S&P 500, Rising To Yet Another Record Intraday Tuesday, Increasingly Top-Heavy

US stocks continue to make fresh highs, with the leaders doing all the heavy lifting. Tech is the leading sector, and it leads by a mile. At some point, this lop-sided leadership becomes more of a risk than a reward.

It is top-heavy. Increasingly so.

The biggest companies in the S&P 500 large-cap index are getting bigger. By the end of last year, the top 10 companies together commanded a market cap of $6.08 trillion. Of this, Apple (AAPL) and Microsoft (MSFT) ended the year in the $1 trillion category – $1.23 trillion and $1.20 trillion respectively, for 4.6 percent and 4.5 percent of the index market cap of $26.8 trillion. Amazon (AMZN) finished third with $769.6 billion.

The data comes courtesy of S&P Dow Jones Indices, which treats Alphabet A (GOOGL) and Alphabet C (GOOG) separately. If treated together, they would have taken the third spot with a market cap of $800.9 billion.

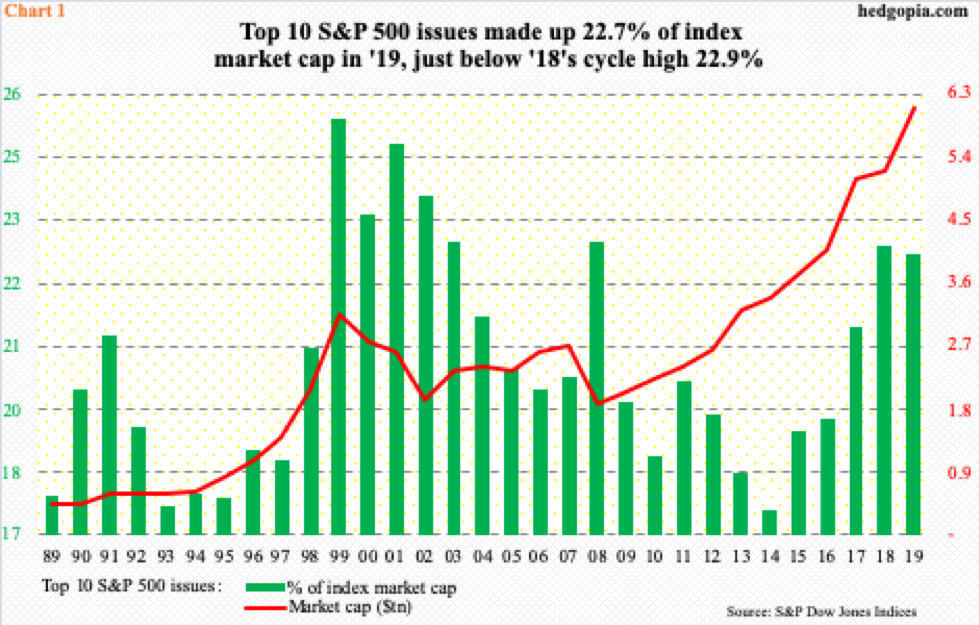

On an absolute basis, the top 10 finished last year with a record total, but not as a share of the total market cap. They made up 22.7 percent, down a little from the cycle high 22.9 percent in 2018. In 2014, the top 10 only accounted for 17.5 percent, so they have come a long way.

At some point, this metric will have become so top-heavy it will begin to fall under its own weight. Are we at that stage? Bulls would say no, citing history. In 2008, the green bars in Chart 1 rose as high as 23 percent before tumbling – and much higher 25.5 percent in 1999.

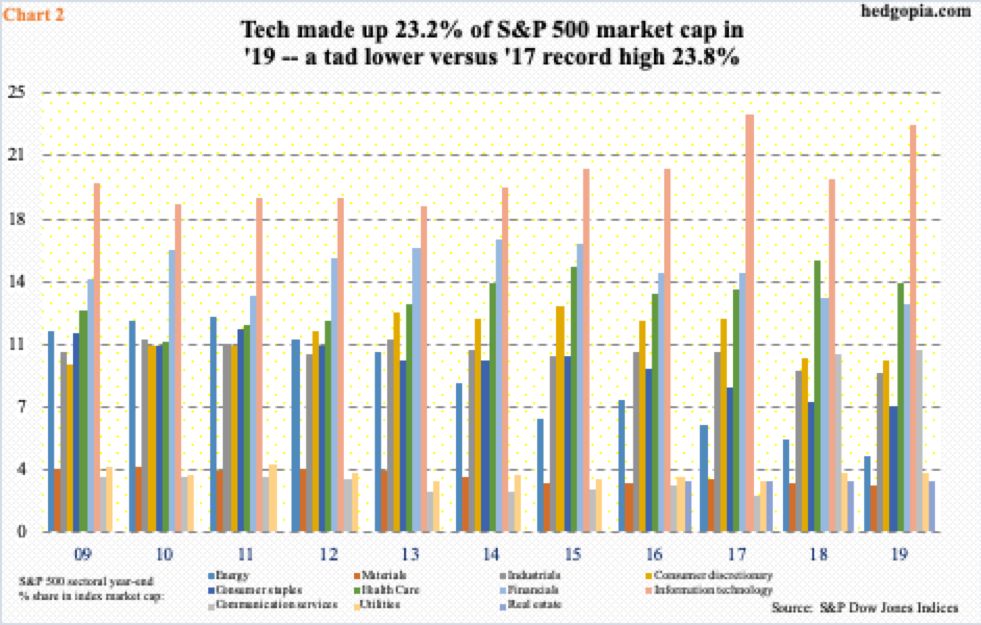

Tech’s dominance in this is obvious. As a matter of fact, the top five are all tech – Alphabet (GOOG/L) and Facebook (FB) being the other two. As a sector, tech last year comprised 23.2 percent of the S&P 500 market cap. Post-Great Recession, this is the second-highest, with the highest 23.8 percent recorded in 2017 (Chart 2). This is elevated. Health care, which last year accounted for 14.2 percent for a second spot, was not even close. Financials were third with 13 percent.

Nothing says the likes of AAPL and MSFT cannot continue on the current trajectory, doing all the heavy lifting. In a risk-on environment, tech’s leadership is viewed favorably – rightly so. But this metric is also worth a close watch. At some point, their lopsided leadership becomes more of a risk than a reward.