Stocks Brush Off Political Tensions As Megacap Earnings Loom

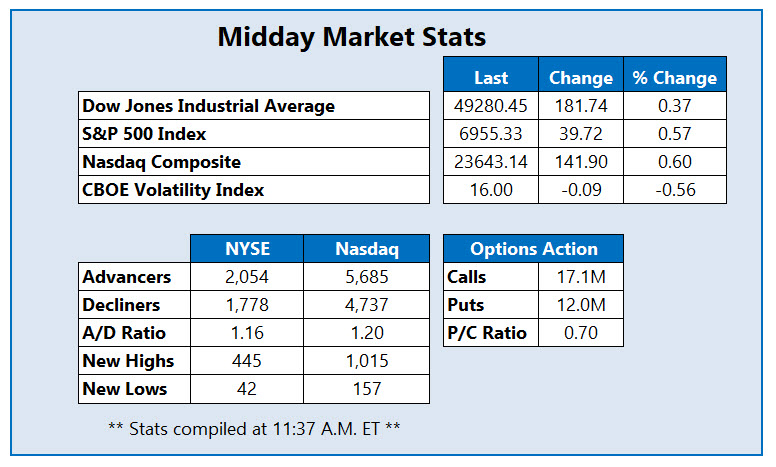

After an unsteady start to the session, the Dow Jones Industrial Average (DJI) and Nasdaq Composite (IXIC) are both up triple digits at midday, while the S&P 500 Index (SPX) sports a more modest gain as investors digest an onslaught of political and economic updates. Trade fears eased after Canadian Prime Minister Mark Carney said Ottawa has "no intention" of fraternizing with Beijing to reach a trade agreement, following President Donald Trump's threats of a 100% levy on the U.S.' neighbor.

Pre-earnings pops from Apple (AAPL) and Facebook's Meta Platforms (META) are boosting sentiment, as well as delayed durable goods data, which came in higher-than-expected, up 5.3% for November. Washington still remained under fire, following the second fatal shooting by federal immigration agents of an American citizen in Minnesota over the weekend

Transocean LTD (NYSE: RIG) is popular in the options pits today, last seen down 0.2% to trade at $4.82, pulling back from its 17-month high of $5.01, hit earlier this morning. The company announced its Q4 earnings date as after the close on Thursday, Feb. 19. Over the past nine months, RIG as added 110%. So far today, 81,000 calls have crossed the tape, six times the average intraday pace. Most popular are the weekly 1/30 5.50-strike and 5.0-strike calls from the same series, with positions being bought to open at the former.

IT services name Cloudflare Inc (NYSE: NET) is near the top of the New York Stock Exchange (NYSE), up 10% at $190.80 at last glance. While the catalyst is unclear, today's pop looks to be a continued bounce off last week's bottom just below $170, the shares eyeing a third-straight gain. NET has been outperforming long term, up 52% over the past 12 months.

One of the worst NYSE performers this afternoon is e.l.f. Beauty Inc (NYSE: ELF), pulling back after Friday's outperformance, which came after Citigroup initiated a "buy" rating on the makeup brand. The shares were last seen at $89.59, down 4.8%, dropping back below the round $90 level, with overhead pressure at the descending, 80-day moving average.

More By This Author:

Wall Street Ends The Week On Uneven GroundEconomic Data, Intel Selloff Send Stocks Mixed

Dow Extends Comeback, Wipes Weekly Deficit Away