S&P 500 Taps Fresh Record High Amid Earnings, Fed Buzz

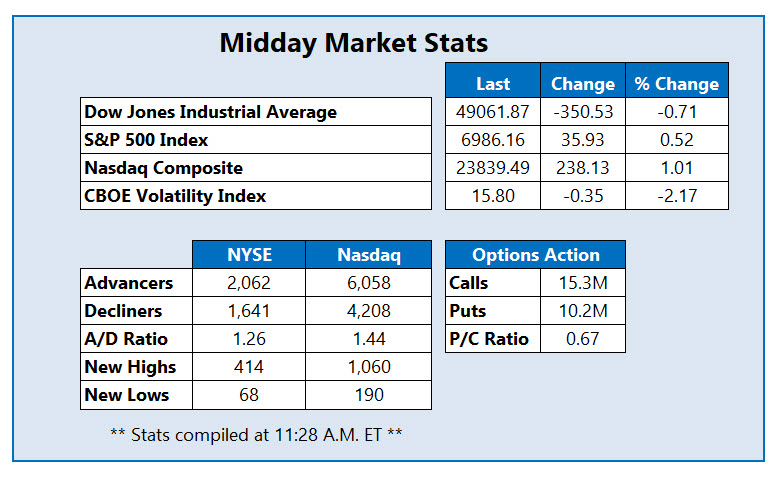

The Dow Jones Industrial Average (DJI) is continuing its staggering pullback, off 350 points at midday, dragged by struggling UnitedHealth Group (UNH). On the flip side, the S&P 500 Index (SPX) has tapped a fresh record high, surging alongside the Nasdaq Composite (IXIC), as Big Tech takes over ahead of several 'Magnificent Seven' earnings reports. While no rate cut is expected this go around, all eyes will be on the Federal Reserve's first decision for 2026, slated to release tomorrow afternoon at 2:00 p.m. ET. Investors also seem to be pushing aside President Donald Trump's latest tariff threats against South Korea

Headed for its fourth win in five sessions, tech name Fastly Inc (NYSE: FSLY) is a popular pick in the options pits today, last seen trading up 6.8% at $10.45. The catalyst behind the options surge is unclear, though 16,000 calls have been exchanged so far -- 16 times the average intraday rate. Most popular is the January 2027 12.50-strike call, where new positions are being sold to open. Over the past six months, FSLY has added 47%, with recent support stemming from the 126-day moving average.

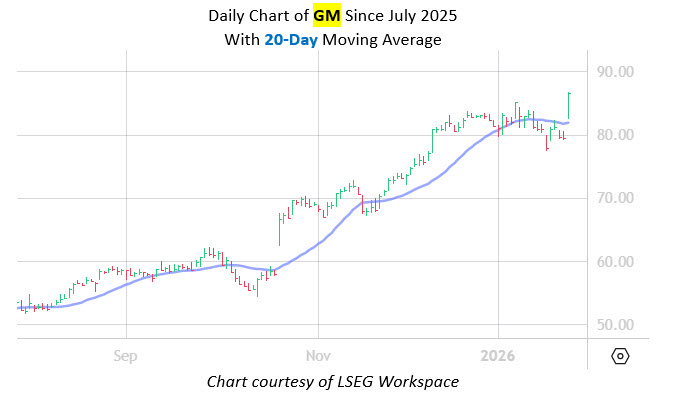

Car manufacturer General Motors Co (NYSE: GM) is one of the top stocks on the New York Stock Exchange (NYSE), up 8.8% at $86.49 at last glance, earlier tapping a record high of $87.19. Shares are enjoying a post-earnings pop, in which the company posted a quarterly beat-and-raise. Today's jump has the equity gapping above recent pressure from the 20-day moving average. GM sports an 84% nine-month gain.

Lower with its health sector peers is CVS Health Inc (NYSE: CVS), pulling back after Medicare Advantage proposed a much lower-than-expected increase to plans for 2027. CVS is now trading below the $75 level for the first time in over a month, eyeing its worst daily performance since May 2024. CVS has outperformed in the long term, however, shares are up 18% over the past 12 months.

More By This Author:

Stocks Rise Ahead Of Big Tech Earnings, Rate Decision

Stocks Brush Off Political Tensions As Megacap Earnings Loom

Wall Street Ends The Week On Uneven Ground