Dancing With Doves: Wall Street Finds Its Rhythm In The Repricing

Image Source: Unsplash

The S&P 500 and Nasdaq just posted their biggest one-day gains since May, answering Friday’s hand-wringing meltdown with a rally that felt less like a bounce and more like a declaration. Traders didn’t just buy the dip—they embraced it like it was the last train out of the hard landing station.

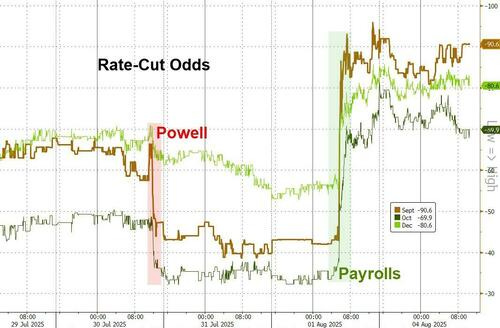

Friday’s chaotic moves, triggered by the weakest jobs report in over a year and compounded by dramatic downward revisions to prior payrolls, had cast a shadow over markets. But in classic operator fashion, the narrative flipped fast: soft jobs equal soft Fed, and soft Fed equals risk-on. Two-year Treasury yields plunged, and rate-cut probabilities for September surged to nearly 95%. The street isn't just pricing in a policy pivot—it’s hedging for a dovish cascade, with an expanding hat tip to the fat left tail of four or more cuts by the end of 2025. It’s as if someone cracked open the old “bad news is good news” playbook, dusted it off, and threw it back on the desk with a vengeance.

But let’s not pretend this is a blanket “buy everything” moment. This market bifurcation is as sharp as it’s ever been. Mega-cap tech and AI darlings like Nvidia (NVDA) and Meta (META) led the charge higher, snapping back to all-time highs. These are the names that still command pricing power, still hold the earnings line, and still promise some semblance of growth in a world tiptoeing toward contraction. Meanwhile, under the surface, there’s a murmur: if cuts are coming because the labour market is slipping from “cooling” to “cracking,” then we’re skating closer to the edge than we care to admit.

That dichotomy—between rate cuts as stimulus and rate cuts as warning flare—is now front and center. If the Fed moves proactively to shield markets from the tariff storm and weak labour, the equity rally has legs. But if policymakers are reacting to a sharper downturn that is in full swing, the runway shortens quickly. Stocks soared, yes—but so did gold and crypto, both barometers of fear as much as speculation. The stock rally felt more like a mechanical hedge to rate cuts boost juice than a hallelujah.

But that’s exactly what I expected, so there were no surprises on this desk. What did catch my attention, though, was the vigour behind the move. The tape didn’t just lift—it surged with intent. After all, while volatility hadn’t vanished, it had been neatly contained for weeks. Before Friday, the S&P hadn’t posted a single daily move greater than 1% in over a month. The range was tight, the intraday swings polite. It was a market pacing in a cage.

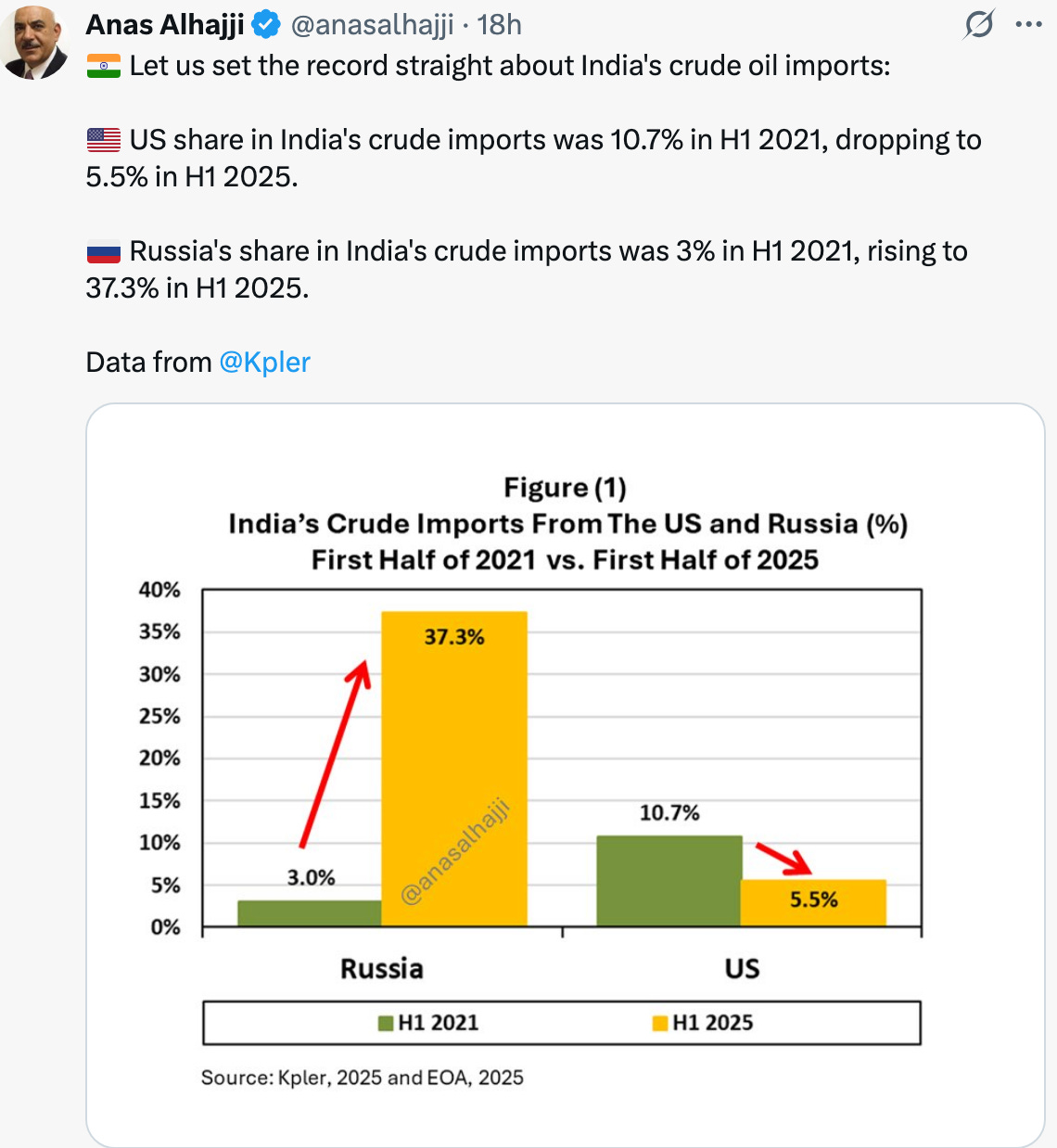

Adding to the complexity: Trump’s unpredictable hand in economic affairs. Monday’s market session began just hours after he vowed to “substantially” raise tariffs on India, ratcheting up pressure on a key oil buyer and geopolitical swing state.

Are the tariffs on India justified, given that it has been funding the Russian War Machine?

This came on the heels of Friday’s political shocker—firing Bureau of Labor Statistics Commissioner Erika McEntarfer for allegedly manipulating data. No evidence was presented. But the implications were immediate: political interference is now firmly in the Fed-and-BLS crosshairs.

The resignation of Fed Governor Adriana Kugler on the same day only deepens the intrigue. A known dove, her exit opens a seat—and a power vacuum. Who fills it, and more importantly, will it be Powell’s eventual successor, that could matter far more than anything in this week’s PMIs or earnings calendar. The market isn’t just trading payrolls or inflation anymore—it’s trading institutional credibility.

Still, in the here and now, price is truth—and price says risk appetite is alive and well. The S&P 500 surged 1.5%, the Dow added nearly 600 points, and the Nasdaq ripped almost 2%. The rally was broad, but it wasn’t blind: the Magnificent 7 carried the torch while small caps and cyclicals played catch-up. This wasn’t a technical bounce; it was a flow-led frenzy built on a dovish repricing.

That said, the tape remains vulnerable. Over $125 billion in long-end U.S. Treasury supply hits this week—a real stress test of confidence, especially with rates and FX traders refusing to confirm Monday’s equity exuberance. The dollar went nowhere, yields failed to rebound meaningfully, and the divergence between asset classes continues to scream caution.

Earnings could provide ballast. Over 100 S&P names report this week, including Palantir (PLTR), Disney (DIS), and Eli Lilly (LLY). If the profit machine keeps humming, the equity train can keep rolling—even on rickety tracks. But if margins compress or forward guidance starts to buckle, this short-covering bonanza could evaporate just as quickly.

At the end of the day, this is what makes macro beautiful—and brutal. You’re constantly trading shifting probabilities, asymmetric risks, and the specter of political meddling. Friday’s collapse in conviction has already been replaced by Monday’s fever dream of rate cuts and AI-fueled upside.

For now, Wall Street’s answer to the labor shock is clear: when in doubt, bet on the Fed to flinch. Just don’t forget to hedge for the next punch.

Fireworks may just be getting started. Powell’s watching his flank, Kugler’s chair is empty, and $125 billion in long-end supply looms like a stress test nobody ordered. The surface looks calm, but below the waterline, cross-asset positioning is not tightly correlated. And when volatility’s been bottled up this long, it doesn’t trickle out—it breaks.

More By This Author:

Asia Shudders As Cracks Form In The Teflon U.S. Economy

The Weekender: Jobs Report To Powell, ‘Hold My Beer'

Microsoft’s $4 Trillion Halo Can’t Light The Whole Market