Stagflation Static

Image Source: Pexels

Tuesday’s session wasn’t exactly a train wreck, but it did have the rhythm of a band stumbling out of sync. The S&P 500 slipped into the red as a cacophony of tariff threats, sour economic data, and rising stagflation chatter drowned out the recent rate-cut chorus. Traders now face a market that looks increasingly like it’s dancing on uneven ground, caught between softening growth signals and lingering inflation tremors.

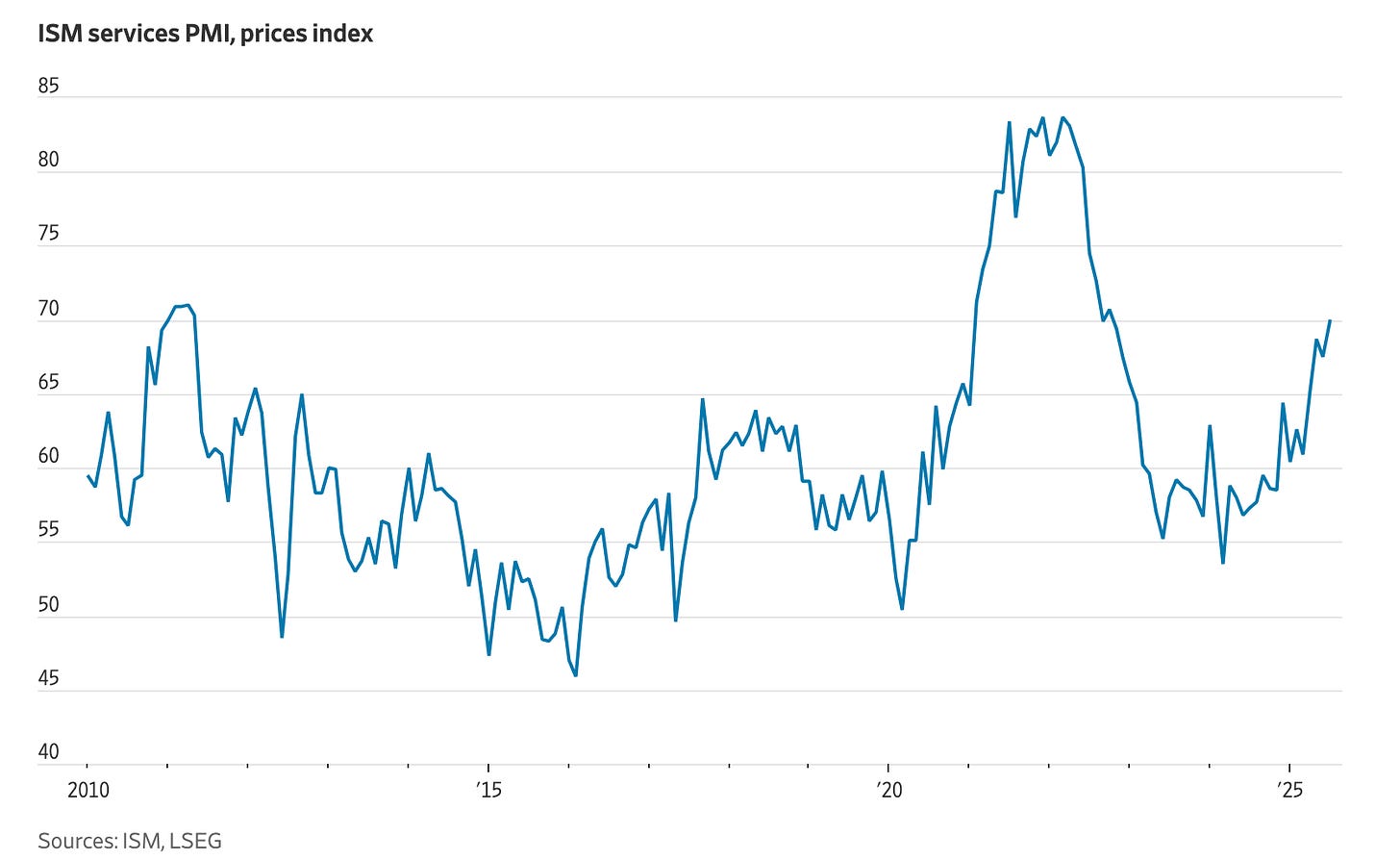

Let’s start with the ISM services print, which didn’t just disappoint—it flatlined. The index barely held expansion at 50.1, while the employment component contracted for the fourth time in five months. Add in a prices-paid surge to 67.5, and the ghost of stagflation has crept back into the room. Services represent roughly 70% of U.S. economic activity, and when the backbone buckles, it’s hard to maintain bullish posture.

A Worrisome Price Rise

This isn’t just another macro blip. It’s a potential inflection. With both manufacturing and services ISMs now weaker than the most bearish forecasts, the market is coming to terms with something darker: job growth could be rolling over hard. If you weigh these surveys together by their economic footprint, the implications are staggering—potential NFP prints dropping by over 100,000. Not just soft, but recessionary-soft.

Yet the kicker? Inflation’s still sticky where it counts. The ISM prices index has now clocked eight consecutive months above 60, with July’s jump hinting that tariffs may be doing more than just posturing—they're actually starting to bite.

And that’s before the tariff barrage from President Trump. On Tuesday, he lit another match under the geopolitical risk stack. Tariffs on semiconductors and pharmaceuticals are reportedly just days away. The numbers floated are staggering: 250% import duties on drugs. Meanwhile, Trump doubled down on India, threatening "very substantial" hikes on Indian goods within 24 hours. Switzerland’s president flew to Washington with a sweetened deal in a last-minute scramble to avoid a 39% rate. The EU, for its part, is desperately trying to shield its wine and spirits from the crossfire.

In trader speak, this isn’t a “headline risk” story—it’s a potential macro regime shift.

Market structure is now part of the drag. Systematic melt-up chasers, the kind that fuel vertical ramps, are drying up in the August heat. CTAs have flipped from buyers to sellers. ( Wall Street desks report that momentum chasers are flipping to sell, approx $20bn this week on a global basis, mostly SPX and SX5E.)Liquidity is thinning, and without big systematic buyers, upside follow-through could prove elusive over the near term unless a fresh bullish catalyst appears.

Palantir stood out as one of the few bright spots, surging nearly 8% after topping $1 billion in revenue—a milestone that fueled some defence-sector optimism. But elsewhere, industrial bellwethers like Caterpillar and Eaton either disappointed or barely moved the needle. Not precisely the earnings follow-through you want to see after a massive AI-led rally.

And here’s the double-bind: even as macro data deteriorates, price inputs are rising—not because of strong demand, but because of political intervention. Tariff-induced inflation is distorting the picture. We’re not looking at a reflationary boom; we’re staring at manufactured inflation amid cooling demand.

Bond markets aren’t blind to the shift. The U.S. 3-year auction saw a modest tail, suggesting some buyer fatigue despite attractive front-end yields. The 10-year is up next, and with disinflation hopes hanging in the balance, it could be a make-or-break moment. In Europe, spreads are tightening as summer supply dries up and the ECB nears the end of its easing cycle. Italian spreads over Bunds just dipped below 80bp, their tightest level since before the sovereign debt crisis. But that tightening leg may be running on fumes.

Meanwhile, Trump is reportedly eyeing a shortlist of four Fed chair contenders, with Kevin Warsh and Kevin Hassett floated—but not Treasury Secretary Scott Bessent. Whether the eventual nominee signals continuity or chaos is still up in the air, but if markets smell political meddling or a weaker Fed, it may only amplify the risk-off tone.

Make no mistake: this tape isn’t in freefall—but it’s certainly lost its lead. Earnings may be trending higher, and yes, rate cuts are likely on the horizon. But when ISM prints dive, inflation edges higher, and tariffs come knocking, traders don’t see a clean pivot—they see friction.

The path forward is murky. If macro deteriorates faster than inflation softens, the Fed is backed into a corner. And as more global partners brace for tariff shocks, risk appetite could prove more fragile than the S&P’s calm surface implies.

This is no longer a one-variable story. It’s a market where bad news is bad again, and policy risks are no longer just noise—they’re moving the tempo. The bull isn’t dead, but the beat has changed. And right now, the dance floor feels less like a party—and more like a minefield.

More By This Author:

Dancing With Doves: Wall Street Finds Its Rhythm In The Repricing

Asia Shudders As Cracks Form In The Teflon U.S. Economy

The Weekender: Jobs Report To Powell, ‘Hold My Beer'