defined peak-to-trough recession dates shaded gray. Source: NBER MacroHistory database (m14144a, m14145a), FRB via FRED, BEA via FRED, Ramey, Atlanta Fed, NBER, and author’s calculations.

Not sure about the correlation in that case. Lots of negative growth rates without recessions pre-1960, the mid-1990s, and 2010.

More By This Author:

Manufacturing’s ProgressThinking About Trade War II

Business Cycle Indicators: Employment Along With Coincident Index, VMT, Heavy Trucks, And Sahm Rule