St. Louis Fed Quietly Finds U.S. Is Now In A Recession

In recent weeks, we have seen a burst of unexpected truthiness out of various regional Fed banks, a sharp contrast to the constant barrage of prevarication out of the Federal Reserve.

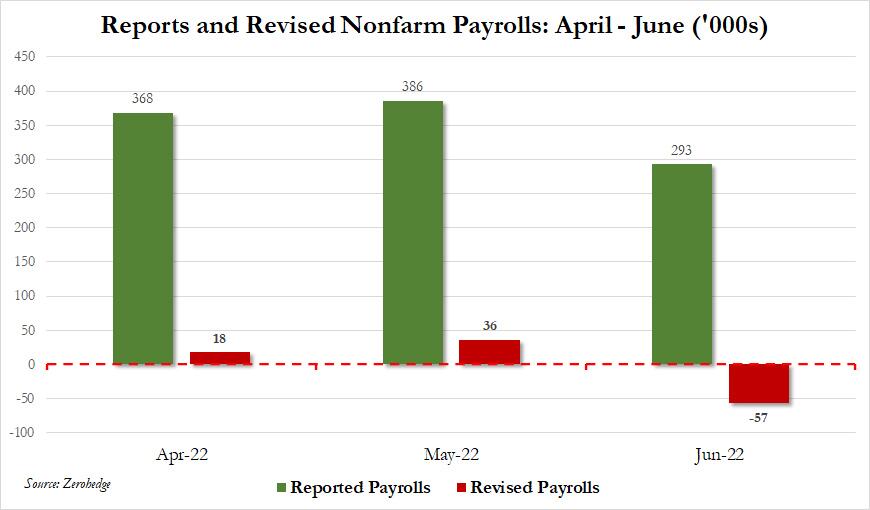

First, it was the Philadelphia Fed that effectively revised what was according to the BLS a gain of 1.1 million jobs to just 10,500 jobs, meaning that the Fed was looking at erroneously overstated, arguably politicized data, as it unleashed its burst of 75bps rate hikes in June... which happened just as June jobs number turned negative.

(Click on image to enlarge)

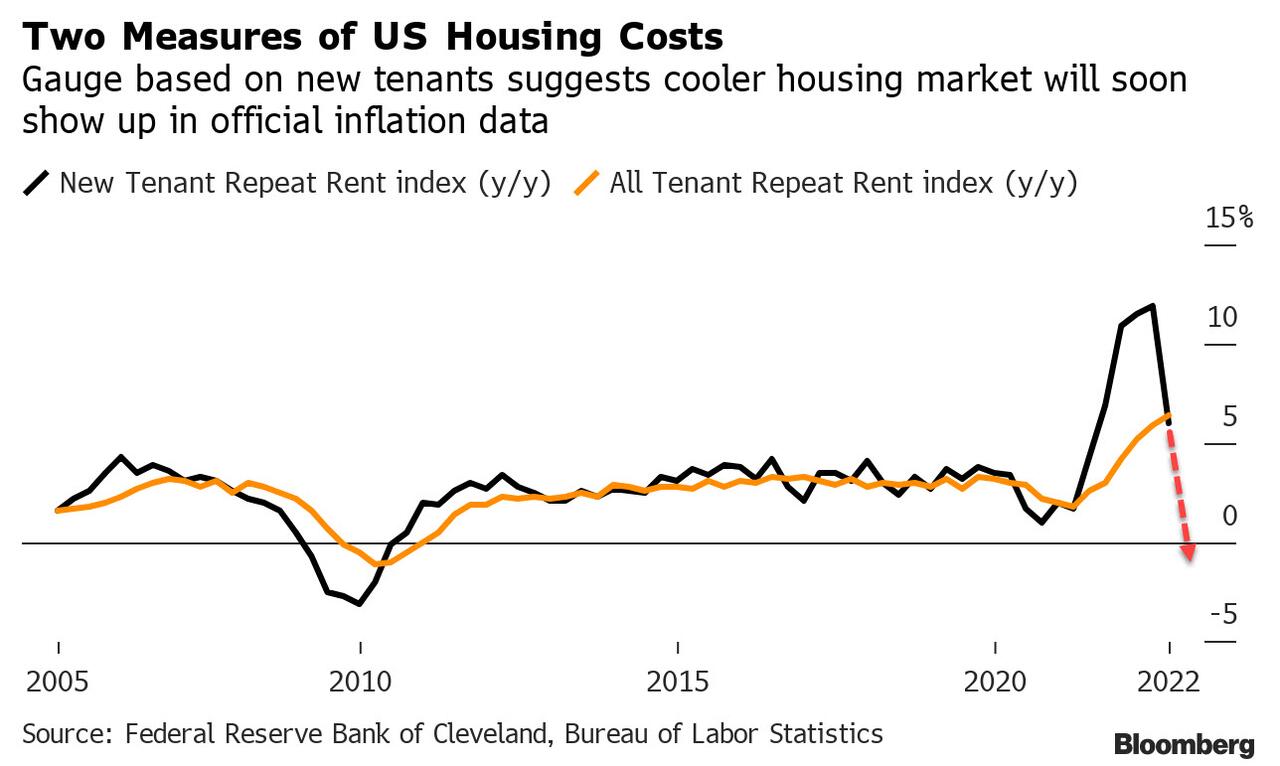

Then, a few days later, the Cleveland Fed suggested that the Fed's entire inflation view is wrong, relying on core CPI (and PCE) data that is woefully, even dangerously, delayed - in some cases lagging market data by up to 12 months, and suggesting that rent inflation - a core component of shelter and OER inflation which is arguably the most important component of "sticky" US service inflation - is actually far lower if measured correctly. Specifically, instead of looking at the "all-tenant repeat rent index" (which looks at a broader, but much more smoothed population sample), the Cleveland Fed argues that what is key is the "New-Tenant Repeat Rent" index, which tracks market indexes such as Zillow and Apartment List far more closely, and thus represents reality much more accurately at key inflection points.

(Click on image to enlarge)

Needless to say, if either- or both - of these analyses are correct, and the real US jobs market is far weaker than represented, and/or inflation is far lower than what the BLS has represented at a time when the Fed has hiked four times by 75bps, an unprecedented pace of tightening last seen only during the Volcker era in hopes of crushing what is an already stalling economy, the implications will be huge and potentially catastrophic for both the Fed and whichever political party is in charge.

But just in case there wasn't enough doubt in the Fed's actions prompted by the Fed's own regional banks, in yet another controversial report, this time published by the St. Louis Fed, has one-upped both its Philadelphia and Cleveland Fed peers, finding that if one looks at the number of states with negative growth, the US is now officially in a recession (way to throw the political operatives at the NBER under the bus, guys).

Here is what St. Louis Fed researchers Kevin Kliesen and Cassandra Marks found in a report published just days before New Year's Eve (a time when absolutely nobody would have noticed a shocking admission that the US is in a recession) in a report titled "Are State Economic Conditions a Harbinger of a National Recession."

The punchline: as the report authors rhetorically ask in the final section, "Is the U.S. Tipping into a Recession?"...

In sum, a threshold estimate based on this analysis shows that 26 states need to have negative growth in the SCI to have reasonable confidence that the national economy entered into a recession. Excluding the 2008 outlier raises the threshold to 29 states.

So, where are we now? In October 2022, 27 states had negative growth in the SCI. That would exceed the six-recession average of 26 states but would fall short of the outlier-adjusted estimate (excluding 2008) of 29.

Their unstated answer: yes.

Putting it all together, in just the past month we have seen (or rather read) the following:

- Philadelphia Fed admitting over 1 million jobs "created" in Q2 never actually happened

- Cleveland Fed admitting core CPI is far lower than what the BLS reports, and what the Fed feeds into its models.

- And now, the St. Louis Fed effectively saying that based on the number of states with negative growth, the US is effectively in a recession.

While we don't know if these attacks on the Fed's credibility by its own economists will be sufficient to force Powell to pivot, they will certainly be used by the Fed's political enemies (because for the past year, whether he wanted to or not, the Fed has become Biden's most powerful tool, and one which will now be attacked by Republicans) to seek a full reversal in Fed policies and it is safe to say, that they will get it.

More By This Author:

"An Awful Year": The Best And Worst Performing Assets Of December, Q4 And 2022

US Inflation: How Much Have Prices Increased In 2022?

"Doom Cycle Of Default, Fraud, And Contagion" Could Give Way To Crypto Spring

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more