Steer Clear Of Lyft’s IPO

The first big IPO of 2019 is here. This year could set new IPO records (for size and lack of profits), and it all starts with Lyft (LYFT). The rideshare company is expected to trade within the next few weeks at a market cap between $20-$25 billion.

At the midpoint of that proposed range, Lyft earns our Unattractive rating. It shares many of the same characteristics that have led us to warn investors away from other recent IPO’s: growing losses, low barriers to entry, poor corporate governance, and an unrealistically high valuation. These factors make Lyft this week’s Danger Zone pick.

No Network Effect Means No Profits

The two things everyone knows about Lyft are that it is growing very fast and losing a lot of money. Bulls will argue that, even if profits aren’t coming yet, Lyft’s growth puts it on the path to profitability. Their theory is that as Lyft grows the number of riders and drivers on its platform, it builds a network effect that increases its value and gives the company a competitive advantage over potential new entrants. A platform with more drivers has greater value to riders, and a platform with more riders has more value to drivers. Therefore, in theory, if the first movers attain a dominant share of riders and drivers, they build formidable barriers to entry for new entrants into the market.

Facebook (FB) is an excellent example of the power of network effects. People might not like Facebook’s privacy policies, but they join and stay on the social network because that’s where all their friends are. What’s the use in posting pictures for no one to see? Accordingly, the more people on FB, the more valuable FB is to its users. The more users on FB, the more money it can make advertising to them.

As FB makes tons of money in advertising, they offer new features to attract and retain new users. That virtuous cycle goes on while new entrants have to suffer losses as they attempt to reach the critical mass of users needed to become profitable and, hopefully, competitive to FB. The power of Facebook’s network allows it to keep growing and maintain a dominant position over competitors like Twitter (TWTR) and Snap (SNAP).

There are two key reasons why Lyft won’t benefit from a Facebook-like network effect:

- Low Switching Costs: It is easy for both drivers and riders to use multiple ridesharing apps. Roughly 70% of drivers work for both Uber and Lyft, and smaller services such as Juno have piggybacked off that network. The only switching cost involved for users of these platforms is the time it takes to close one app and open another. Switching cost are inconsequential for drivers too, especially for new rideshare apps that can use driver ratings from Lyft and Uber as a lower-cost way to screen drivers.

- No Scale Effects: The bulk of Lyft and Uber use comes within a single city. Lyft states in its S-1 that 52% of its riders use Lyft to commute to work. The localized nature of the ridesharing industry means that competitors can make inroads by focusing on a single city. If a startup can attract enough riders and drivers in a single city, it doesn’t matter if Lyft has a superior network nationwide.

These two factors will make it difficult for Lyft to build a network effect that gives it a sustainable competitive advantage or the ability to make money.

Growing Losses Reflect No Network Effect

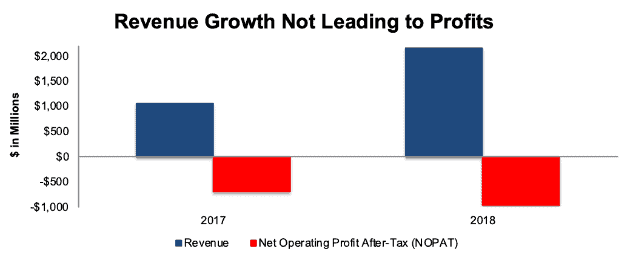

The scale of Lyft’s losses is staggering, even accounting for the structural problems it faces. The company’s net operating profit after tax (NOPAT) was -$953 million in 2018, a 38% increase from its $691 million loss in 2017. No IPO in recent history can match those losses. The closest, Snap (SNAP), lost $498 million the year before its IPO, or roughly half that of Lyft.

Figure 1: Lyft Revenue and NOPAT Moving in Opposite Direction

Sources: New Constructs, LLC and company filings

Figure 1 shows that Lyft grew revenue by 104% in 2018, but made no progress on its path to profitability.

Investors Should Be Skeptical of Lyft’s Reported Market Share

Early in its S-1, on page 2, Lyft claims it has a 39% share of the U.S. rideshare market, up from 22% in 2016. Several news outlets have treated that number as fact, but there are three reasons why investors should be extremely skeptical of Lyft’s self-reported market share number:

- Conflicted source: the results come from Rakuten Intelligence, which is also a major investor in Lyft. Rakuten clearly has a financial interest in making Lyft look better ahead of its IPO.

- Incomplete: the 39% only accounts for Lyft and Uber. It ignores smaller companies, such as Juno, that have a non-negligible share of the market in certain cities.

- Cherry-picked time frame: the data only covers the month of December. With people travelling or going to holiday parties in December, rideshare usage for that month is probably not representative of the rest of the year. In addition, choosing a shorter measurement timeframe allows Lyft to boost its self-reported number by offering steep discounts and incentives in December.

A more reliable market share analysis comes from data company Second Measure, which puts Lyft at a 29% share of the U.S. market compared to 69% for Uber and 3% for all others. Second Measure’s data put Lyft at just over 15% market share in 2016. Lyft is gaining market share as it claims, but at a slower rate than its self-reported numbers suggest. In addition, Second Measure’s data suggests that the bulk of Lyft’s gains came in 2017 during the #deleteuber campaign. Meanwhile, the company’s market share in 2018 only improved by 3 percentage points year-over-year.

Lyft wants investors to believe that it is on pace to achieve market share parity with Uber in the near future, but third-party data suggests it’s still a distant second.

Low Barriers to Entry

Even if we could trust Lyft’s market share number, the question becomes, “so what?” If Lyft is able to capture a large portion of the rideshare market by operating at a loss, the only way investors can profit is by selling to greater fools. Ultimately, the company needs to be able to raise its prices, lower costs, shrink the cut of proceeds it gives to drivers, or all three in order to generate sustainable profits.

However, if either Lyft or Uber attempt this strategy, they only make it easier for new entrants to siphon away riders and drivers. If anything, Lyft and Uber have paved the way for fast-follower competitors by establishing the rideshare market. For example, Juno has quickly established a decent foothold in New York City in part by piggybacking on Uber and Lyft's vetting of drivers, i.e. only accepting those which receive a suitable rating, and thereby lowering its employee (driver) acquisition costs.

Further, start-up costs for the single-city focused firms, like Juno or Bubbl, are already quite low. If Lyft and Uber raise prices, new entrants will also enjoy higher revenue and even lower start-up costs. Consequently, we think Uber and Lyft can expect an onslaught of competition in every major city when they can no longer afford to burn millions of dollars a year and must operate as a going concern.

Raising Money Is Not A Sustainable Competitive Advantage

The only competitive advantage that Lyft can claim at the moment is the ability to raise capital. With $4.9 billion in capital raised prior to its IPO and $2 billion of cash on its balance sheet, Lyft can afford to operate at a loss for longer than potential competitors. Lyft and Uber presumably believe that their cash piles and ability to raise future capital will scare off smaller competitors and allow them to establish a sustainable duopoly in the U.S.

Even in a duopoly, Lyft is at a significant disadvantage to Uber, which has raised over $24 billion. In addition, Lyft and Uber also face potential competition from well-funded international companies like Didi, as well as larger companies that may attempt to break into the rideshare market, especially companies such as Waymo (GOOGL) and General Motors (GM) that are developing self-driving technology.

Not Even Lyft Expects Profits

Most companies with Lyft’s profile of rapid growth and high losses claim they are building their customer base through high sales and marketing spending, and when they reach a certain scale they can cut back on that spending to achieve profits. That answer is typically nonsense, but it’s especially unrealistic for Lyft. Even if the company cut its sales and marketing costs to zero, it would still have lost $149 million last year.

Lyft’s own accounting suggests that it doesn’t expect to earn profits anytime soon. For example, management assumes that it will not realize the benefit of its large deferred tax assets (perhaps the only benefit of large cash losses) when it discloses a full valuation allowance against those assets: From page 93:

“We expect to maintain this valuation allowance until it becomes more likely than not that the benefit of our federal and state deferred tax assets will be realized by way of expected future taxable income in the United States.”

In accounting speak, Lyft is saying that its deferred tax assets are presently worthless because the company doesn’t expect to turn a profit in the foreseeable future.

Cutting Out the Drivers Doesn’t Solve the Profit Problem

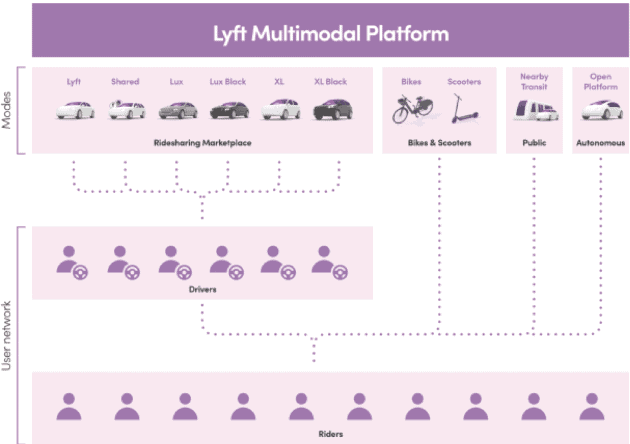

Lyft talks a lot about the importance of drivers, but they clearly foresee a future where they can cut them out of the equation. Lyft spent $250 million (9% of invested capital) in 2018 to acquire the bikeshare company Motivate, and they repeatedly use the term “Multimodal Platform” to describe themselves in their filing. Figure 2, taken directly from Lyft’s S-1, shows how the company conceives of its platform beyond the drivers.

Figure 2: Lyft’s Efforts to Eliminate Drivers

Sources: New Constructs, LLC and company filings

Lyft claims bike, scooters, and even public transportation as a part of its platform, but the most critical part of Figure 2 is autonomous vehicles in the far right corner. Self-driving cars are often presented as the silver bullet that will turn ridesharing platforms into profitable enterprises.

At first glance, this theory makes sense. Currently, drivers claim ~71 cents for every dollar spent on Lyft’s platform.[1] If all that money went to Lyft instead, it would earn substantial profits.

However, this overly simplistic model doesn’t translate into reality. Self-driving cars would cut out the need for drivers, but they would add new costs for maintenance, R&D, and insurance, as well as much higher initial capital requirements. Further, Lyft remains vulnerable to competition pushing down prices and margins unless it develops proprietary technology with which no one else can compete.

Lyft seems to recognize that it’s unlikely to be a leader in self-driving tech due to disadvantages in resources and scale compared to Uber, Waymo, and GM. Consequently, the company has focused on partnering with leaders through its Open Platform, which allows other companies to deploy their self-driving vehicles on Lyft’s platform.

This strategy reduces the costs to Lyft, but it also reduces the reward. If, for instance, Waymo develops self-driving technology at scale, it could simply license that technology to all rideshare companies and earn a significant cut of each ride. In effect, Waymo replaces the driver in this situation, while the rideshare companies remain as relatively undifferentiated middle-men.

Bull Case Doesn’t Hold Water

The most plausible bull case for Lyft at the proposed IPO valuation is that a company like GM (which is a major Lyft investor) builds self-driving tech and decides to acquire Lyft to monetize that technology. However, it’s hard to imagine that GM would pay $20-$25 billion for Lyft, or any more than the ~$3 billion Lyft spent to get where it is today.

Specifically, if Lyft has raised $5 billion in capital, and it still has ~$2 billion in cash, then why wouldn't GM, or any other potential acquirer, consider $3 billion as the maximum amount it would need to build out its own rideshare business? And, if it can build its own rideshare company for $3 billion, then why pay any more for LYFT?

We struggle to see how GM would justify paying $20-25 billion for Lyft. After all, the ground that Lyft and Uber have plowed to build driver networks and get consumers on board with ridesharing only makes replicating their success easier and cheaper.

We can’t discount the stupid money risk of a company overpaying for an acquisition, but it’s hard to build a sound fundamental case for anyone to acquire Lyft at its current valuation.

Hidden Liabilities Further Raise Risk

Investors should be aware that Lyft’s reported valuation ignores significant hidden liabilities in the form of employee stock options and restricted stock units (RSU’s). These hidden liabilities represent shares that are not included in the official share count but will eventually vest and dilute existing shareholders.

On page 36 of the footnotes (page 256 overall), Lyft discloses 13.8 million outstanding employee stock options with a reported intrinsic value of $609 million. However, the company’s valuation of these options is based on assuming the fair value of its stock is $47.37/share. We don’t yet know Lyft’s official IPO price, but at the rumored valuation of $20-$25 billion, its shares would be worth ~$90/each, or roughly double the fair value assumption. At the IPO share price, Lyft’s stock option liability is more like ~$1.2 billion.

In addition, Lyft discloses that it currently has 46 million (~19% of shares outstanding) RSU’s outstanding. Of this total, over half (24 million) were granted during the past year. As with the stock options, Lyft values these RSU’s at $47.37/share, giving them a reported intrinsic value of $2.2 billion. At the rumored IPO valuation, these RSU’s would be worth over $4 billion.

Investors should be aware that these RSU’s represent a significant deferred cost that will hit the income statement after Lyft completes its IPO. The company estimates that it has $1.3 billion in unrecognized compensation cost related to RSU’s, but that number almost certainly understates the true amount. When Snap went public with a similar valuation and a similar number of RSU’s (~20% of outstanding shares), it recorded $2.6 billion in stock compensation expense in its first year as a public company.

Combined, Lyft’s stock options and RSU’s represent over $5 billion in future dilution or 20-25% of the proposed market cap of the company. Investors who care about fundamentals should deduct this $5 billion out of their valuation models for LYFT.

Valuation Already Assumes the Best Case Scenario

Even before accounting for these hidden liabilities, it is quite difficult to create a plausible scenario for future cash flows that justifies the proposed IPO valuation. Below, we model three scenarios for Lyft’s future cash flows:

- High Competition Scenario: Lyft is barely able to scrape out an economic profit as any price increase opens the door for new competitors. The company earns the same razor-thin margins that airlines had prior to industry consolidation. If Lyft achieves 4% pre-tax margins and grows revenue by 25% compounded annually for 10 years (~$20 billion in year 10), it has a fair value of $1.6 billion today, over 90% downside from the proposed valuation. See the math behind this dynamic DCF scenario.

- Duopoly Scenario: Lyft and Uber are able to control the U.S. market and keep out competitors, perhaps through some form of regulatory capture. This control of the market allows them to set prices at a profitable level, although they still face constraints, as regulated firms, as to how high they can go. If we use the same revenue growth scenario and double pre-tax margins to 8% (more comparable to airlines after consolidation), Lyft has a fair value of $8.5 billion today, about 62% downside from the proposed valuation. See the math behind this dynamic DCF scenario.

- Self-Driving Scenario: What would Lyft be worth to GM or another company that develops self-driving technology? In this scenario, we optimistically assume, for argument's sake, Lyft captures a significant amount of the value from self-driving technology. If we keep the same revenue growth and double Lyft’s margins again to 16% (closer to an online platform like EBAY), then the firm is worth its $22.5 billion valuation. See the math behind this dynamic DCF scenario.

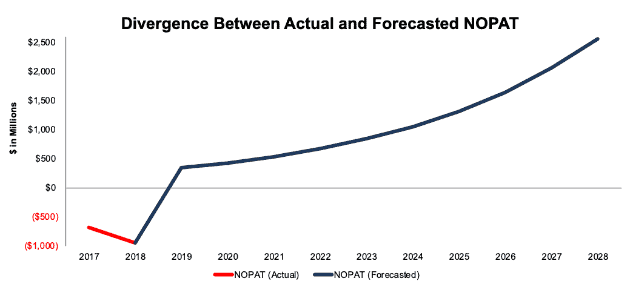

Figure 3 shows just how optimistic the growth in the self-driving scenario is compared to Lyft’s present cash flows.

Figure 3: Lyft’s Present NOPAT vs. Future NOPAT Required to Justify Valuation

Sources: New Constructs, LLC and company filings

To say Lyft is priced for the best-case scenario is an understatement. A $22.5 billion valuation assumes the company either magically becomes highly profitable while maintaining its high growth rate for a long period of time or convinces someone to buy it for far more than it would cost to replicate what they’ve done.

Dual Class Shares Hurt IPO Investors

In case IPO investors need another sign that LYFT is a bad deal for them, they should review the voting rights (or lack thereof) of the IPO shares.

Lyft plans to list shares using the dual class structure that has become the default for recent IPOs. The company’s founders will receive Class B shares that have 20x the voting rights of the Class A shares sold to the public. We showed how the dual-class structure that prevents investors from holding executives accountable contributes to the dysfunction and falling share price at Snap Inc. (SNAP).

Lyft’s S-1 currently does not specify what the ratio of Class B to Class A shares will be after the IPO. It may be that the founders will not have complete voting control over the company, but at the very least they will have a disproportionate influence that will make it difficult for the average investor to have a meaningful say on corporate governance.

This poor corporate governance, combined with the unrealistic valuation and total lack of expectation for future profits, suggests that Lyft has little interest in creating long-term value for investors. Instead, this IPO is a way for employees and early investors to cash out and leave people who buy the IPO holding the bag.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments[2] we make based on Robo-Analyst[3] findings in Lyft’s S-1:

Income Statement: we made $92 million of adjustments, with a net effect of removing $42 million in non-operating income (2% of revenue). You can see all the adjustments made to LYFT’s income statement here.

Balance Sheet: we made $776 million of adjustments to calculate invested capital with a net increase of $222 million. The most notable adjustment was $348 million in off-balance sheet debt. This adjustment represented 15% of reported net assets. You can see all the adjustments made to LYFT’s balance sheet here.

Valuation: we made $1.5 billion of adjustments with a net effect of decreasing shareholder value by $1.5 billion. These adjustments represent 7% of LYFT’s proposed market cap.

[1] Lyft does not count the driver’s cut of each fare as part of revenue. Instead, it discloses the total amount of money spent on its platform as “Bookings”. In 2018, Lyft reported $8.1 billion in bookings and $2.2 billion in revenue.

[2] Ernst & Young’s recent white paper “Getting ROIC Right” demonstrates the link between an accurate calculation of ROIC and shareholder value.

[3] Harvard Business School Features the powerful impact of research automation in the case study New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

Disclosure: David Trainer, Sam McBride and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.